Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Over the last few years, there’s been a fundamental shift in the way companies do business.

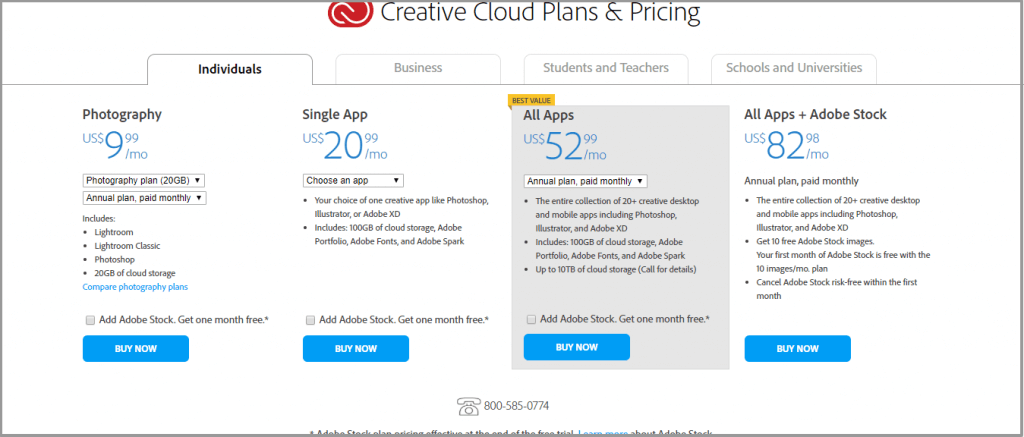

A decade ago, you could walk into a store and buy software like Adobe and use it forever. That’s not the case anymore. It and other big players like Microsoft have moved to the cloud and started charging a monthly fee for their products.

Software isn’t the only industry this is happening. Everything from groceries to clothes is moving to a subscription model.

When you run the numbers it seems like a no brainer. Subscription businesses can unlock more value from their customers and deliver better products as a result.

That doesn’t mean it’s right for you.

This post looks closely at the differences between the two billing models so you can decide which one is best for you.

Before you look at the pros and cons of the different billing models, it’s important to look at what you’re selling in the first place. There are some products that lend themselves well to a subscription model while others lend themselves to one-time payments.

Software is has been moving towards the subscription model for years now and it’s almost standard practice to charge a continuous fee for access.

Adobe is a prominent example.

Clothes and other physical products only recently started taking advantage of the subscription model.

On the other hand, consulting services work on a monthly retainer but the contract has a limited lifespan unless renewed.

Look at what other people are doing in your industry and how people are responding to it. Are one-time payments or subscription payments more common? If companies are doing both, which ones unlock the most value from customers.

Also, consider your market and price point. In a B2B setting, no price point is off limits but in a B2C setting, people will only pay so much every month. Most subscription boxes are priced below a specific threshold and may be difficult to get people to buy luxury items through a subscription box.

Once you’ve done the preliminary survey, you can look at the pros and cons of each.

Even though subscriptions are becoming more common, there are still a lot of benefits of choosing a one-time payment. There are also clear disadvantages built into the billing model that need to be addressed.

Instant revenue. This may be the biggest advantage of the one-time payment. You unlock the complete value from your products and services as soon as your customer pays. You don’t have to wait months or years for it to materialize.

This frees up your cash to focus on other things like acquisition or improving your processes.

Less spent on customer support. Since the customer is buying the product and not paying you a regular fee, they’ll reach out to support less often. In most cases, you’ll only hear from them when they’re getting it set up or if the product is defective. You’ll field far few support requests/messages with this billing model.

Lower conversion rates. One-time payments, by their very nature, require a higher price point. The higher the price, the harder it is to convert shoppers into customers. Even though you’ll get instant revenue, in absolute terms the money may be less due to lower conversions. You can counteract this with a well-developed sales funnel.

Less predictability. It’s difficult to know when people will come back and buy from you again when don’t have built-in recurring payments. You’ll end up spending more of your time on acquisition than retention. This is especially true when you have a more expensive product that’s not purchased often.

No built-in loyalty. When you pay someone every month for an extended period, there’s a lot of trust involved in the relationship. You trust them to continue to deliver on their products and they trust you to pay on time. With one-time payments, it’s over as soon as it began. Without that relationship, it’s hard to stimulate organic word of mouth and recommendations.

Depending on your perspective, this has become the more popular way to sell products and services. In certain industries, that’s true. Just like with one-time payments. There are clear advantages and disadvantages.

Subscription businesses have higher conversion rates because the initial asking price is much cheaper. Of course, it depends on the product but subscription companies can spread out the cost of the product over the course of months or years. This makes it a more attractive prospect for customers on the fence.

There’s a lot of predictability when you know a customer has signed up to pay you every month. When you know your churn and CLTV, you’ll have a pretty solid picture of how much the customer will be worth and when they’ll leave. With that information, you can plan accordingly and make smarter long term decisions.

Subscription companies that understand their customer and the value they derive from their product tie their pricing to a value metric. The more successful a person is with the o, the more likely they are to upgrade. Your job as a subscription company is to make your customers as successful as possible to get those upsells.

Takes longer to grow. Because of the lower price point, it takes longer to grow and more effort to get there. If you’re cash strapped or haven’t found the right market then this can spell death.

Retention can be a big issue. If you’re losing a large chunk of customers every month then it becomes impossible to grow. Unlike with one-time payments, if a customer leaves they’re most likely not coming back. Your entire organization needs to be set up to reduce churn.

Higher support costs. A subscription business is really a customer support business. That’s their core competency. They have to constantly educate customers and make sure they’re getting the most out of the product or they risk losing them. This just isn’t as big an issue with one-time payments.

Not every business is built for recurring payments and not every business is built for one-time payments.

It depends on a number of factors but the most important are your products, your price point, and what’s acceptable in your market.

If your niche lends itself to either model then look at the pros and cons outlined in the post to decide which billing model is best for you.

Let me know which one you’re using in the comments and don’t forget to share.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu