Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

There’s a common thread in every subscription business. It doesn’t matter if you’re selling software or clothes, if you’re not careful, it’ll eat up all your revenue.

I’m talking about churn.

There are many types of churn such as revenue churn, customer churn, voluntary churn, and involuntary churn.

It should be the top priority of every subscription business to reduce churn to the bare minimum. In this article, you’ll learn about voluntary and involuntary churn, common examples, and solutions that’ll help keep it in check.

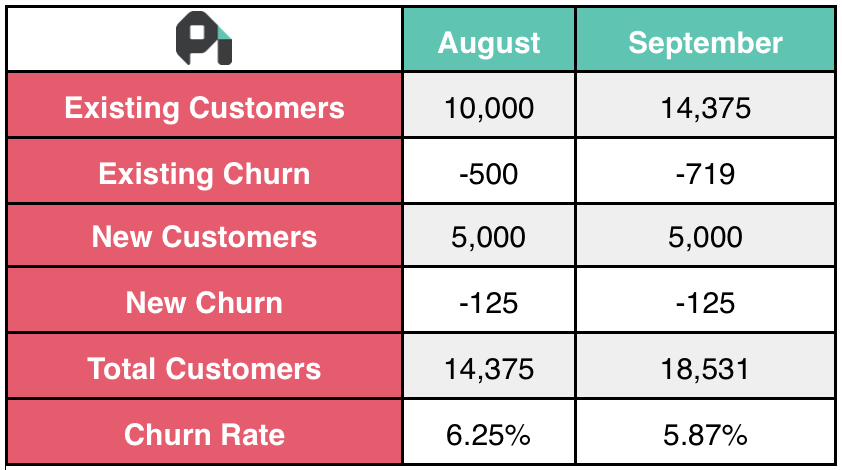

Churn can be defined as the percentage of customers who leave your service every billing cycle. The most common timeframe to measure churn is yearly or monthly. It can be divided into two overarching types.

Source: profitwell.com

The goal with a subscription business is to get to net negative revenue churn. Even though you’re losing customers, the revenue lost is offset by expansion revenue.

Both revenue churn and customer churn can be through voluntary or involuntary churn.

Voluntary churn is when someone chooses to stop paying for your service. In many businesses, this is the most common type of churn and has a huge impact on their ability to grow revenue consistently. It’s also more challenging to tackle because it’s a choice.

Involuntary churn is when someone’s subscription is canceled without them taking any action. The most common form of involuntary churn is when a credit card expires or otherwise gets declined. There could be a hold on the card, insufficient funds, cancellation due to being lost, etc.

While voluntary churn is more common, involuntary churn is more painful. It’s hard to stomach because you know you have a great product, the customer appreciates it, but they still stop paying. It’s like all your hard work is lost because of a technicality.

Voluntary churn usually happens due to a shortcoming on your part. Maybe your service isn’t quite what they needed and they’re tired of trying to hack it together. It’s possible that they’ve outgrown your solution because of a larger team or a change of focus.

Whatever the case, churn should be reduced using all the resources at your disposal. Throughout the rest of this article, we’ll look at different ways to combat churn in your business.

Since voluntary churn is an active choice, it stands to reason that if you meet the needs of your customers, they’ll stick around longer.

There are many ways to go about this but the first step is to figure out why people are churning in the first place. You can do this in a number of ways. For example, at PayKickstart there’s a two part method to understand why people churn.

First, there’s a short survey when a customer cancels their subscription that asks what the problem is. It presents multiple options. Afterward, the head of customer success will reach out to schedule a call or get a deeper understanding of the problem.

In some cases, this wins back the customer because they had a problem that could be solved. In other cases, it sheds light on where improvements need to be made.

Once you have this information on hand, you’ll be better equipped to tackle your voluntary churn. If you’re not in a position to get enough data on cancellations, here are a few ways to reduce churn that can help almost every business.

The onboarding process helps users get acquainted with your product, reiterates your value, and leads them to the first aha moment. When done well, it can have a huge impact on churn.

Take a look at your product analytics. Are there important features that aren’t being used often? Is there a screen that takes a lot of time for people to navigate? Do people abandon your product at specific places? Are there a lot of customer support queries about the same thing? What important aspects are necessary to set up a customer account properly and are people doing it?

All of these things can be opportunities to improve the onboarding process. After finding these bottlenecks, either make it easier or create useful instructions to help people get through them quickly.

Another way to reduce voluntary churn is by designing your products to keep people engaged. This can be done in multiple ways.

Last but not least, ask your customers. Ask them what they like, ask them what they dislike, ask them what you can improve. This will go a long way towards reducing churn because customers feel like they have a voice (which they should).

It’s even more powerful when you quickly implement their feedback and make the products easier or better for them. Don’t take this aspect for granted. Ask more often than you think you should and don’t let up unless customers tell you to slow it down.

Involuntary churn is a different beast entirely but it’s easier to tackle. Remember, involuntary churn happens through no action of your customers. In most cases, they didn’t want to churn so if you take a few proactive measures, you’ll be able to reduce by a large amount.

One of the most impactful things you can do is simply send reminder emails to let customers know the card on file will soon expire (this is called pre-dunning but may not be ideal in every situation). On average, Americans have 2.6 credit cards. This average is influenced by people who don’t own any card. When that group is excluded, the average jumps to 3.7 cards per person.

That means whoever signed up with your service may have done so with one of their many cards. They may not remember the card used to sign up for your service so it may be a good idea to remind them about the upcoming expiration.

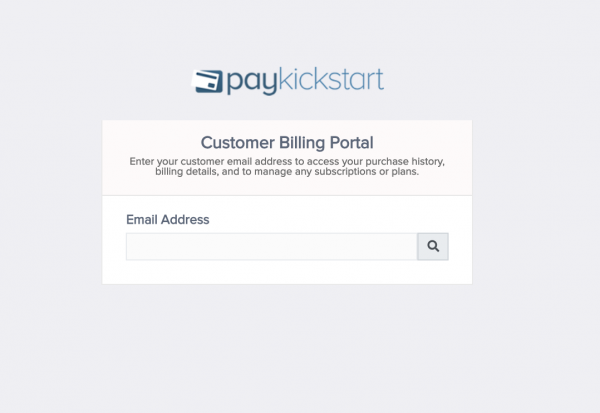

Give them an easy way to change the card details. With PayKickstart, you can take advantage of the Customer Billing Portal so customers can update card details without having to log in.

In-app messaging works well if you have the kind of product that requires constant use. For example, if you’re using an email marketing service, you’ll probably log in a few times a month. When your card is close to expiring, the service will start showing you a notification every time you log in.

Most people who want to continue using the service will update the card as soon as they can. PayKickstart also offers this service. You just need to paste a snippet of code in your membership portal or application and it takes care of the rest.

If it has gotten to the point where the card is declined, it may still be updated with no action on your part or the customer’s part. This is because of the Automatic Billing Updater (known as the ABU – MasterCard, Visa, and Discover support this with more card networks adopting it). The ABU helps ensure uninterrupted service so if you try the first time and the transaction fails, it may go through the next time.

Keep in mind this isn’t a universal solution amongst the card networks that have adopted it. Only about 70% of cards are covered worldwide.

Churn is a constant threat to the health of subscription businesses but it doesn’t have to drag you down. This article has gone through the major types of churn and what you can do to protect your business.

Implement the fixes one by one so you’re not overwhelmed and check on your solutions regularly. Over time, you’ll see that churn is reducing and you’re able to retain much more revenue. Let me know what you think in the comments and don’t forget to share.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu