Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit GroupAre you looking for ways to boost your SaaS business income or speed up your cash collections?

It may be time to improve your invoicing strategy.

If you are still using manual SaaS invoicing, chances are it is holding your business back. Here’s how:

Humans make errors, there’s no way around that. No matter how well your workflows are set up, there are bound to be errors at some point, and that may cost you an account.

Human errors may come at different stages of a billing cycle, including:

As your business expands, the risks associated with human errors become even higher, and streamlining workflows alone may no longer be sufficient to detect or avoid those errors.

Automation can eliminate any chances of errors and also add another layer of security to your customers’ payment data processing process.

When billing is done manually, it will likely make the work environment for your employees quite stressful. Dealing with highly sensitive data is not fun. It can cause employee burnout, which can make it hard for a business to keep going.

Therefore switching to an automated payment management system (which includes automated invoicing) is so essential to your business growth, on so many levels.

Most SaaS businesses operate on subscription revenue which means that customers are likely to be billed on a monthly basis. Well, guess what, your customers will likely be surprised by your next charge even if they knew it was coming at some point.

There are many reasons for that, but mostly:

Keeping your customers updated is key to keeping them as customers. And that is where it becomes almost impossible to do manually. Your account managers can use a CRM solution to keep track of all the billing cycles, but sending manual notifications on a daily basis to inform customers of upcoming payments is next to impossible.

Misinformation can lead to bad reviews and accounts leaving, so it may have a direct impact on your company’s cash flow.

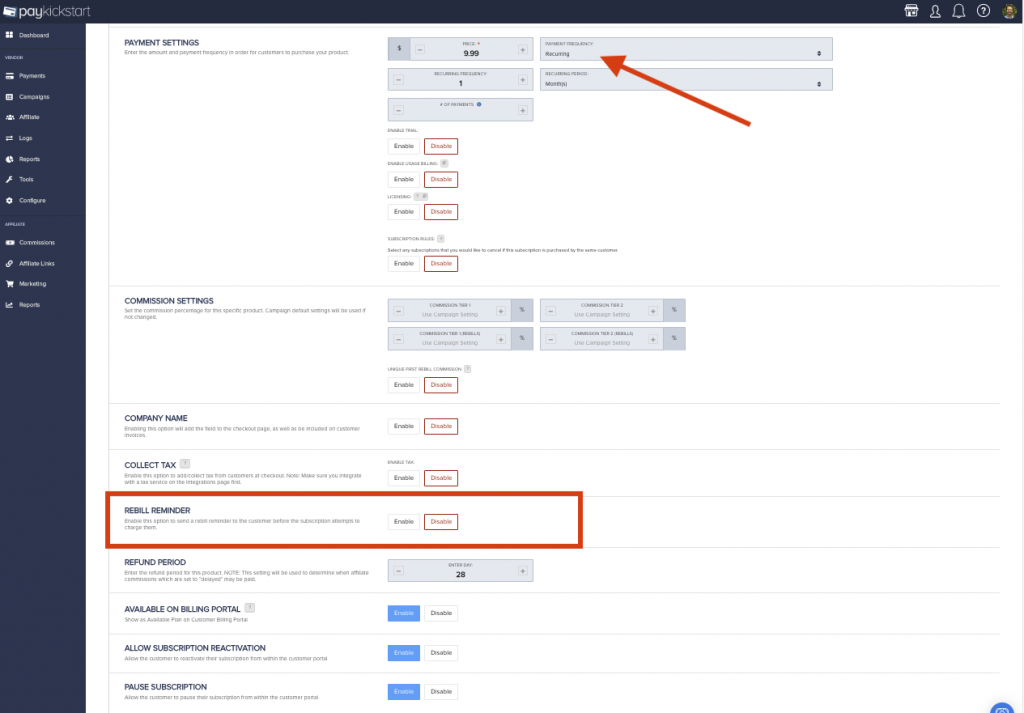

Automated billing solutions have this all covered. They come with billing reminder notifications that will give your customers a heads up that they are going to be charged for your product in a few days. You can normally customize those reminders to set when you want your customers to be notified:

By using a recurring billing system, your company can become more efficient and reduce operational costs. A good system can help you run a smaller team and make processes more efficient since most of the billing requirements will be automated.

When billing is done through manual invoicing, this can hurt collections timing and add up to a month of no cash coming in for a particular customer. There are a few different elements that can cause slower cash flow when manually invoicing for your SaaS or subscription service.

Your cash flow and conversion cycle matters. When manually invoicing, your cash conversion can be up to an additional 30 days, just to collect the money that you would have automatically collected with a comprehensive automated billing system like PayKickstart.

If you have a SaaS business, credit card errors will inevitably happen on a pretty regular basis. Credit card payments can be declined for many reasons, including:

Handling all these errors and interruptions manually would mean a huge workload on your team, as well as the need to keep up with all the statuses and responses on a daily basis.

With your recurring billing system, it should be easy to stay in touch with your customers regarding any billing issues. You tend to have an option to choose how and when you communicate with your users, or you can integrate your consumer data into mailing lists, CRM, or other apps if you prefer.

A subscription billing solution with dunning features will immediately attempt to solve the problem and reinstate the account without any of your team members getting involved.

Dunning notifications automate customer communications alerting them of overdue accounts:

PayKickstart offers powerful revenue retention capabilities allowing you to set up smart notifications that will keep your clients using your platform longer.

These capabilities include (but are not limited to) multiple email marketing integrations, subscription management tools, and many more. PayKickstart will automatically manage your whole subscription relationship management process by:

Here are quite a few effective dunning templates for inspiration.

Using automated subscription billing will make your business more efficient, keep your customers longer, build loyalty, increase revenue, and make your team happier.

All of this has a direct impact on your cash flow. Therefore switching to automated subscription management is likely to make a huge difference to your business success.

PayKickstart offers automated billing solution which comes with several important benefits:

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty