Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

The nature of SaaS businesses is usually global. Without physical products to ship, you can pretty easily expand your offering to other countries and increase your reach and userbase.

But there’s one distinct problem with turning your business global: Meeting your customers’ international payment needs.

Cross-border transactions can become a major barrier to any business wishing to accommodate international customers.

And it is not just acquiring new customers we are talking about.

Today’s world is global. People move abroad all the time, for personal, business or political reasons. Business executives work from different countries while traveling. A once domestic customers may become an international customer for the next billing cycle.

Accommodating cross-border payments means reducing churn as much as expanding your customer base to different countries.

Subscription businesses that are willing to enter new markets should tailor their payment processing options to other countries.

So the first step is to thoroughly research your target market.

Foreign market research is a huge topic which definitely deserves a separate tutorial. Here are a few resources that may turn helpful:

Finally, research your international consumers’ buying journeys and habits. It is a good idea to look into existing marketplaces and shopping apps that are popular in that country.

For example, Ozon is Russian alternative to Amazon, and in China that’s Alibaba. Here’s a list of online shopping apps in India, and you can easily switch the regions there to see the difference. China’s SaaS giants are absolutely different than those in India, and United States.

Understanding the international consumers start with knowing what they currently use, so take some time researching that.

Global checkout support (i.e. allowing your customers to pay from anywhere in the world) is crucial to your business success.

Which problems can occur for international payments?

International payments may fail because of the global banking communication failure. Some banks may block a payment request from abroad. Other local banks may not even support international payments.

It is very difficult to verify the legitimacy of an international transaction.

There’s a lot that comes down to choosing a payment processor that is able to overcome cross-border problems.

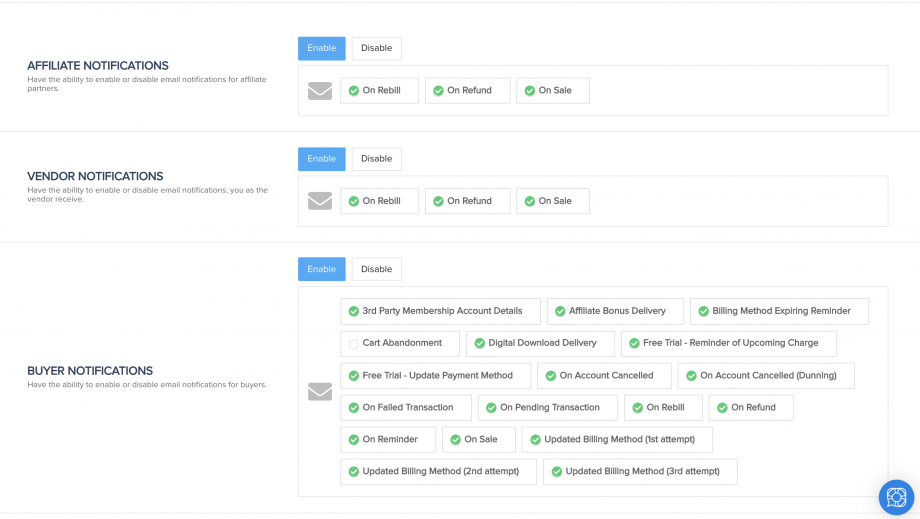

In this respect, international payment recovery isn’t much different from your general payment recovery strategy:

Further reading:

Not many banks outside of the United States will be able to process payments in US dollars. Currency conversion comes with additional fees, daily discrepancies and extra payment processing steps.

All of that causes errors and failures, and ultimately lost customers.

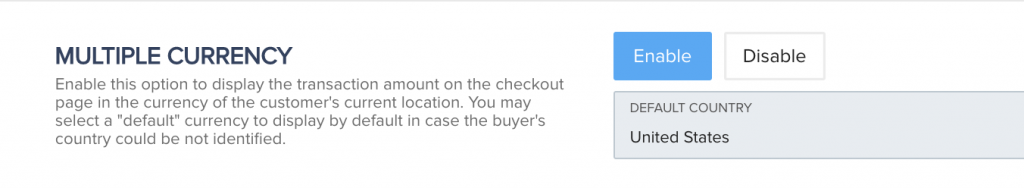

PayKickstart offers a “Multi-currency” feature which allows vendors to let their customers purchase in their local currency.

This feature comes with many benefits:

By enabling the Multiple Currency feature, you can allow your customers to purchase using their native currency from your custom checkout page. PayKickstart will adjust the currency to the most recent exchange rate.

By enabling the multi-currency feature, PayKickstart customers have seen an increase in conversions by 20-30%!

PayKickstart allows vendors to choose from one of 32 different currencies:

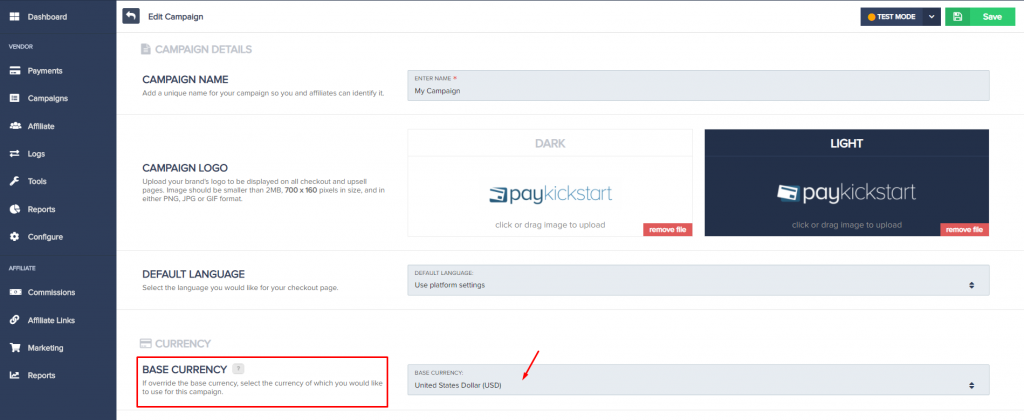

For example, maybe you run two businesses or have two different product offerings, you could have your local services-based business in Canada charge your clients in the Canadian Dollar, but your digital information products business in the US Dollar.

Also read on setting up your base currency.

Date formats are a constant cause of confusion. While your US customers may type an expiration date in a format they are well accustomed with: MM/DD/YYYY

Well, the rest of the world has different date formats, predominantly DD/MM/YYYY

Lots of international customers will attempt to use their familiar localized details, even if instructions are provided to put things otherwise. And all of those payments will naturally fail.

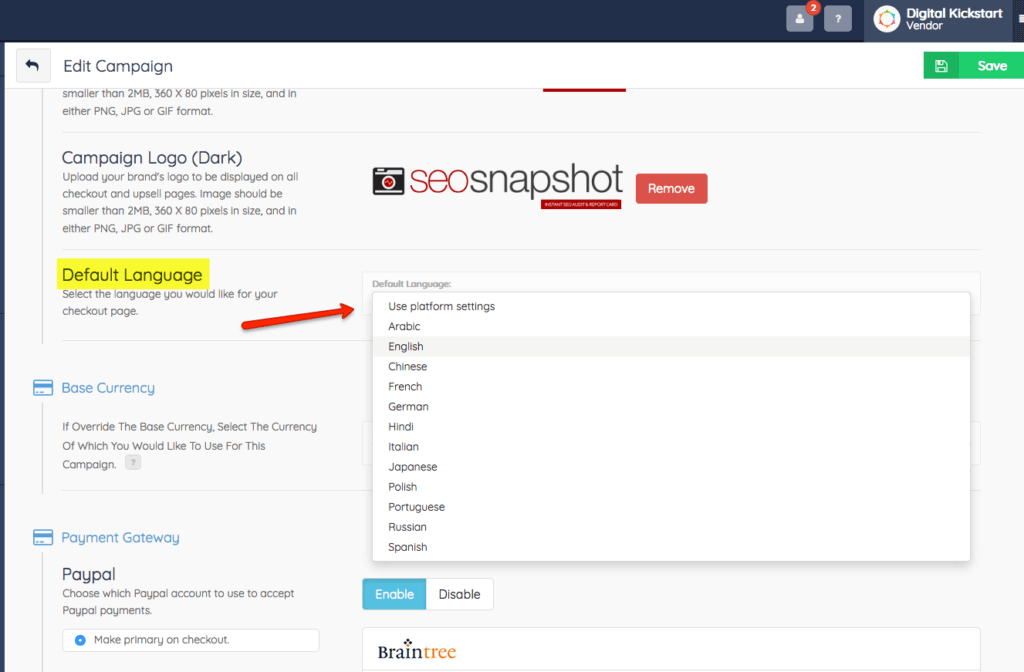

PayKickstart will automatically translate your checkout page into 12 languages. You need to choose your default language first:

It is a good idea to create custom landing and checkout pages for some of your locations that have the most customers.

Localization is part of personalized marketing, and there is no easy answer to that.

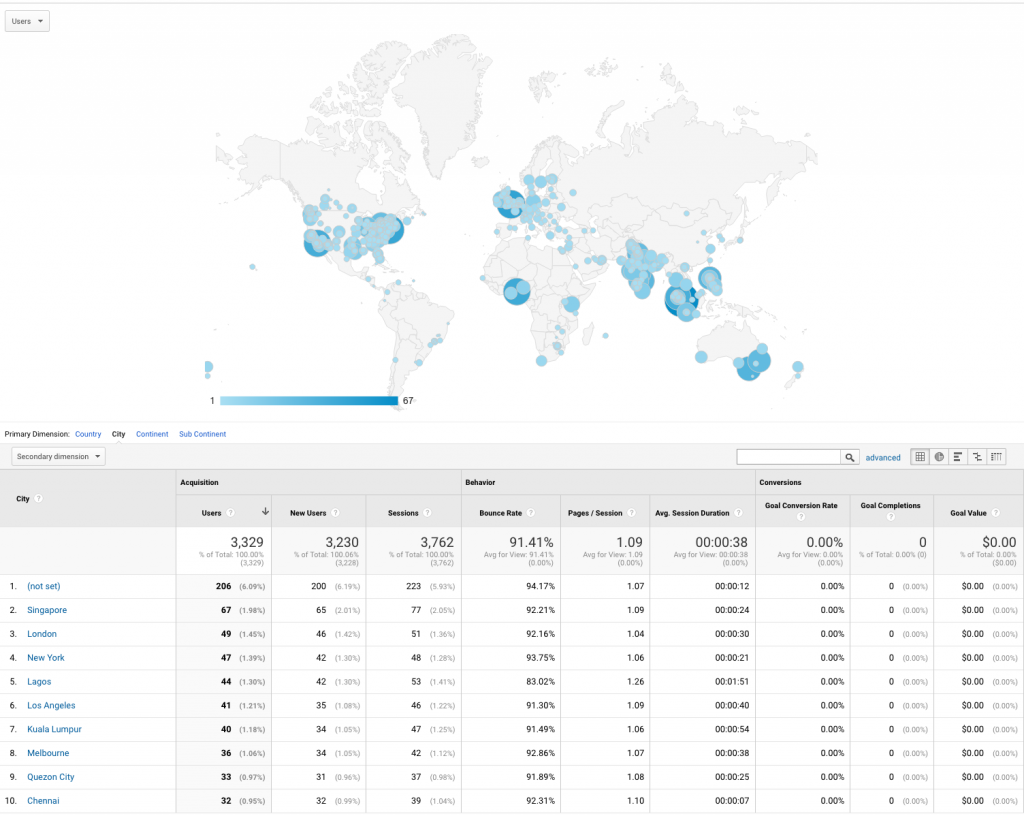

The first step is identifying which countries your audience is coming from. This will help you prioritize those locations that currently send most traffic. Google Analytics offers a detailed report on your most popular locations. There are two separate reports:

Finteza allows an easy way to analyze conversion rates, sales funnel and even revenue from any chosen location:

Prioritizing will help you make more informed decisions as to which localized pages (or sites) you need to create and which localized specifics you need to research. Using feedback forms will also help you identify and fix location-driven problems. Conversational forms may make all the difference when it comes to audience engagement.

Localizing your checkout pages will likely decrease your overall cart abandonment rate because your international customers will be more confident in completing the payment.

Fixing transaction processing issues is the best way to increase your revenue and expand into new markets. It is also more affordable than investing in finding new customers, so understandably it is the first and fundamental step in building a SaaS business.

PayKickstart offers a wide variety of tools allowing you to enable cross-country payments and boost your customer base.

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty