Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

There are two things every digital marketer should know about “credit card declined” problems that put a screeching halt to sales during the online checkout process:

Whether you realize it or not, about 15 percent of the people who want to buy from you are hitting a card declined barrier at checkout. And if your online income is significantly tied to subscription renewals, it’s likely that up to 40 percent of your churn rate is a direct result of failed credit card transactions.

Whether you’re selling information products, lawn services, tee shirts, or software – there’s one thing I know for sure about your business:

Credit card decline issues are taking a significant chunk out of your income.

Would you like to learn how to save many of those credit card declined transactions, keep the sales that would’ve been lost, and boost your revenue by following a simple strategic plan?

That’s exactly what this article is about.

We’ll look at the primary reasons card declined events occur and the steps you can take when someone who wants to buy from you gets waylaid by a card declined event.

The system described below is completely automated. It will work for you 24/7 to keep customers happy and the cash register ringing.

NOTE: Keep reading and I’ll even throw in a bonus: A ninja-only secret aimed at preventing credit card declined situations from occurring in the first place.

At first blush, this may sound like a no-brainer. Credit cards get declined due to insufficient available credit – right?

That’s part of it, but there are other possible reasons too:

When a card is declined, your payment system’s job is to determine what caused the issue and (therefore) whose job it is to fix it.

The buyer may only need to check and re-enter the verification data, a database problem on your end could be the culprit, or you may need to place a call to the gateway or bank to see if the problem is on their end.

Here’s what definitely doesn’t need to happen:

The buyer gets a popup saying “Your card was declined.”

Then … silence.

NOTE: For the purposes of this article, there is little difference between a “credit card” and a “debit card.” Both are apt to be denied, and both require the same sort of strategy to save the sale.

You don’t need to keep a constant watch on your checkout sequence to catch card declined problems and handle them manually.

Nobody wants that job.

What you do need is an effective, automated strategy for dealing with a problem that’s causing you to lose sales that should’ve been completed.

The good news is that you probably already own or subscribe to the tools and platforms you need to save credit card sales and boost your online marketing ROI.

(There is no bad news.)

Put this simple five-step strategy into action, and you can earn more money from online sales … starting today:

Let’s look at those steps one at a time.

You can pull the data needed to compute the card declined rate for your online business from any of several places: your analytics program, your shopping cart or affiliate management dashboard, or your payment processing gateway. If you’re not sure how, ask customer service for the particular platform you use.

PayKickstart members can get full information on credit card declines by following this path from the PayKickstart dashboard:

Dashboard > Payments > Transactions

That will give you all an overall look at payments processed, payments pending, and payments failed. You can also test the system and see the results there. To get details on any transaction, click on it. For failed transactions, you’ll see the transaction id, the message returned by the payment gateway, the campaign name, the amount, and more.

Regardless of where you pull the numbers from, here’s the formula for determining your credit card decline rate:

Card Decline Rate = Failed Transactions / (Processed Transactions + Failed Transactions)

Compute that rate for the past 30 days of sales and determine the average. That’s your baseline. Note that the formula given above ignores pending transactions. Since we don’t yet know which way they’ll go, we can’t assign them. We could apply a statistics formula to get closer to the actual rate, but the basic formula gets us plenty close enough to the actual figure.

[Design suggestion: Insert a screenshot of the PK dashboard showing the readout from a failed transaction … alternatively, prepare a graphic showing the card decline rate formula.]

Check your shopping cart software or provider to find out how declined card events are handled by your particular system. Your first job is to determine what that method looks like and whether it is sufficient.

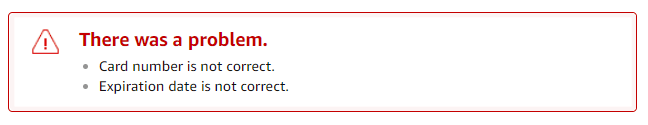

Here are the components of an effective declined card notification:

The wording you use will depend on how much real-time information you have about the reason for the declined card. Ideally, you’ll be able to use feedback from the payment gateway (incorrect card number, card expired, zip code doesn’t match, etc.) in the message you show the customer. That makes the fix evident and simple.

If the card is rejected for a reason not easily fixable (fraud alert, insufficient funds, etc.), suggest alternate means of payment. Offer options for PayPal and direct withdrawal, for instance. Your aim is to provide enough information without turning the card declined pop-up notification into a document that looks confusing to customers. Keep it brief and helpful.

NOTE: Fraud alerts are often false. Both your payment processor and gateway use fraud filters that can catch and reject transactions needlessly. You may be able to adjust the gateway filters to ignore or flag certain kinds of suspicious transactions. Payments from customers outside of the USA, for instance, or transactions greater than a set limit. If you’ve ever had a card declined at a gasoline pump while traveling – because the issuer didn’t know you’d be out of your usual area – you’ve been on the receiving end of an erroneous fraud alert.

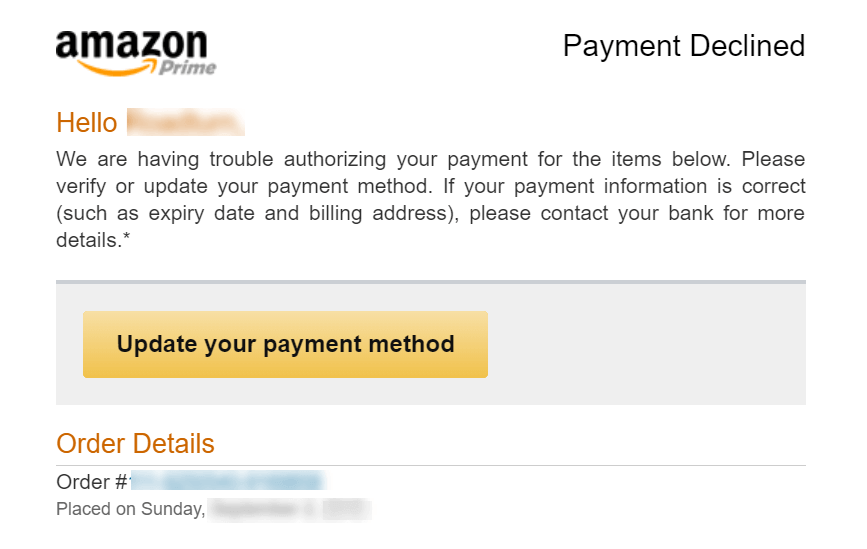

If the prospect fails to complete the purchase, your checkout system should immediately send an email to the prospective buyer to address the declined card event.

This is the first step in your “dunning” sequence.

The goal is to remind the prospect of the situation and provide alternate methods of finalizing the purchase.

In essence, the first email is an expanded version of the initial pop-up message shown to customers while they are still in your checkout procedure. Subsequent emails serve as reminders.

Here again, keep the messaging light and non-threatening. You’re not the IRS going after a delinquent taxpayer. Stay in relationship-building mode and assist the prospect. Do everything you can to make buying from you one of the easiest things the prospect has done all day. Check the Amazon email example below.

If prevention is worth a pound of cure, then this step can save your business a ton of money and save you a truckload of unnecessary headaches.

Here are some of the ways you can proactively reduce the number of credit card decline issues occurring in your checkout process:

Now, let’s talk about that ninja-only secret I promised. It’s a process called “3D Secure.” And if you’re selling to customers in Europe or Asia-Pacific , this additional layer of authentication can save sales your payment processing system would almost surely reject. Not only that, but 3D Secure can relieve you of chargebacks arising from fraudulent charges.

Many foreign banks absolutely won’t accept transactions not verified by this system. This is especially true with the ever-toughening European regulations on ecommerce. Check with your payment gateway to determine how to enable 3D secure for your account.

Treat your revenue losses due to credit card declined errors like an avoidable pothole instead of like an inevitable evil. Pull a regular (at least weekly) analytics report on failed payments and study it closely.

Once you’ve developed a feel for why cards are being declined and have successfully made changes to lower your card decline rate, you won’t want to stop. Smart marketers know this is an often unrecognized and unappreciated leverage point in the ecommerce conversion rate optimization strategy.

The path I’ve recommended here begins and ends with keeping tabs on the credit card declined rate for your online business.

You may be surprised to find out how much money card decline errors are costing you.

NOTE: I’m a PayKickstart member, so most of the suggestions I’ve made are covered by the PayKickstart system – right out of the box. I’ve edited the copy in my dunning emails to address my particular audience, but that’s about all the modifications I’ve needed to make for my account.

Are you ready to check your credit card decline rate and use the five steps given above as a checklist for creating an effective card decline strategy?

Good.

Writer, Dreamer, Believer. Don Sturgill is author of The Daily DEEP and a friend to entrepreneurs everywhere. Get your copy of The DEEP and find out more about Don's work at donsturgill.com.

Read More About Don Sturgill