Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

ARPU is a metric used by subscription businesses and non-subscription businesses alike. It helps them understand how much they’ll earn every time they sell a unit of product.

This number is an average and shouldn’t be used to evaluate individual transactions. Instead, it should be used to understand your businesses health over time.

It’s relevant to your CLTV, CAC, and MRR. In short, this metric affects all of them.

In this article, I’ll look at what ARPU is, how to calculate it, and a few strategies to help you increase it.

ARPU is an acronym that stands for average revenue per user or average revenue per unit depending on what type of business you run. In subscription businesses, it’s users and in an ecommerce or other product business it’s unit.

Average revenue per user is the amount of money a business can expect to generate from an individual customer over a certain timeframe – usually a month. ARPU is similar to ACV but ACV is measured over a one year period and deals more with bookings.

Average revenue per unit is the amount of money a business can expect to generate from a selling a single product unit.

It’s important to note that these aren’t GAAP accounting terms or practices so there’s no standard calculation. Even so, the calculation is the same or similar across industries and businesses.

The calculation for ARPU is straightforward.

ARPU = Total revenue / Total number of users

ARPU = Total revenue / Total units sold

There are two things to take into consideration with this calculation.

The first one is the timeframe. How long should you calculate revenue? The most common approach, especially in subscription businesses, is to use one month.

Simply take revenue for that month and divide by total active users in the same month. The result is your ARPU.

There are exceptions to this rule of thumb. If your users only renew or purchase quarterly then that may be a better timeframe to measure ARPU.

The second thing to consider is what counts as a user. This won’t be an issue if your subscription doesn’t use per seat pricing.

For example, PayKickstart doesn’t scale pricing based on how many people in a company are using the account. A user is the same thing as a customer.

Other companies scale pricing based on users. An example would be customer support software like Help Scout. Every user added to an account increases the amount billed to the account. You’ll have to decide whether you consider each seat a user or the entire account a user.

If you’re selling tangible goods or customers perform one off transactions then you’d consider each customer within the stipulated timeframe a user.

What’s most important here is that you define users or units in a way that makes sense for your business and stick with it.

ARPU is relevant to a lot of other things in your business like customer lifetime value and customer acquisition costs. It helps you understand a number of things.

It’s possible to get even more granular with ARPU and track it based on acquisition channel. In some cases you’ll realize that when taken as a whole, your ARPU doesn’t allow you to use certain channels profitably.

As you drill down and segment customers that come from that channel you realize it’s profitable.

For example, ACME Inc. has an ARPU of $20 overall and aims for a payback period of 3 months (that equates to $60 CAC). It used Google Ads in the past and got customers for $80 which exceeded their maximum payback period of 3 months.

Later on, it revisited Google Ads and decided to calculate ARPU from users who came from that acquisition channel separately. After running the numbers, it realized ARPU from Google Ads was $30 which meant it was within their target payback period and a viable acquisition channel.

This is why it’s important to decide on a timeframe and a definition for “user” early on. It makes it possible to compare your ARPU to different periods accurately.

If you see your ARPU is increasing month over month then you’re doing something right. If it’s decreasing month over month then something needs to be corrected. It’s effective for spotting trends over time.

We all want to increase the amount each customer pays us – right? Here are a few effective ways to do that.

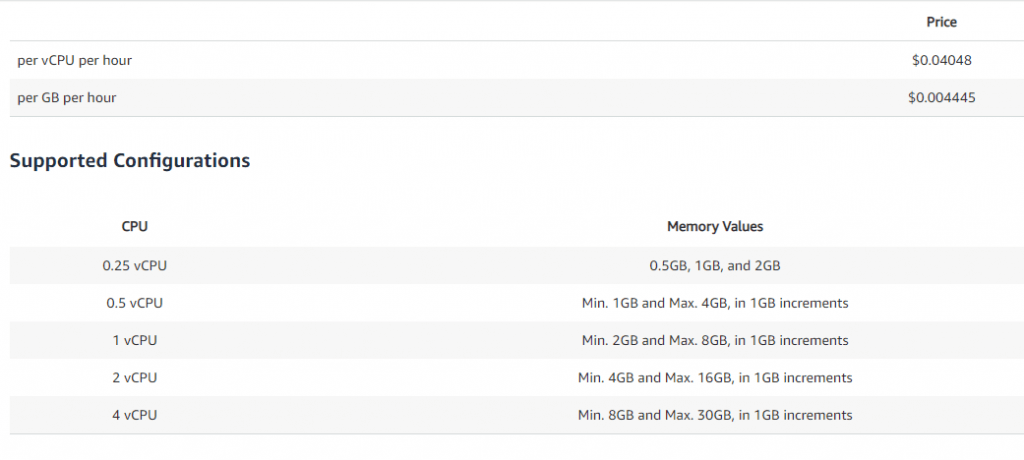

Tiered and volume pricing can be an effective way to increase your average revenue per user if you use them correctly.

The advantage is that it lets you present a smaller entry level price but the product is built in a way that encourages upgrades when your users derive value.

The bad part about this type of pricing is the added complexity. It may be difficult for customers to understand exactly what they’re paying for.

I find the pricing above confusing and this is just a tiny part of the service.

This is the easiest way to increase ARPU and is a strategy many companies follow. They price entry level customers out of the service and slowly move upmarket.

While this does add to your ARPU, it comes with its own set of challenges. The more expensive a product is the longer the sales cycle. If you go this route, be sure to test pricing changes thoroughly before you alienate a large chunk of your customer base.

I may be biased but this is my favorite way to increase ARPU. One click upsells and cross sells add value to your customers and encourage them to spend more with little extra effort.

It gets a bad reputation from the way some internet marketers have used it in the past. You shouldn’t worry about those aspects because you’re a legitimate business selling useful products.

I digress.

Pair your upsells with lower cost products to drive up the revenue from your least valuable customer segment. When you have a few sales funnels set up, continue to tweak them and watch as your ARPU rises over time.

ARPU is a metric that helps you understand how valuable each transaction is to you. With that information, you’re able to plan acquisition strategies and other initiatives.

It also helps you understand whether your customers are becoming more valuable over time.

It’s relatively simple to calculate and I mentioned a few solid strategies to help you increase it over time. The higher your ARPU the more money you have to reinvest in your business.

Let me know what you think about ARPU in the comments and don’t forget to share.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu