Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

The global COVID-19 pandemic accelerated the growth of cryptocurrency like Bitcoin.

An increasing number of businesses are using cryptocurrency globally, and there are lots of startups trying to make the process of cryptocurrency exchange easier.

What does it mean for your business and billing strategy?

According to Crunchbase, the crypto sector has attracted more than $12 billion in the US and $19 billion globally in venture investment since 2017.

And while cryptocurrency has seen at least a 5-year acceleration during the pandemic years, the mainstream adoption is not still there, and that’s key to the success of that sector.

In other words, until digital currencies become mainstream, there will be no huge impact on online billing.

The two main obstacles to the mainstream adoption of Bitcoin and other cryptocurrencies are: Price volatility and regulations.

Bitcoin remains volatile, and that is one of the most crucial factors preventing the cryptocurrency from going mainstream.

However Bitcoin is one of 200 cryptocurrencies out there. Both Dubai and Sweden have come up with their own digital currencies, and the United States is expected to do the same at some point.

In fact, Bitcoin is already considered the grandfather of cryptocurrencies, even though these terms are still commonly used as synonymous. Plus, with the growing popularity of NFTs, crypto is going to become only more powerful.

Tax evasion and market manipulation are one of the main reasons governments want to regulate cryptocurrencies.

In the United States, bitcoin operations are considered cash exchanges and must be reported to the IRS. In many jurisdictions, there’s no clear categorization of the cryptocurrency which makes it difficult to adopt or report.

Furthermore, Bitcoin is said to open up a lot of possibilities for financial operations that leave no traces. Hence, for less experienced users, there’s also a growing threat of falling prey to a theft.

To enable cryptocurrency payments, you will need to set up a crypto payment gateway which is a payment processor for digital currencies. Most crypto getaways perform immediate conversion and let you receive fiat currency in exchange.

There are currently a few options already available, including Coinbase, CoinsBank and Coingate. Because of different regulations, most crypto getaways will enable payments within a limited number of countries. There are also not too many options for SaaS and subscription businesses yet.

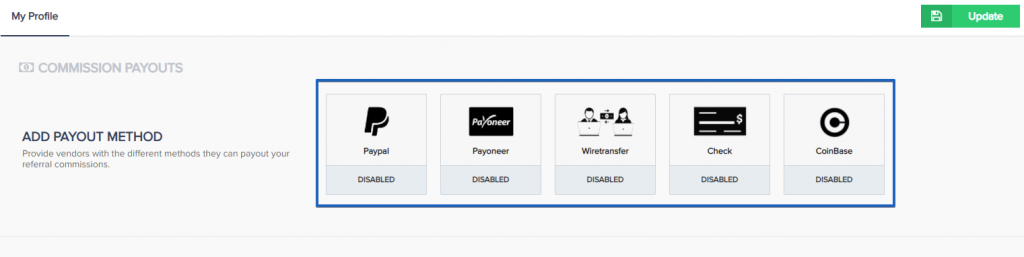

Coinbase is the most trustworthy crypto getaway out there. It is based in the US and has to adhere to the local regulations which makes it very reliable. PayKickstart has a seamless integration with Coinbase allowing you to enable affiliate payouts using crypto:

While the crypto sector remains far from becoming mainstream, there are already certain benefits of enabling crypto getaways:

Further reading: 6 Payment Processing Trends that Will Shape Your SaaS Business

In his book “The Future of Money,” Eswar S. Prasad, Professor of Economics at Cornell University, predicts the death of physical cash, and I guess we have all seen that coming. And in many ways, the fast growth of cryptocurrency is the driving force behind that force.

In his article, Eswar describes the future of cryptocurrency:

Digital tokens representing money and other assets could ease electronic transactions that involve transfers of assets and payments, often without trusted third parties such as real estate settlement attorneys. Governments will still be needed to enforce contractual obligations and property rights, but software could someday take the place of other intermediaries, including bankers, accountants and lawyers.

As soon as central banks develop their own digital currencies, the world will undergo a major revolution of how we buy, invest, and manage risk.

As government and institutional adoption continues, businesses will need to adapt to the changing financial landscape and eventually add support of crypto to their billing strategy.

We are not there yet but cryptocurrencies have an unconventional potential to allow consumers access to a global payment system.

The cryptocurrency has already laid the important foundation for a more honest and open worldwide financial system, redefining the very concept of money. The future is in the new decentralized financial system, and that future is almost here.

The biggest factor that drives the future of digital currencies is an ability and flexibility to serve people all over the world, whether they have bank accounts or not. The current banking system is inefficient and limited. No wonder, there are 1.7 billion unbanked people in the world that can be included into global transactions thanks to the crypto industry.

The blockchain technology provides easier ways for unbanked people to access the global payment ecosystem.

Major companies are already warming up to crypto technology, including Tesla, Square, Visa, Paypal among many others.

Sooner or later, cryptocurrency is going to disrupt marketing and billing strategy all over the world. We are still at an early stage of mainstream adoption, so it is not easy to foresee how exactly it will change the way to exchange transactions, but it is already evolving our understanding of business operations.

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty