Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Sales tax is a normal part of making purchases.

If you go to any brick and mortar business, you’ll pay a fixed amount depending on which state or locality you’re in.

Online sales tax is a bit of a grey area.

Major online retailers like Amazon apply a sales tax accross the board but many others don’t collect a sales tax on the majority of their purchases.

What about your business, are you required to charge sales tax for purchases made online?

In this article, you’ll get a high-level overview of sales tax for online sales. Please note that this post is purely informational and is not a substitute for tax advice from a qualified professional.

With that being said, let’s dive in.

Almost every state has sales tax in one form or another except for five notable exceptions. Alaska, Delaware, Montana, New Hampshire, and Oregon have no sales tax but Alaska and Montana allow local areas to charge a sales tax.

In a 1992 ruling by the Supreme Court (Quill Corp vs. North Dakota), it was established that businesses were required to collect sales tax if they had a physical presence in a state.

This tax presence is called a tax nexus. If you have a tax nexus in a state then you are required to collect online sales tax for purchases.

It’s important to note that this ruling wasn’t explicitly for online businesses but rather mail order catalogues.

When the internet and online shopping became popular, there was no clear guideline established so the 1992 ruling was applied across the board.

If you conducted business online and had a physical presence in the state the purchase was made then a tax nexus could be established. After a tax nexus was established you’d be required to collect sales tax.

In June 2018, that changed. South Dakota vs. Wayfair found its way to the Supreme Court. This time, the legislation in question dealt specifically with how online businesses should collect sales tax for purchases.

The Court removed the physical presence rule required to establish a tax nexus. This gave states the authority to make businesses collect sales tax even if they don’t have a physical presence in the state.

In a word, yes.

The ruling is still new and many states haven’t had an opportunity to create or amend laws to address it. That means you have time to prepare yourself to collect sales tax in states you do business in.

Even without a specific law addressing it, you’ll likely be considered a tax nexus in any jurisdiction where you have a physical presence. That means you’re required to add sales tax for online sales in those places.

There are a lot of ways you may be affected by the new rules.

Don’t allow yourself to get overwhelmed. Start with the states where you have a physical presence and the ones you get the majority of your sales from.

From there, continue to move down the list until you have all your bases covered.

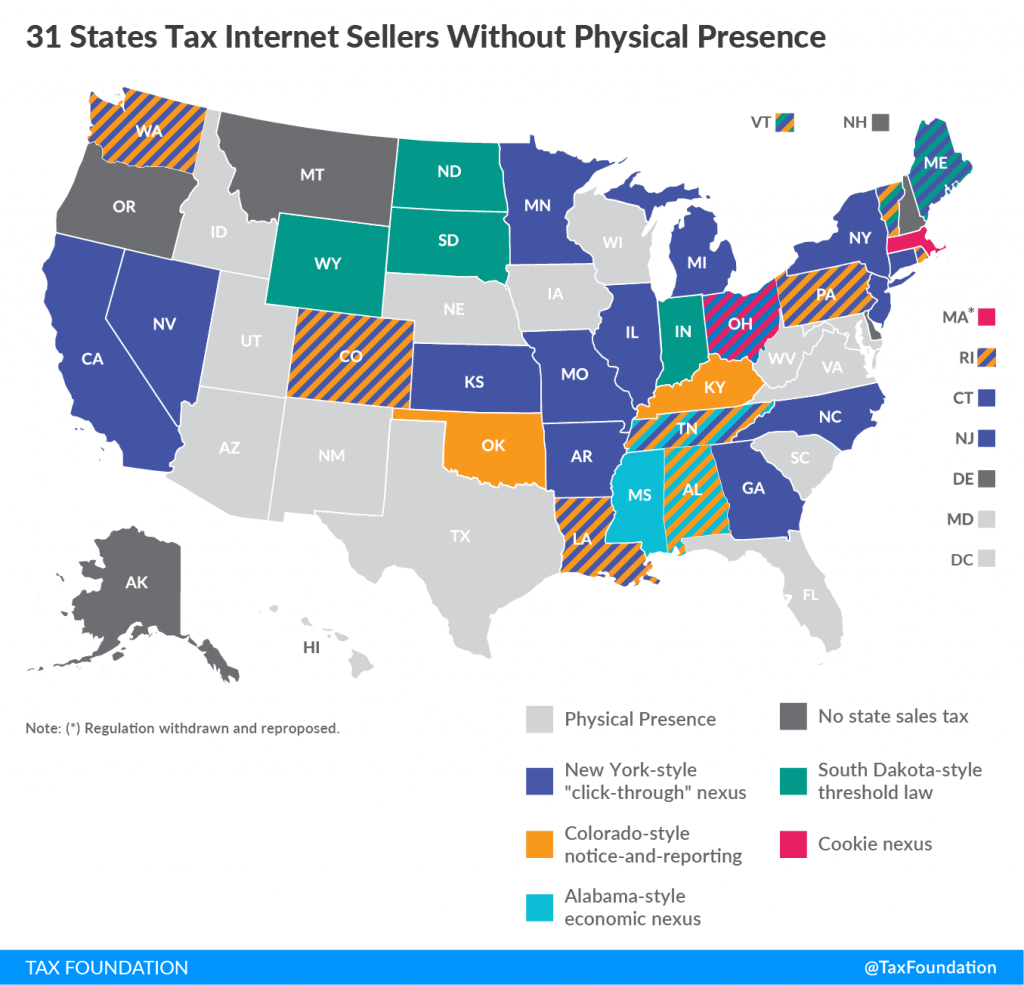

The way a tax nexus will be determined is unique across all states.

Even though you’re not a tax nexus in Delaware, the same conditions may make you a tax nexus in California. This is a big challenge because states intentionally give themselves room to interpret their rules to encompass as many businesses as possible.

In addition to that, they’re always changing.

Here’s a sampling of the language states use to establish a tax nexus:

The last clause is most variable across states but the amount set shouldn’t unnecessarily impede interstate commerce or put an undue burden on the merchant.

As of this writing, 31 states tax online businesses without a physical presence.

Source: taxfoundation.org

It’s also interesting to note that having affiliates also creates nexus.

Some states may want to collect the sales tax you would’ve remitted in the past.

The actual case in question (South Dakota vs. Wayfair) doesn’t talk about retroactive collection but it’s a possibility for cash strapped states.

Though this seems a bit aggressive to me, you can never tell so it’s important to prepare in advance.

GDPR was enacted in the European Union and any company that did business with European companies or consumers had to comply.

As long a company is selling direct to consumers in the United States it’ll have to comply with local laws and regulations.

This can be a major challenge if you don’t have an established physical presence to serve as a base of operations. Enlist the expertise of a tax attorney or accountant to help you navigate these challenges.

Even though you’ll be passing on the costs of the sales tax directly to your customers, compliance costs money.

You’ll be required to purchase services and software to calculate sales tax in each jurisdiction. This adds time and complexity to the challenges of running a business.

One silver lining present in online sales tax collection is that for a nexus to be established you need a physical presence in a state. If you don’t have a physical presence then you’ll have to process hundreds of transactions before nexus can be established.

Charging online sales tax is an unavoidable part of doing business.

Instead of looking for a way around it, embrace it by doing further research about what’s required of you. When you’ve gotten a solid base of knowledge, tackle the process head on.

This will save you time, energy, money, and possibly headaches in the long run. Let me know what you think about charging online sales tax in the comments and do

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu