Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Would you like to explore new markets and discover a new customer base for your product or the service you are offering?

Adding crypto payments as one of your payment methods is likely what you need!

Fundamentally, crypto payment processing works similarly to credit card payment processing, but with digital currencies.

While crypto payments are technically processed in a different way, the client-facing process remains the same: With crypto payment processing enabled, your customers will be able to make cryptocurrency payments from their wallets.

PayKickstart users will now be able to add a new payment method at checkout enabling customers to use digital currencies to complete the purchases.

This new integration will likely unlock an entirely new audience (blockchain businesses), as well as help your business meet a growing demand of crypto payment adoption. In 2023, 5.5 million US consumers will use cryptocurrency to make payments, which is a leap of more than 350% in three years.

That is almost 6 million people in the US only that will likely choose your business just because you are ahead of your competition in supporting digital currency payments.

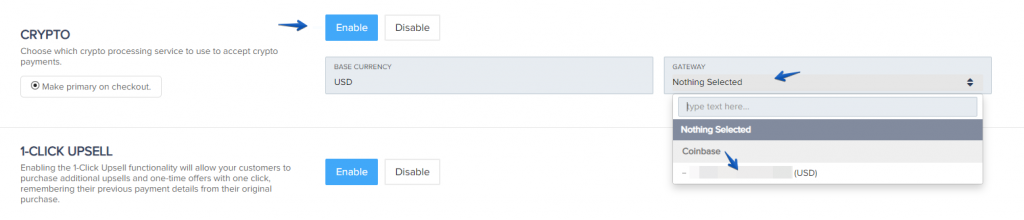

To enable crypto as an additional payment method at your checkout, simply select “Enable” next to Coinbase payments when editing your campaign, and follow the steps.

Once enabled, crypto payments will be available to your customers as an option to pay. They will be able to select the Crypto/Coinbase option at checkout which will allow them to securely connect their Coinbase account and pay with selected cryptocurrencies.

If your customer chooses crypto to finalize their purchases with you, Coinbase will create a charge (i.e. a request to pay) representing the expected payment.

Unlike credit card payments where businesses must obtain payment credentials in order to charge a customer, cryptocurrencies are more like digital cash which rely on a customer explicitly sending money to the merchant.

Once a charge is created, Coinbase will begin monitoring to detect any inbound payments. As cryptocurrencies are operated as push payments, Coinbase sets an expiration time for every charge, which is currently one hour.

When customers pay for something with a credit card, their information is used to pull the payment from them. Traditional payments are mostly pull payments.

By contrast, when customers pay for something with crypto, they use a wallet to push the payment (a crypto amount and wallet address) to the merchant. Cryptocurrency payments are push payments.

Source: coinbase

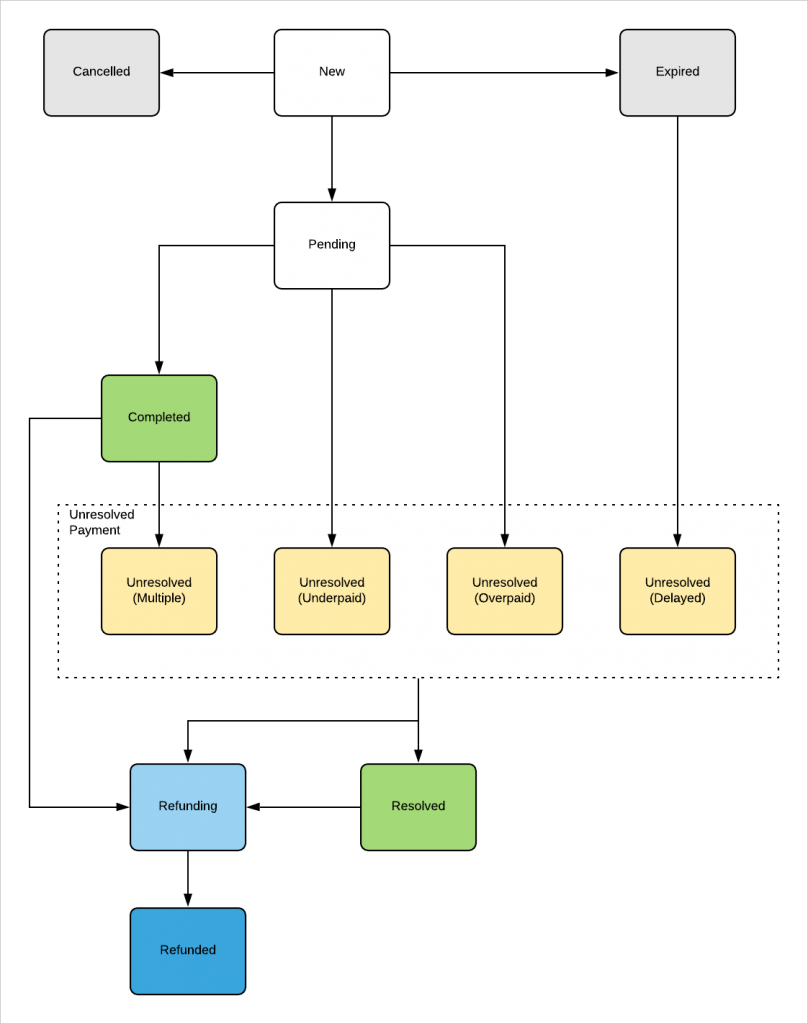

Once a payment has been requested, Coinbase updates your Dashboard with the payment status information.

As soon as the transaction is validated by the blockchain network, its status will change to “Completed.” You can process that new order now. If the request expires (after one hour), the customer will be invited to create another request to pay.

This diagram explains the accepting crypto payments in more detail:

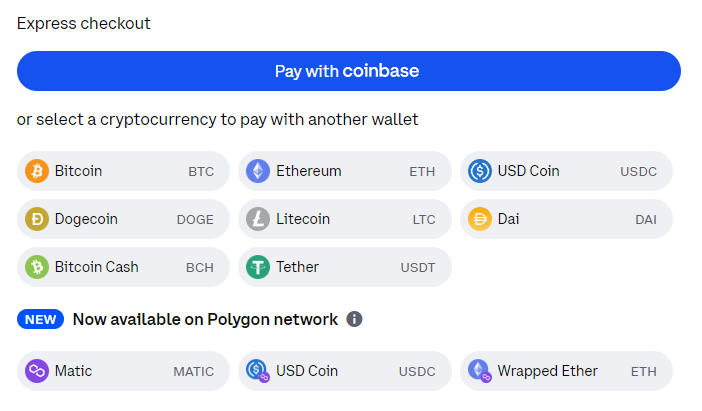

The crypto integration within your current shopping card includes many popular digital currencies your customers will be able to use, including:

Note: Paykickstart has had Coinbase integration for affiliate payouts for quite a while now. This new integration allows businesses to start accepting digital payments from customers directly.

Cryptocurrency is the future of the billing industry, but it is still not as well adopted which gives businesses an opportunity to stand out by being one of the first few who started supporting digital currency payments:

Becoming an earlier adopter of industry trends is one of the most effective ways to boost your business ROI and grow brand awareness.

Further reading: 6 Payment Processing Trends that Will Shape Your SaaS Business

Cryptocurrency is ultimately going to disrupt the billing industry globally. We are still at an early stage of mainstream adoption, but it is already evolving our understanding of business operations. If you want your business to survive the disruption and win from it, becoming an early adopter of cryptocurrency processing is an excellent idea.

And while it may seem overwhelming, PayKickstart makes it doable. With Coinbase integration, we did all the hard work for you by integrating crypto payments into your current shopping cart. All you need to do is to enable that integration and give it a try.

PayKickstart’s crypto processing integration makes digital currency integration easy and affordable allowing you to focus on benefiting from new payment processing options.

Become a PayKickstart customer now.

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty