Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

PayPal is one of the most popular payment processors in the world.

It has millions of customers and processes almost $750 billion in transactions annually.

Needless to say, it can’t be ignored if you want to acquire the maximum number of customers with minimal friction.

It has a product called PayPal Subscriptions that allows you to collect recurring payments from your customers. Like other payment processors, there are advantages and disadvantages you should be aware of to prevent surprises and get maximum value.

In this article, you’ll get a rundown of what PayPal Subscriptions is, advantages and disadvantages, and other things to keep in mind when using it.

PayPal Subscriptions is the company’s version of recurring billing. With it, you’re able to charge customers for physical and digital goods at regular intervals. It offers support for both fixed and usage-based pricing models.

It’s different from many other payment processors because there’s an extra step involved. With platforms such as Stripe, you’re in charge of letting the customer know they’ll be billed every month and making sure the customer accepts the terms.

PayPal has an additional step after a user decided to pay for a subscription. They’re taken off your website and have to agree and subscribe to the terms of the subscription within PayPal. The subscription can also be canceled easily within PayPal. Depending on your business, this may be far from ideal, especially if you’re trying to create a seamless experience for your customers.

To set up PayPal Subscriptions, you’ll need a solution like PayKickstart that has already set up the API integration for you. All you have to do is connect your PayPal account. Conversely, you can go through the API docs yourself and set up a custom integration.

PayPal subscriptions come with a few distinct advantages that are worth mentioning before you get started. These are the things that compel merchants to use it in spite of everything else.

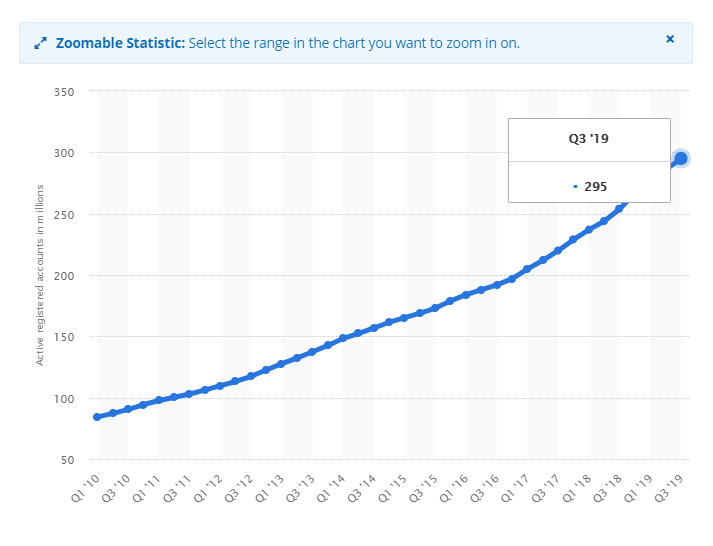

PayPal has a huge number of users that rely on it when shopping online and transferring money from point A to point B. It has an estimated 295 million users and is adding roughly 10 million users every quarter.

It also has the best name recognition out of all the popular consumer-facing online payment processors. On average, 72% of consumers recognize the PayPal brand as opposed to less than 50% brand recognition for competitors.

PayPal natively supports over 20 currencies and is available in more than 200 markets. No other payment processor has such a large coverage area. Chances are that if you have customers there, PayPal can help you collect payments from them. It’s always adding new supported currencies and regions so even if an area of interest isn’t available now, it may be in the near future.

Though you may not get robust reporting as you do with PayKickstart, it shows you all of your transactions. Since you don’t pay a monthly fee for usage, it’ll always be available as long as your account is in good standing. You can view your revenue with the click of a button and download your transaction history for reporting.

PayPal has a few decent advantages but the main one is access to a large user base that trusts the company to keep them safe. It’s not all roses, PayPal Subscriptions also has key disadvantages that you should be aware of.

PayPal is an older company when we talk about the internet and has built up a reputation for itself. Depending on what side of the fence you’re on (customer or merchant) it’s good or bad. Let’s look at a few of the disadvantages of PayPal Subscriptions.

With online subscription businesses, user experience is one of the most important considerations. If something is too difficult or complicated to use, people will cancel their account without a second thought.

The majority of subscription businesses have multiple pricing tiers and, as customers grow, they’ll want to upgrade (or downgrade in some cases). This process should be painless. With PayPal, it’s not.

It’s done by canceling the current subscription and asking them to sign up for and authorize a new one. This is far from ideal, creates extra steps, and runs the risk of creating involuntary churn. You may be able to get around this by walking customers through the process on the phone but that may not be possible in all situations.

The normal PayPal checkout process allows customers to choose between using their PayPal account or their card to pay. PayPal Subscriptions adds a required step in the process. A customer needs to sign up for a PayPal account (if they don’t already have one) and go through the verification process before agreeing to the terms of the subscription.

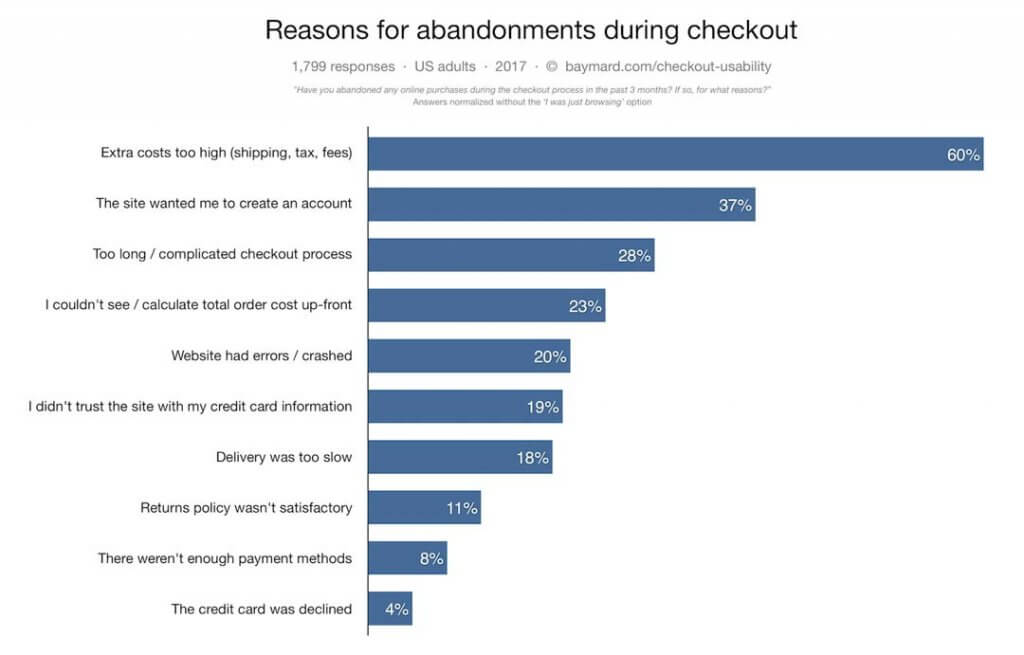

Now, customers have an account with your service and an account with PayPal. One of the most common reasons for cart abandonment is forcing customers to set up an account so keep this in mind when working with PayPal Subscriptions.

This may be the most damaging disadvantage of PayPal Subscriptions. The company has a hard nose policy on fraud and innocent merchants can get caught in the crosshairs. It regularly monitors customer accounts and if you have an influx of transactions over a short period, your account can get frozen for months.

There’s language in PayPal’s terms of service that prevents customers from participating in certain types of lawsuits and instead are subject to arbitration. These decisions are final and cannot be appealed by customers.

PayPal Subscriptions can open up a new market for your business. Millions of consumers trust PayPal to protect them and you can borrow that trust to grow your brand. It will also allow you to tap into international markets other payment processors can’t access.

On the other hand, PayPal has a controversial method of freezing merchant accounts for months at a time. If the arbitration doesn’t go in your favor then your funds may be gone forever.

If you’re considering PayPal for subscriptions, make sure you understand all of the pros and cons. Weigh those before you make your final decision and if you want to go ahead, PayKickstart will make the process seamless for you.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu