Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

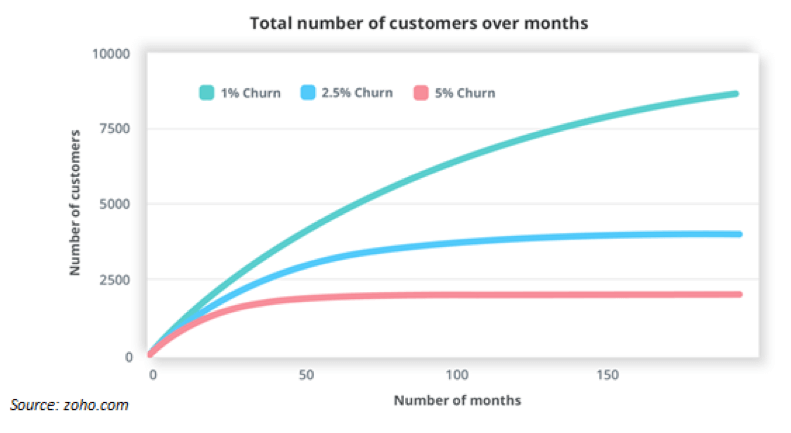

As a subscription business, you know churn will hurt your bottom line over time more than anything else.

We rigorously test onboarding flows, acquisition channels, and even reach out to customers to better understand what they like and dislike.

It’s part of the fabric of growing your business but no matter how hard you try, churn never really gets to zero. That’s the case even if you have net negative churn from expansion revenue. There’s still logo churn.

Churn comes in many shapes and sizes. Sometimes, it’s because your products stop meeting the needs of customers and other times it’s because of competition.

The worst kind of churn is delinquent churn.

In this article, I’ll look at delinquent churn and why it’s important to get it under control sooner rather than later.

Delinquent churn (also known as involuntary churn) is the process of losing customers because of payment problems such as out of date cards on file. You attempt to charge the card a few times and, depending on how you’ve set your payment collection system, the account is canceled when the charges fail.

This is passive churn and isn’t something many businesses are familiar with. They’re more worried about the other type of churn known as active churn.

With active churn, people are in some way dissatisfied with your product or service and decide to cancel.

Competitors may spring up, you fall behind in features, or customer service leaves a lot to be desired. These are things you can identify and take action to correct.

That’s not the case with passive churn which is why it’s so dangerous. It’s called involuntary because your customers don’t actively cancel their subscription. The effect is the same – they’re no longer customers because they didn’t make their payment.

I don’t know about you but I don’t want to lose a large chunk of revenue because of a technicality.

There are multiple ways delinquent churn happens. I wish it was just a single reason but, unfortunately, the world is too complicated for that.

All the reasons combined can account for up to 40% of your total logo churn in any given period. If churn is 5% then delinquent churn can account for 2% of that number.

Are you starting to see why it’s so important to tackle it early and with as much energy as possible?

If you’re not convinced already, here are a few more reasons why delinquent churn reduction should be the very first thing you do to secure your growth.

As long as you run a subscription business model, cards will eventually expire. There’s no getting around it.

That means all of your customers will become delinquent at some point whether they’re power users or only log in once every six months.

All of us are busy. You’re busy running your business and they’re busy doing the same or living their life. Your subscription isn’t top of mind until they need it. At that point, it may be too late.

That’s why it’s important to put processes in place that let customers know when they’re delinquent and what they can do about it.

A lot of assumptions are built on your churn rate. Your customer lifetime value(CLTV), MRR growth, acceptable customer acquisition costs, and more rely on understanding your churn.

If it creeps up then CLTV drops, you’re unable to spend as much on acquisition, and MRR growth stalls.

Involuntary churn can have a pronounced impact on all three of these metrics.

Let’s say you acquire customers at $500 and you charge them $50/m. your average customer lifetime is 30 months which means they have a CLTV of $1,500. You’re well within the golden ratio of 3:1 for CLTV and have no active churn.

What if you allow involuntary churn to push those customers out? After 15 months, roughly 42% of your customers will be gone due to delinquencies (credit cards expire every three years).

If you have 10,000 customers then that means 4,200 may leave involuntarily.

How would you feel if you’ve been using a piece of software for two and a half years then when you went to sign in one day, your account was locked?

You’d probably think it was some kind of error so, naturally, you’d reach out to support and try to figure out what was happening.

After a few back and forth messages, the support rep tells you that your account was canceled and all the data was deleted because you didn’t pay.

You’re pissed for a number of reasons:

After a few choice words to let the customer rep know what you think about the company, you vow to never use them again.

In that kind of scenario, do you think they could win your business back? Probably not.

Churn is an inevitable part of running a subscription business. Unless you’re selling a subscription for life-saving medicine, people will leave.

There are many types of churn. Some of them are as a direct result of a bad experience or the product not meeting the needs of users.

Other reasons for churn are involuntary. It’s the involuntary churn that you should be worried about because it eats into your business and affects your customers whether they’re happy or not.

Tackle delinquent churn as soon as possible and devote as much time and energy to solving it as it takes.

Mark Thompson is CEO of PayKickstart and a serial entrepreneur. He is passionate about helping thousands of entrepreneurs and businesses grow through advice, automating payments and providing affiliate tools.

Read More About Mark Thompson