Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

The payment processing industry powers the giant global online e-commerce market. In 2018, Statista estimated there were 1.8 billion global e-commerce buyers. In 2019, they determined that e-commerce sales accounted for close to 15% of total global retail sales. If you are a business owner wondering how e-commerce can help your business grow online, there is one aspect about the e-commerce industry you must first understand – the payment processing industry.

Payment processing or credit card payment processing is the backbone of the global e-commerce industry. Almost all online transactions use a form of card payment, whether credit or debit, to complete a purchase. For this process to work, several parties and processes involved in the payment processing industry must work in concert in the background. In this article, we shed light on the players involved as well as the processes that enable global online e-commerce payments.

A merchant is any entity (individual or company) that sells goods or services. In e-commerce, an e-commerce merchant is an entity that sells products and services online. For an e-commerce merchant to accept credit card payments, they must first get an e-commerce merchant account from an acquiring or merchant bank (more on this later).

Think of this as a bank account but one that is specific to online merchants. The merchant account is what will enable the merchant to accept credit card payments.

With the merchant account, the merchant can identify themselves as the owner of any credit card transactions originating from their e-commerce website. Merchant accounts typically attract fees, which may be charged monthly, as a transaction percentage or both.

Getting a merchant account is usually easy but you must agree to specific payment processing industry regulations set by both the acquiring bank and credit card associations like Mastercard and Visa.

An e-commerce shopper is anyone who makes a purchase online using a credit card. When a shopper visits an e-commerce website intending to make a purchase, they must have a valid credit card for a transaction to go through. A valid credit card is defined as one that has not expired, has not been flagged and has not been reported as stolen or compromised.

For a merchant, the essential parts they must provide the shopper with are a shopping cart and an encrypted connection. The shopping cart gives the shopper a way of inputting their credit card details while the encrypted connection (evidenced by a URL with the prefix https) ensures these details are encrypted before being sent onwards to the payment gateway.

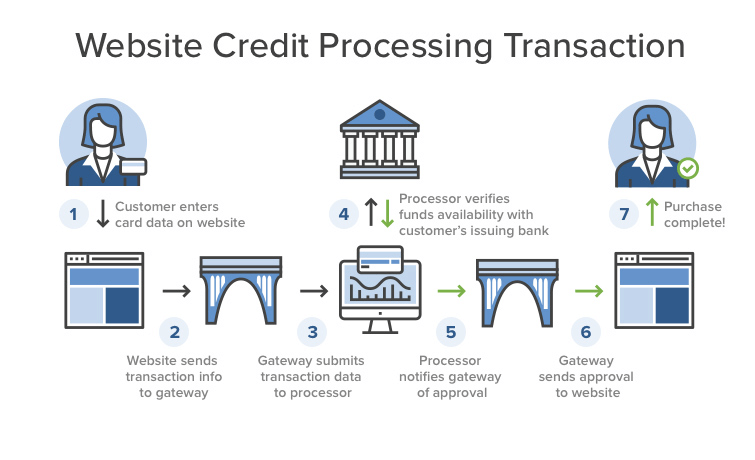

Payment processing is what happens behind the scenes once a shopper has initiated an e-commerce transaction through a purchase. While it is usually a complicated and highly technical process, here we break it down into its constituent parts:

A payment gateway is a software that transmits and receives transaction information from an acquiring bank. A payment gateway facilitates the transmission of e-commerce transaction data between banks and e-commerce shopping carts to enable payment processing. The main reason banks receive data through a payment gateway is because it also acts as a security buffer between the merchant’s website and the bank’s core banking systems.

If a merchant cannot or does not want to go directly to an acquiring bank to get a merchant account, they can work with a payment service provider or PSP who provides and manages merchant accounts on behalf of the merchant. You can say a PSP acts as a merchant account reseller for an acquiring bank. Besides providing merchant accounts, most PSPs also offer other services like PCI compliance, cybersecurity and fraud protection.

A payment processor is an entity authorized to process credit card payments on behalf of a merchant. The payment processor accomplishes this by acting as an intermediary between a cardholder, a merchant, the payment gateway, the acquiring bank and the issuing bank.

When a merchant works with a payment processor, the payment processor handles everything related to the entire payment processing process. Payment processors are responsible for maintaining PCI compliance, implementing anti-fraud measures, chargeback mitigation, and identity theft prevention.

We have mentioned the issuing bank severally so here is the definition: an issuing bank is any bank or financial institution that issues or grants cards (both debit and credit) on behalf of a card association. In other words, an issuing bank is a bank a shopper holds an account with, and which has granted them a card, which they can use for e-commerce purchases.

A card association is a string of banks in the payment processing industry that issue and accept payments from a specific brand of payment cards (i.e., Mastercard, Visa, American Express, etc.) In some cases, card transactions are evaluated by the banks within a card association on behalf of the card company (e.g., Visa, Mastercard) while in other cases, the card company itself will authorize or decline the transaction (e.g., American Express).

As the name suggests, an acquiring bank is a bank that accepts or acquires card payment transactions from cardholders (shoppers) on behalf of the merchant. It is also where the merchant receives funds once a transaction is completed.

Any card used to make a purchase must first be authorized before the transaction can be approved. Card authorization, which differs from payment authorization, typically follows these steps: the cardholder initiates a purchase, a card authorization request is sent to the acquiring bank, then to the card network and finally to the issuing bank.

The issuing bank compares the request to the card holder’s details (card balance, flagged cards, cancelled cards). The issuing bank then sends this information back to the acquiring bank via the card network and the acquiring bank authorizes/declines the card.

A transaction settlement is where a merchant receives funds for a completed transaction once all authorizations have been completed. The process starts when the issuing bank sends funds to the merchant’s acquiring bank through its payment processor. The acquiring bank then deposits the funds in the merchant’s account, completing the sale.

Now that we have analyzed the individual parts of the payments industry, let’s put it all together in a sample transaction:

Although the payment processing industry is complicated, thanks to payment processors like PayKickstart, you as a merchant do not have to deal with any of these complexities. PayKickstart simplifies the credit card payment process for you so you can focus on building your business. If you would like to find out more about how PayKickstart can help you start accepting credit card payments online, start a free trial today or contact sales by emailing sales@paykickstart.com.

Dan Macharia is an experienced copywriter with over ten years of experience writing for both large and small companies all across the United States. When he is not writing, find him reading a book or outdoors playing lawn tennis, running or just walking and soaking in life.

Read More About Dan Macharia