Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Subscription payment management is not an easy task. You need to deal with failed payments as well as customers who signed up for something they didn’t really understand or need.

One of the most complicated (and confusing) areas here is dealing with refunds.

Any SaaS business will have to deal with cancellations and refund requests. While you can minimize them, you are very unlikely to get them to zero.

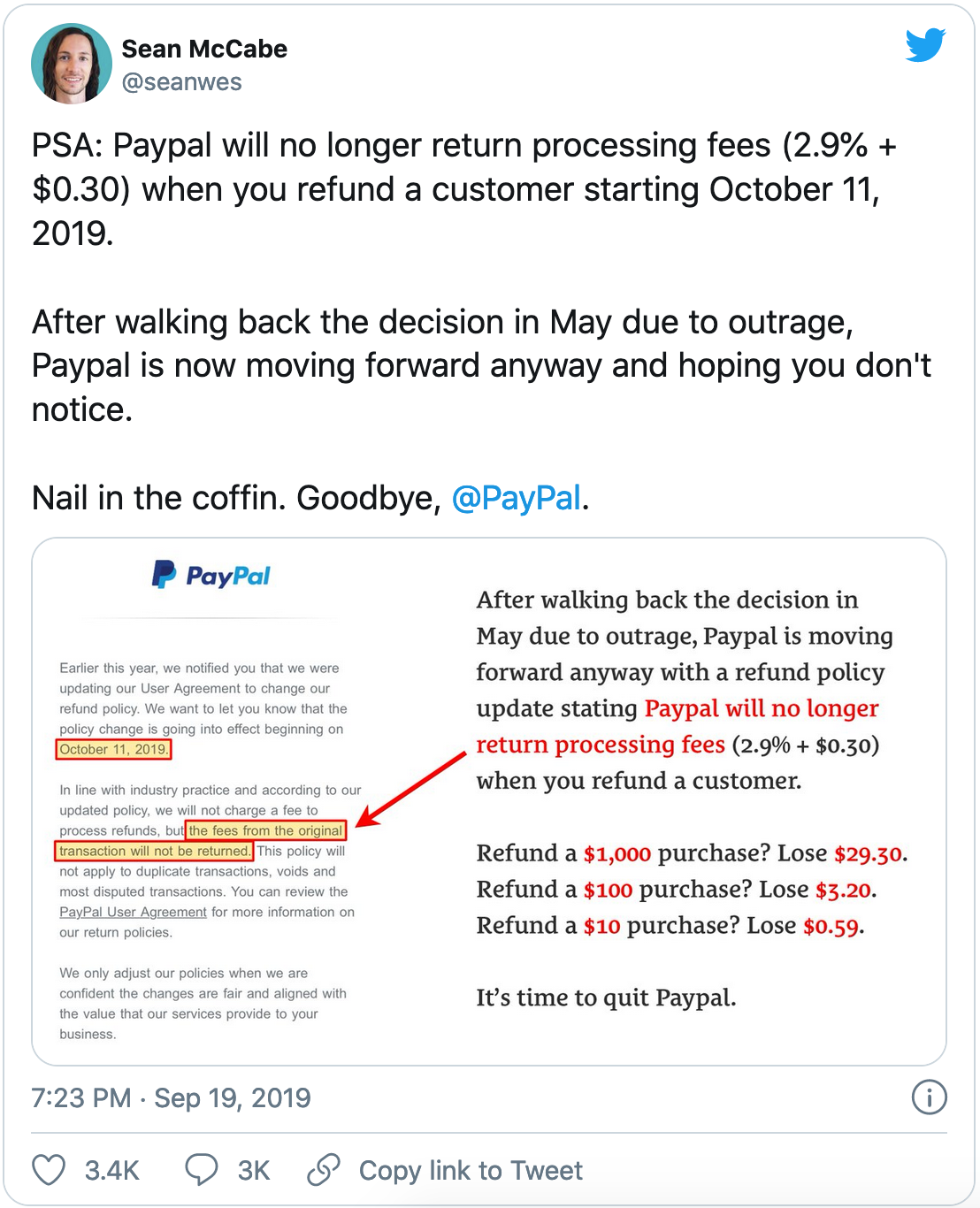

And this is where you will have to deal with the controversial fee policy and an unexpected income loss: Major payment processing companies out there have introduced controversial policies allowing them to retain the payment fee when refunding transactions.

Is this fair and how to deal with that?

The controversial fee policy is a practice adopted by a payment processor that claims the transaction processing fees after the payment was refunded.

This refund fee policy seems to be the trend now as more and more popular payment processing companies are introducing it.

Prior to 2019 most major payment processors would refund a merchant the transaction processing fees once a respective payment has been refunded. Things are rapidly changing these days leaving SaaS businesses annoyed and confused.

Obviously, the higher the average transaction amount a business operates, the more loss it incurs due to this policy.

The best-known companies that have introduced the controversial fee policy include:

As of March 2021, the following companies will return the transaction fee when you refund the payment:

There are also a few companies that charge a fixed fee for a refund versus retaining the whole fee. For example, National Processing refunds the transaction processing fees but also charges a $0.05 transaction fee, when a merchant issues a refund to a customer.

The reason behind this policy seems to be the payment processing companies undergo an interchange fee which is being retained by the payment networks and a card holder’s banks.

Whether it is 100% true remains a mystery. It is also unclear which exact portion of the payment goes to Visa/Mastercard and which to the card-holder’s bank.

Stripe representative provides their reasoning behind the policy in the long thread here:

this has been around for a couple years (for only new Stripe users). Payments are costing more to process. Card network fees have been gradually increasing over the years.

Stripe has kept this at bay for its longtime users for as long as we could, even as it’s been getting more expensive. But with the water rising across the whole pond, we sadly have to start charging for some of these things.

PayPal’s explanation is that the policy has to be in place due to “cost structure” and the industry practice.

The latter at least must be true: More and more payment processing companies are introducing these controversial policies these days, so it is really becoming an industry standard.

It probably isn’t but what does it matter? Sure you can leave your current payment processor over this but for subscription businesses changing a payment processor may easily turn into a nightmare. Plus, there’s no guarantee your newly selected payment processing partner is not going to introduce the same policy down the road.

No one likes to lose money. But when you have been with a payment processor for years and then receive an email of their updated refund fee policy, what are your options?

While the policy is quickly becoming the industry standard, it is time that business owners start factoring that loss in their product pricing and revenue estimates.

After all, for SaaS companies it is not as bad as for ecommerce businesses that are seeing many more returns now that so many more people are shopping (and returning) from home. For real (non-digital products) returns are part of normal online shopping process where customers are buying clothes to try on.

I know it doesn’t sound too comforting. Loss is loss and nothing is going to change that. But at least understanding how the refund fees work and including that in your income estimates will make things more predictable.

Obviously, minimizing your refund requests will help you minimize the impact from these controversial fee policies, so I’ll wrap up with a few helpful guides here:

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty