Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

When the US constitution was first written and signed, Benjamin Franklin wrote a letter.

He said the constitution looks permanent but nothing in this life is certain but death and taxes. That statement has proven to be more or less true.

Tax law, especially for online businesses, has grown more complex over the years but you’re still liable for it. Canada sales tax, like other jurisdictions, isn’t optional and is an essential part of doing business.

If you don’t collect it from your customers then you’ll still have to pay it from your revenue. That’s not a fun proposition.

How do you make sure you’re collecting the right amount of sales tax without adding unnecessary complexity to your operations?

This post will help you better understand GST & HST tax and show you how to implement it for your PayKickstart shopping cart.

These terms are often lumped together but represent two different things.

The Federal Goods and Services Tax, also known as GST, is a blanket tax that applies to most goods and services bought or sold within Canada. It’s a relatively new tax introduced in 1991 to replace the hidden 13.5% tax manufactures had to pay. It was considered hidden because the cost was added to goods and wasn’t noticed by the end user.

An issue arose because many provinces didn’t want to merge their own sales tax (PST) with GST. That meant businesses had to file separately for GST and PST. Needless to say, it’s an extra headache for businesses who need to collect Canada sales tax.

Though some provinces didn’t want to lump their taxes together with GST, some had no problem doing that. The end result is the harmonized sales tax (HST). This single tax includes both the GST and PST which makes compliance easier for businesses.

Another issue with the GST and PST is that some goods and services are taxable under GST but aren’t under PST and vice versa. It differs from province to province so it’s important to understand what type of business you operate.

If you’re a small supplier, as stipulated by the Canada Revenue Agency, you don’t have to register for or remit GST/HST. Though the definition may change, currently, a small supplier is a business that does $30,000 or less in taxable revenue a year before expenses. For public institutions such as charities, universities, non-profits, etc. that threshold is increased to $50,000 a year in revenue before expenses.

If you live in or conduct business originating in Alberta, the Northwest Territories, Nunavut, or the Yukon then you’re in luck. Those regions don’t have PST so only GST on purchases is charged.

Since not all businesses are subject to Canada sales tax, do a little digging to find out what category you fall into. You can contact your local tax authority or the Canada Revenue Agency directly.

If, after you’ve done a bit of homework and you’re supposed to collect sales tax then read on, the rest of the article will show you how to implement Canada Sales tax in your PayKickstart shopping cart.

There are two major ways you can implement Canadian sales tax in PayKickstart.

Neither one is inherently better, it just depends on your preference.

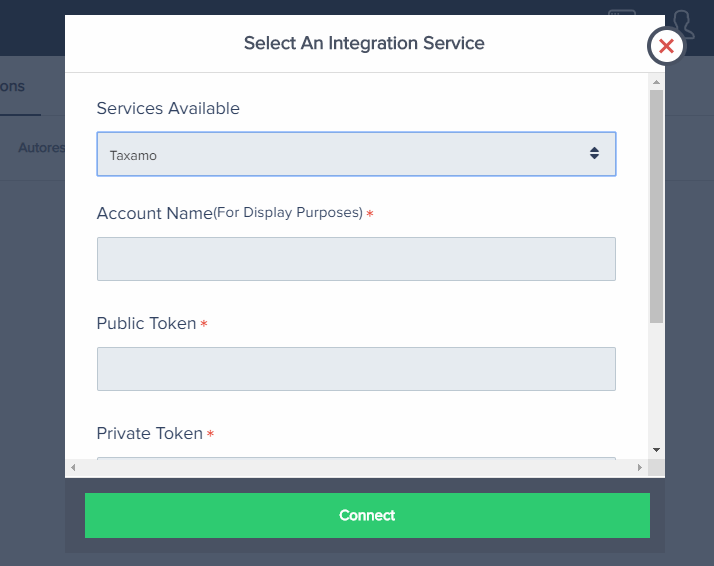

For this integration, you’ll need a Taxamo account. Once you’re set up, go to the integrations area of your Taxamo account and grab your public and private API tokens.

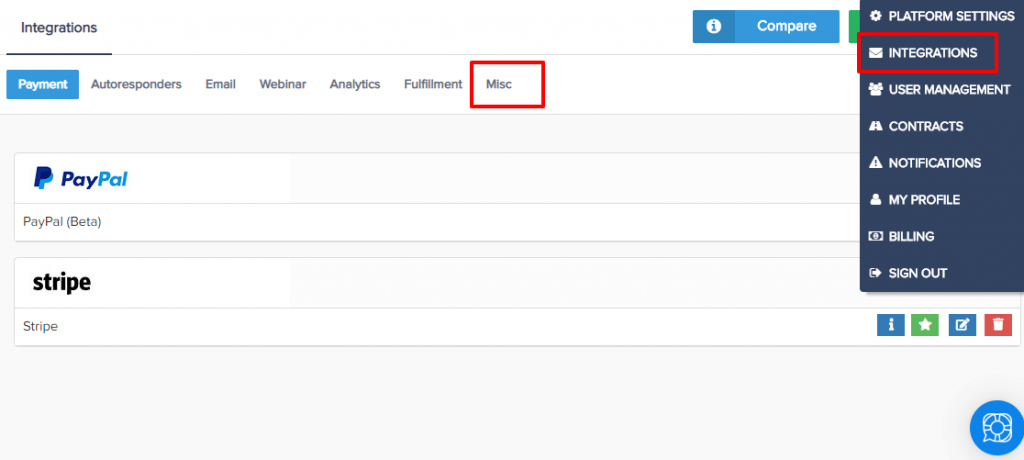

Once you have them, open your PayKickstart account and navigate to integrations from the top right hamburger menu. When the screen opens up, click on the ‘misc’ menu option.

After the page loads, add a new integration and you’ll see Taxamo as an option. Name the integration for easy reference and paste your API tokens in the proper place. Also, add your country.

Once added, you’ll be able to select which products have an associated tax and which ones don’t. Go to your campaigns and select the product you’d like to add Canada sales tax to.

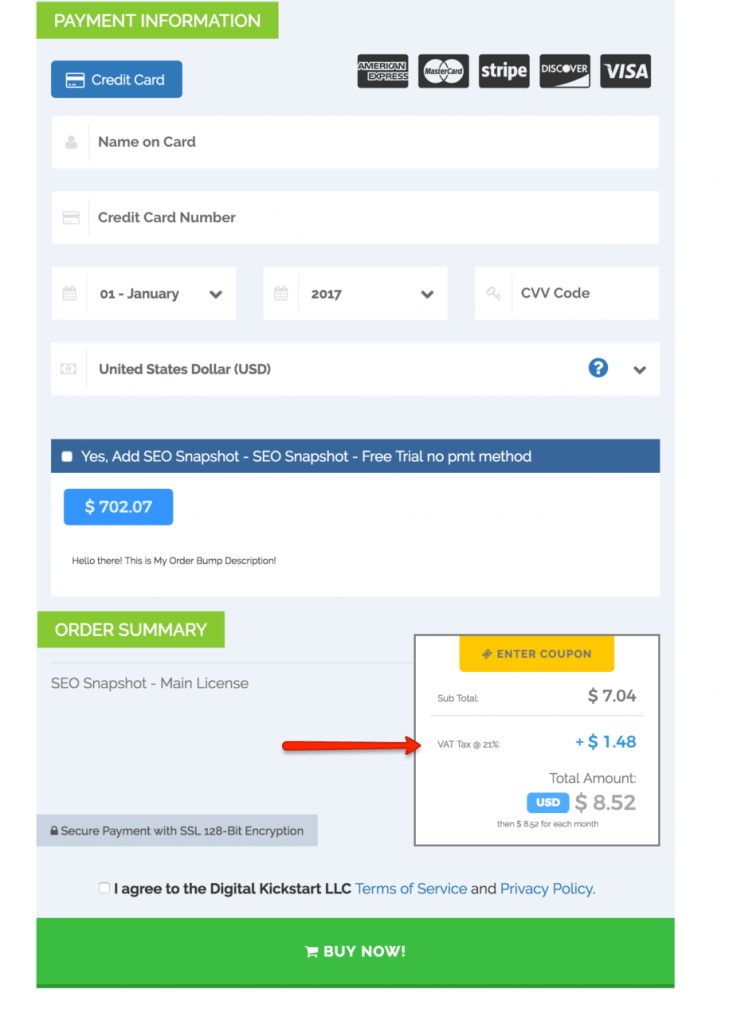

Toggle the option for tax collection to enable. Choose the integration you just set up and save. Now, anytime a customer wants to checkout with this product, sales tax from Taxamo will be automatically shown.

Here’s how it’ll look to your customers.

If you don’t have a Taxamo account or want to control the Canada sales tax from directly within PayKickstart then you can do so.

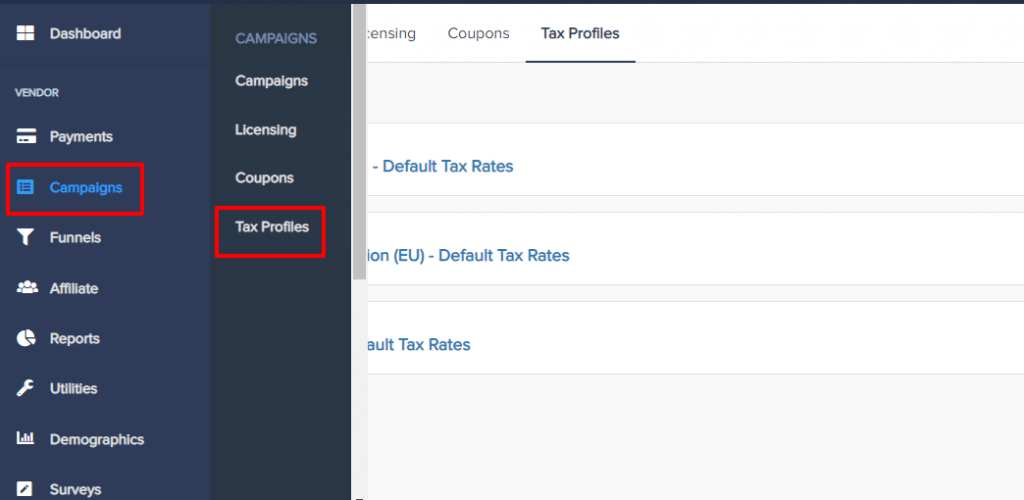

For this to work you’ll have to create a tax profile. Log in to your PayKickstart account and navigate to campaigns > tax profile.

By default, you’ll see three different tax profiles which are US, Canada, and Europe. Of course, you’re interested in Canada sales tax so you’ll select the last option on the list.

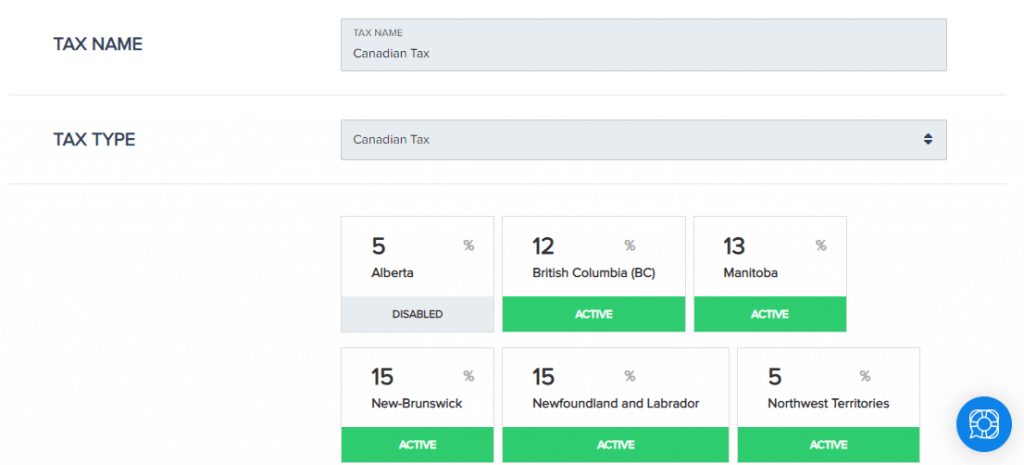

After selecting it, a page opens up that displays HST tax for Canada. Conversely, you can click the green “+” icon at the top right of the screen to create your own tax profile.

On the screen that loads, you can name your tax profile, select the tax (Canada sales tax is an option) and toggle each option on or off and make changes to the tax percentage.

In the above image, I disabled Alberta Tax which is just a GST tax since it doesn’t have a PST. These values are updated once a month so you can be sure that you’re charging the right sales tax.

Just like with the Taxamo integration, you’re able to select the tax profile while creating individual products. This gives you a lot of versatility when you’re targeting different markets with different products.

Canada sales tax is an inevitable part of doing business. Just like many other countries, it can be confusing and time-consuming to get right.

Before you start charging tax, make sure you don’t’ fall into the exemption lists. If you’re one of the businesses that should be collecting tax then be sure to familiarize yourself the different requirements in different regions.

After that, set up PayKickstart to collect sales tax on your behalf and free yourself to focus on your core business.

Let me know what you think about implementing Canada sales tax in your shopping cart and don’t’ forget to share.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu