Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit GroupChurn is something any SaaS company will always keep fighting with.

Put simply, churn stands for losing existing paying customers.

The two main types of churn are:

Obviously, these two are inter-connected for most of the SaaS businesses out there.

Additionally, there are:

Voluntary churn happens for many reasons, many of which may not be necessarily connected to your business, like your customers’ budget limitations or changes in decision-making units. But there are many reasons for voluntary churn that can be controlled and fixed by you, including:

In many cases, it is the combination of reasons that results in increased churn. It is important to identify those underlying issues and work on fixing them.

Further reading: Top 5 Reasons for Customer Churn + Fixes for Each

There are several reasons why involuntary churn may happen, for example:

Further reading: Combating Voluntary vs Involuntary Churn

Here are the 5 most effective churn-saving techniques:

This may sound self-explanatory but too many businesses fail to actually listen to their customers. And yet, there’s no other way to clearly understand why they may be leaving.

There are several ways to ask for your customers’ feedback without distracting them from following those sales funnels. These methods include:

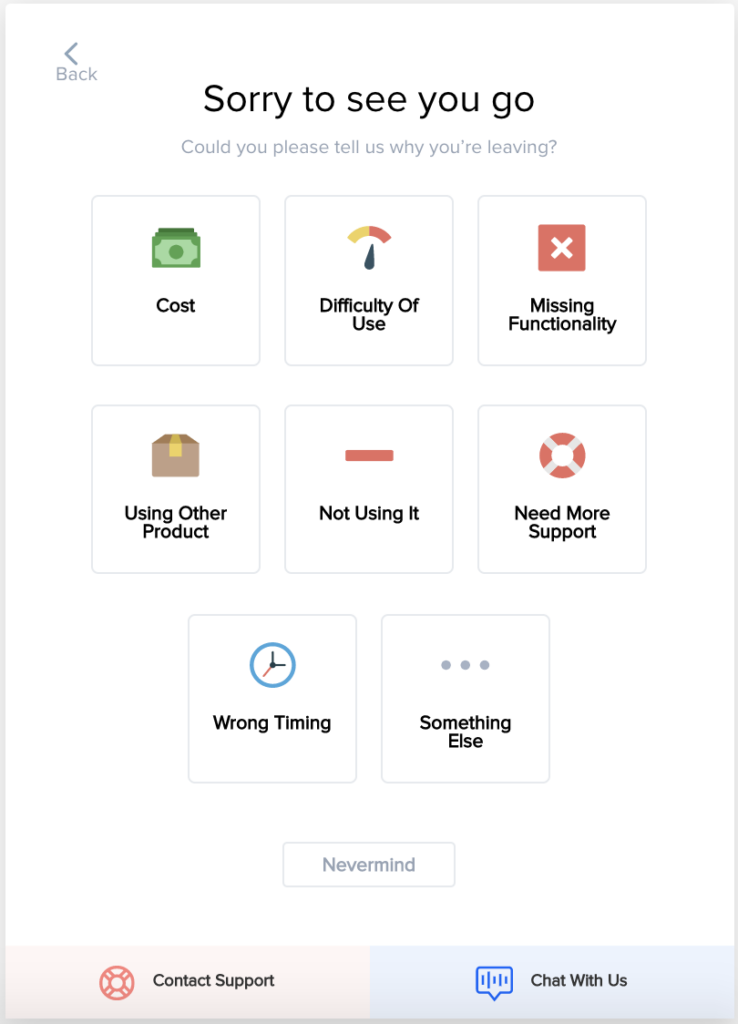

Additionally, PayKickstart offers the “Cancellation Saver” that will prompt your user to choose the reason for canceling right when they are about to quit:

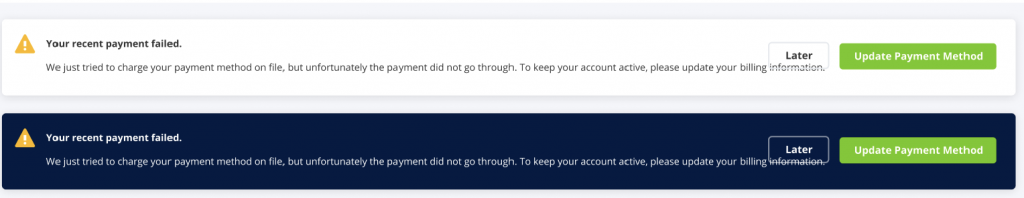

Make sure your customers know that there is a problem with their accounts, and give them time to correct mistakes before canceling their accounts. Automate email notifications alerting your customers:

PayKickstart has both of these email notifications handled for you:

Additionally, PayKickstart offers multiple email marketing integrations, subscription management tools, and many more:

It is a good idea to set your email alerts on an alternative domain to keep yours safer.

Ensuring top-notch customer support is key to reducing churn. First of all, your customer support representatives are able to save any account if help is provided promptly and effectively. When customers have issues or questions, they want to feel heard and understood. Good customer support can provide that empathy, and also help to solve problems quickly and efficiently.

To meet these expectations, support teams need accurate, up-to-date contact information, which is why tools that identify the carrier behind a phone number are so important. By using carrier lookup, businesses can quickly verify numbers and determine the correct network provider, ensuring time-sensitive messages like SMS confirmations or follow-ups are delivered smoothly without delays or failures, resulting in better communication and faster issue resolution.

By focusing on customer needs and building strong relationships, your support team can help improve customer retention and drive long-term success for your business. Clear and reliable communication is key to this effort, which depends on having accurate contact information.

Secondly, your reps talk to your customers on a daily basis. If you need to know what dissatisfies your customers, ask your support team!

Building a detailed knowledge base will help your customer service be more efficient in two ways:

Text Optimizer helps you put together a knowledge base by allowing you to auto-generate answers to questions. Make sure you edit those answers by adding specific details related to your business and product:

In-app notifications are messages that pop up within your application for your logged-in users. These notifications can be used as additional incentives for your users to keep their accounts.

With PayKickStart you can set up various kinds of transactional in-app notifications, including:

For example, if your paying customer logs in to their dashboard, they will see an in-app notification about their failed payment. This way, even if they missed your email (for example, if it was sent to the spam folder, they will know there is a problem when using your product.

Here’s an example from PayKickstart:

A lot of accounts may be lost if your team is invoicing manually. Emails get lost, and payments take longer as they rely on your accounting team to be always present to process invoices.

Manual SaaS invoicing will hurt your cash flow and increase churn, so make sure you automate it with PayKickstart.

It is important to manage churn because it comes with important risks:

Reducing churn is key to maintaining a healthy business and ensuring long-term success. Good luck!

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty