Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Setting up a reliable SaaS billing system is the foundation of your business success.

Scaling SaaS billing can be overwhelming. On top of all, it can be risky and complex. In this article, we’ll have a look at various SaaS billing options.

Selecting a billing system for a SaaS business could well be a make or break decision for a company. If you implement a solution that does not offer the flexibility the pricing model needs, it could lead to lost revenue.

If you have to strip out or change the integrated billing system somewhere down the line, it could be incredibly destructive.

You need to get SaaS billing right from the start.

Basically, there are two ways to accept payments for your SaaS company: in-house (custom) billing and third-party billing.

In-house billing involves developing your own custom solution handling the whole process. Some (bigger) SaaS businesses choose this option because it allows for substantial control and flexibility over the management and processing of payments within the platform, as well as of the data associated with the process.

On the other hand, in-house billing:

Third-party billing means integrating one of the existing payment processing solutions that handles payments on its side.

Normally, a third-party billing system charges small transaction-based fees, so there is no large upfront investment associated with building your own system.

The biggest argument in favor for a third-party solution is speed of integration. Giving away a small part of each transaction value will almost always be less important than the advantage of having a working billing system up and running in a relatively short time frame.

Two of the better-known third-party solutions are PayPal and Stripe.

Third-party billing has a few more strong benefits, including:

At the end of the day, the choice depends on your budget and business needs. For smaller businesses, developing your own in-house billing solution may not be even an option.

To choose your own third-party solution for your SaaS billing, investigate the following questions:

Does your business model require subscription fees as well as one-time charges?

If your business model only requires subscription-based charges, you could use any of the many specialized subscription billing systems that are available.

If you however also need to handle one-time charges like, for example, setup costs, you will need to select a system that can cater for those.

Which billing process elements are covered?

Third-party billing systems normally cover 3 stages of the billing process, with not all of them being mandatory.

What is the scope of operations?

Although currency and country support are both very important, they are actually not the same thing. When a billing system supports transactions in a specific country, it does not necessarily mean that it will cater for accepting payments in that country’s currency.

Very few, if any, payment processing solutions support all countries (with PayPal being a notable exception), so it is important to do proper research into this aspect. It is however also true that most third-party billing systems do support the major currencies of the world.

How much does it cost?

Billing systems typically have various different categories of fees, each of which will impact your profitability:

Does it have all the essential features?

Billing systems have many different features and you’ll have to decided which ones are most essential to you.

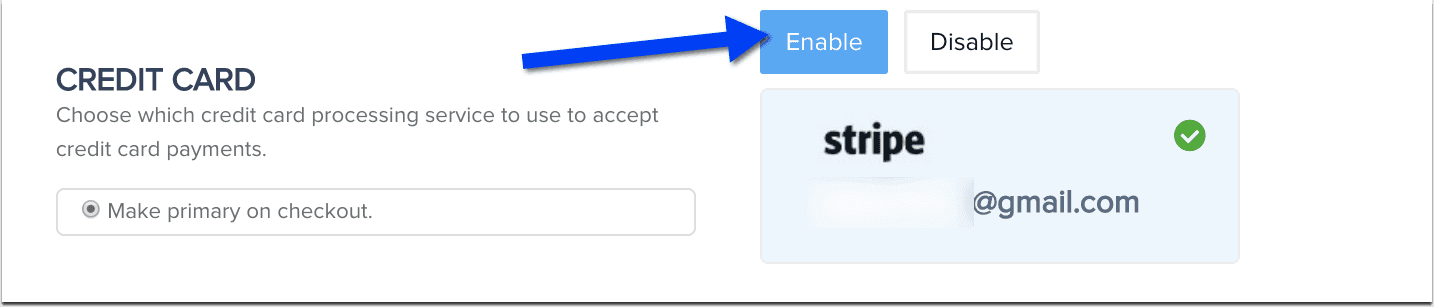

PayKickstart provides easy integration with most third-party payment solutions including:

To integrate any (or several) of the billing solutions and start accepting payments, go to “Integrations” section inside PayKickstart and there click “Payment” and then “Add a payment gateway“

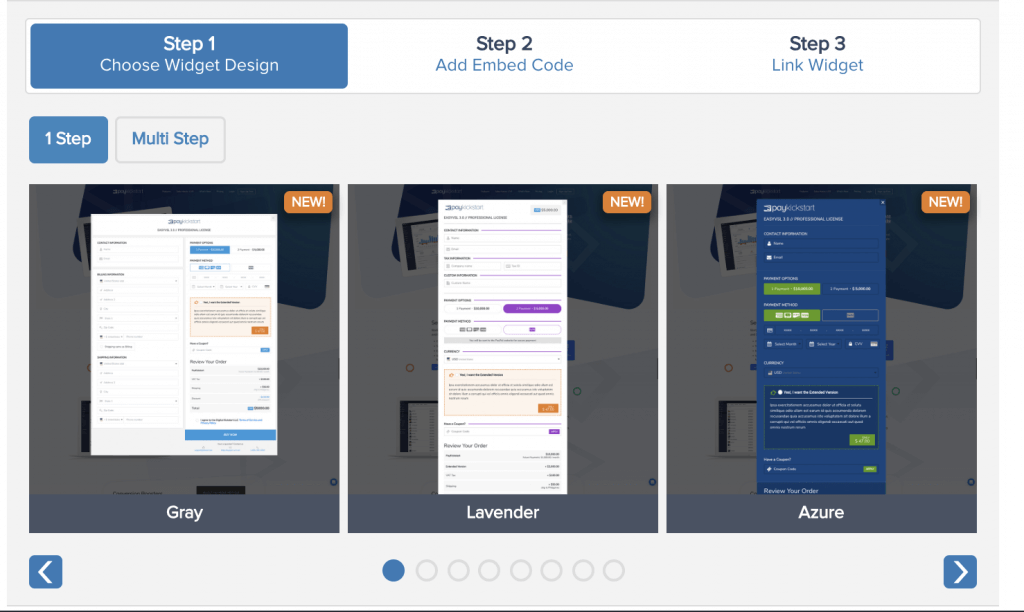

For any of the subscription payment solutions you choose to integrate with PayKickstart, you can use PayKickstart beautiful checkout design templates and popup widgets to accept online payments via Stripe:

Use PayKickstart to create your SaaS shopping card, with no development help required.

Mark Thompson is CEO of PayKickstart and a serial entrepreneur. He is passionate about helping thousands of entrepreneurs and businesses grow through advice, automating payments and providing affiliate tools.

Read More About Mark Thompson