Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

CLTV is one of the most important metrics in your business. It’s the difference between focusing on customers segments that’ll grow your bottom line exponentially and losing it all.

Yes, it’s that important.

What is CLTV?

CLTV (Customer Lifetime Value and) also known as LTV (Lifetime Value) is the dollar amount each customer is worth to you over the entirety of their relationship with your business.

Put another way, it’s the amount they’re expected to produce for your business over time.

When you have a handle on your CLTV, you can acquire customers profitably; better allocate resources, and segment customers.

This article looks at the benefits, use cases, and how to calculate CLTV so you can make better decisions in your business.

Some of the benefits of tracking CLTV are obvious like knowing how much a customer is worth to you. While other benefits like segmentation and resource allocation aren’t immediately obvious.

When you understand how much revenue a customer will yield over time, you can decide how much you can spend to acquire them.

The relationship can be direct expenses like Facebook ad spend and the salary of the person managing it. Or you can look at indirect spend like blogging and video marketing which yields dividends over time.

Either way, your CLTV will inform which channels you can use to acquire customers and which ones are too expensive for you.

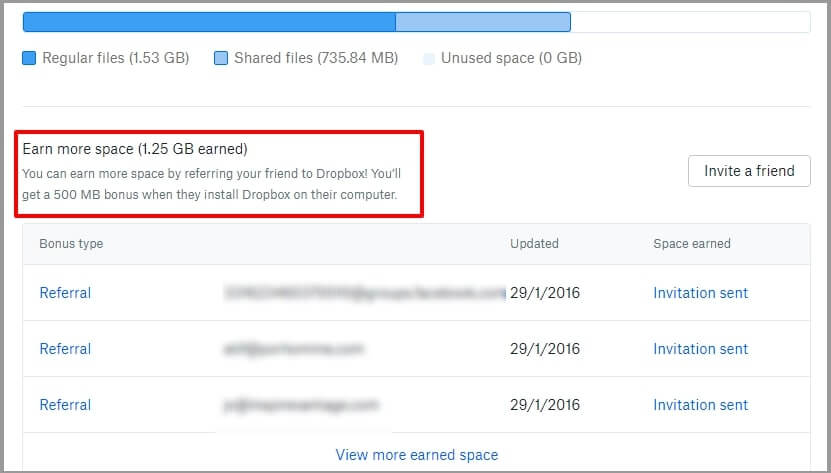

When Dropbox first entered the market, they were using Google Ads and acquiring customers for more than $100. The only problem was their CLTV was $99. This means they were losing money on every acquired customer.

That was unsustainable so they turned Google Ads off as an acquisition channel and instead focused on their most popular strategy to date. An affiliate referral program that paid affiliates with more storage space.

This dramatically reduced their customer acquisition costs (CAC) and built the billion dollar company we know.

A CAC to CLTV ration of 1:3 or more is ideal.

To calculate CAC, add up all your advertising, marketing, and sales expenses and divide it by the number of new customers over a certain time frame.

Here’s an example.

We’ll add up all the marketing and advertising expenses (1,000 + 2,300 + 4,500 + 450)/215 = $38.37

The customer acquisition cost is $38.37 per customer. A longer timeframe will give you a better average.

CAC means nothing on its own. If the lifetime value of your customers is $40 then a CAC of $38.37 is horrible. If your CLTV is $1,000 then a CAC of $38.37 is amazing. Context is important here.

Note: exclude returning customer from your CAC calculation. It costs as much as 5x more to acquire new customers than retain old ones.

The CLTV calculation takes all customers into consideration and gives you an average.

That’s the most basic way to use it. Even then, you still get an edge over anyone who’s not using CLTV to make decisions.

It’s possible to increase the utility of CLTV by using it to segment your customers. For example, you can divide them into the top 25%, middle 25%, and bottom 50% of CLTV.

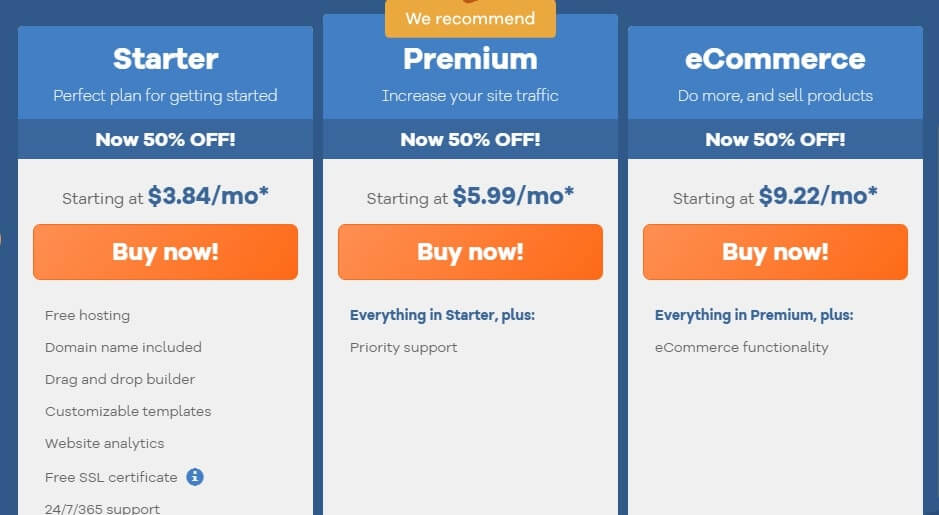

Subscription businesses tend to have multiple pricing tiers which a great way to start segmenting customers based on CLTV.

Let’s use an example.

A company has a CLTV of $1,000. When they segment their customers into different ranges of CLTV, they realize a segment of their customer base is worth $2,000, another group is worth $1250, and the final group is worth $500.

They took it a step further and segmented CLTV by advertising channel. They realized that Instagram brought the lowest value customers and Pinterest brought in the highest value customers.

With these insights, they can determine the psychographic and demographic profile of their best customers and optimize marketing and advertising to appeal to them.

A customer that’s worth $150 should receive different resources and attention than one worth $10,000.

Of course, I’m not saying the lower value customer should be treated poorly. I’m saying, through simple economics, you can’t deliver the same service level to everyone.

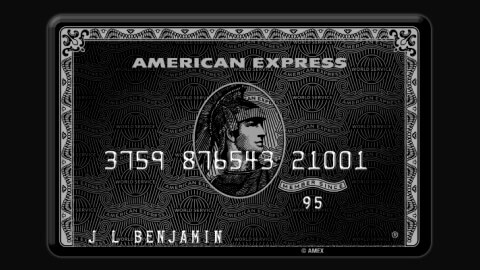

Take the Amex Centurion Card (Black Card) as an example. It comes with an unlimited concierge service.

There are stories of American Express employees traveling to the Dead Sea to collect sand for a card holder that lives in London. They’ll get you almost anything from anywhere.

Of course, they couldn’t do that for millions of customers, just the ones with a CLTV that’s high enough.

On many pricing pages, support is allocated based on how much you’re paying.

It’s interesting to note that the more a customer pays the less likely they are to use support channels.

Upselling and cross selling are powerful ways to increase your customer lifetime value.

Upsells and cross sells are a great way to improve your CLTV but your CLTV informs when you should use upsells and cross sells.

Let me explain that a bit more.

Let’s say your average order value is $100. A customer comes around and wants to check out with only $70 in their cart. You can trigger a cross sell or an upsell that increases the cart value.

That way, you’re able to capture more value and make sure the customer is in line with your expected CLTV.

PayKickstart was built to maximize your conversions and revenue in situations like this.

There are many different variations from the basic to the advanced so I’ll lay out the calculation then go through a few examples.

Please note: there are multiple ways to calculate CLTV and take many factors into consideration. I’ll give you two formulas. One focuses on revenue from a customer and one focuses on gross profit from a customer.

This formula gives you a solid idea of the total dollar amount a customer is worth to your business over time.

(Average order value x order frequency per month) x retention period in months.

Let’s go through a few examples.

Company A has an average order value of $131 and an average order frequency of 2 times a month. Customers who have a positive experience stay with Company A for 12 months.

Their CLTV calculation would be (131×2)(12) = $3,144.

Company B has an average order value of $20 and an order frequency of 4 times a month. Customers stay with the company for 5 years.

Their CLTV calculation would be (20×4)(60) = $4,800

This lifetime value calculation only tells part of the picture. Company B appears more valuable than Company A. You can’t draw that conclusion until you understand the gross profit margin.

This formula lets you know how much a customer is worth in terms of profit.

((Average order value x order frequency per month) x Average gross margin as a percentage) x retention period in months

Let’s use Company A and Company B again but this time we’ll add their gross profit margins to the equation.

Company A has a gross profit margin of 50%.

The calculation would change to ((131×2).5)(12) = $1,572

This is a big change from the $3,000+ Company A produces in revenue.

Company B has a gross profit margin of 25%.

The calculation would change to ((20×4).25)(60) = $1200

After looking deeper into the numbers behind each business, it’s clear that Company A derives more value from its customers.

Customer lifetime value is one of the most important metrics in your business. It informs how you go about major decisions related to customer acquisition and resource allocation.

You can also use CLTV to determine if product lines are performing up to your expectations.

The calculations themselves, which we went through in the article, are straightforward but it’s important to use the right data. Otherwise, you’ll be making decisions based on flawed metrics.

Let me know what you think about CLTV in the comments, how you’ve been using it, and any additions.

Mark Thompson is CEO of PayKickstart and a serial entrepreneur. He is passionate about helping thousands of entrepreneurs and businesses grow through advice, automating payments and providing affiliate tools.

Read More About Mark Thompson