Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

A backup payment method can help reduce cart abandonment in ways you may not have considered.

Shopping cart abandonment is a real issue facing online business owners. The latest estimates from Barilliance put the cart abandonment rate at over 75%.

There are many reasons for cart abandonment such as unexpected fees, a confusing checkout process, or shoppers not being ready to buy. There are also many fixes such as cart abandonment emails, clear pricing information, or optional account creation.

Many people overlook adding a backup payment method as a way to reduce cart abandonment.

This article looks at the reasons why adding a backup payment method to your billing page should be a priority.

A backup payment method is an alternate form of payment your customers can use when the main one fails. It’s also available for customers who’d like to use an alternative method of paying for various reasons.

For example, someone may have cash in their PayPal account and would like to use that balance to make a purchase.

Note: a backup payment method is not a way for customers to split transactions between two cards or payment methods.

Now, that it’s clear what a backup payment is and isn’t here are a few reasons to implement it as quickly as possible.

Whenever possible, I like to pay with PayPal because they have buyer protection mechanisms in place. If I’m using a website for the first time and don’t know much about it then I’ll think twice about using my credit card (or abandon the cart altogether).

I’m not alone, a survey found that 50% of regular online shoppers will cancel their purchase if their preferred payment option isn’t available.

That’s a staggering amount of lost revenue for something that’s simple to fix.

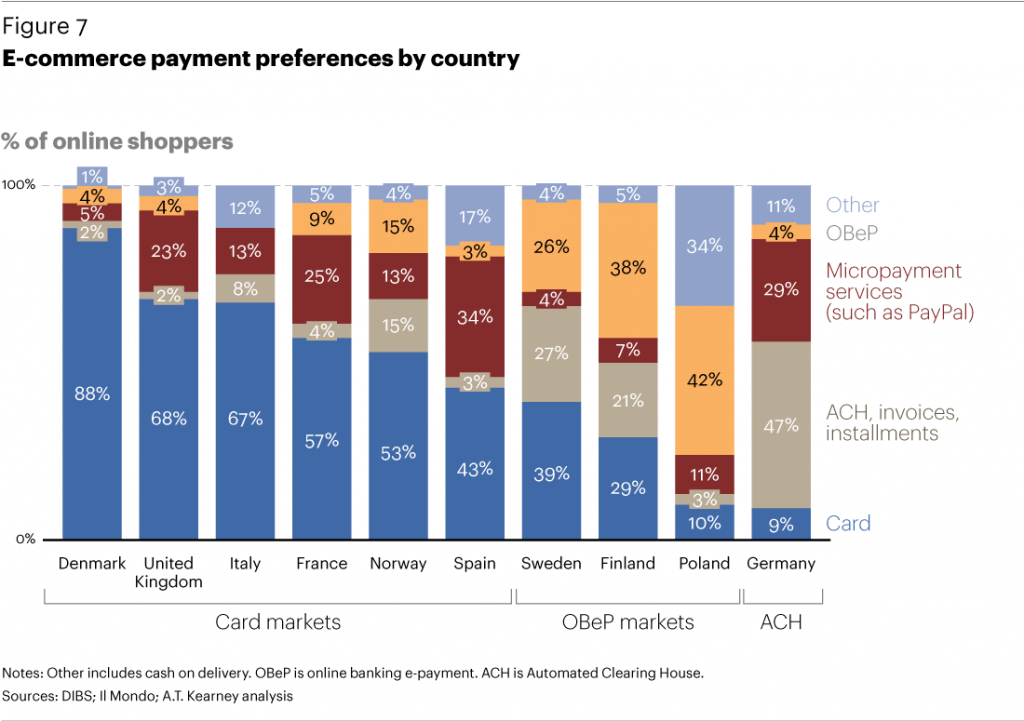

The percentage of people who opt out of a transaction will only rise as alternative payments gain more market share. By the end of 2019, they’re expected to hit 55% of all online transactions.

I touched on this a bit before when discussing my habits around making purchases. If you’re a new vendor or aren’t too popular, people will hesitate before buying from you.

This isn’t a reflection of your business practices but a reflection of the web as a whole. It’s like the Wild West.

I digress.

Shoppers like to know they can communicate with a third party to secure their transaction if anything goes wrong. Instill that confidence in them by adding trusted payment gateways like Google, Apple, or PayPal.

PayPal Express Checkout alone has a checkout rate of over 80%.

After they’re comfortable purchasing from you then they can make the switch to your main payment method.

Many people are using newer forms of payments such as digital wallets and cryptocurrency. These come with their own advantages and disadvantages which I won’t get into here. The fact remains that you shouldn’t ignore them completely.

The group leading the charge are millennials. A decade ago they weren’t worth a mention because, as a demographic, they didn’t have much purchasing power.

That has changed. The youngest member of the millennial group is 23 years old. That means they’re finishing school and getting their first real job.

The oldest members of this group are 38. They’ve established families and are making more expensive purchases.

As a group, almost nothing is off limits for them. Whether you think they’re entitled or lazy doesn’t matter. They can’t be ignored.

They’re also the group most likely to try out new technologies and integrate them into their daily lives. New payment methods were built for them because they’re convenient, have low fees, and can be personalized to fit their preferences.

As you adopt them, you’re able to tap into a global audience that may not have been able to purchase from you otherwise.

For example, many countries restrict the way cards can be used online. There’s no way to stop cryptocurrencies which opens up a huge opportunity if you accept it on your website.

Note: before you add cryptocurrency as a backup payment method be sure to do your research. Your audience may not use it as much as you thought so it wouldn’t be worthwhile.

This may seem odd because existing customers have already used your current payment methods and are happy with them. Well, they may have used them but aren’t happy.

It happens.

Adding additional payment methods can make it more convenient for existing customers to buy from you. Instead of visiting once every six months, they may increase it to every quarter or every other month.

Another reason why existing customers may be more willing to shop when you have backup payment methods is because of security.

It’s no secret that credit card information is under threat of being stolen all the time. If Marriott – a multibillion dollar company – can lose 500 million contact records then how will a small business cope?

Backup payment methods such as Apple and PayPal remove that responsibility from you and put it squarely on the shoulders of the payment processor.

It has been shown that accepting multiple payment methods is good for revenue. It makes sense when you think about it. If someone was making a larger purchase they may want to use a credit card. While smaller purchases could be made with their PayPal balance.

Conversely, some people may want to use a different digital wallet for one-off transactions.

Whatever the motivation, having those options available will increase the likelihood that a visitor completes their transaction.

The world is moving fast and the payment space is moving right along with it.

Backup payment methods are no longer optional if you want to maximize the revenue your business brings in.

There are many reasons why customers skip out on your main payment method. It’s your job to create an environment where you can still secure the sale in case people are hesitant about using their credit card.

Let me know why you think there should be a backup payment method available in the comments and don’t forget to share.

Mark Thompson is CEO of PayKickstart and a serial entrepreneur. He is passionate about helping thousands of entrepreneurs and businesses grow through advice, automating payments and providing affiliate tools.

Read More About Mark Thompson