Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Data security breaches are all over the news nowadays, and businesses and consumers are both hypervigilant about identity theft and credit card fraud.

And the unfortunate trend is growing: in 2018, consumers reported losing almost $1.48 billion to credit card fraud, an increase of $406 million from 2017.

Ecommerce and SaaS businesses are continuously looking for more ways to improve credit card fraud detection and tighten up credit card information storage security.

Credit card fraud is a form of identity theft that happens when an unauthorized person uses another person’s account information or credit card details to access (and use) funds through cash advances or to make purchases.

Credit card fraud does not only occur online. It can also happen at any retail outlet. Business owners can avoid reputation crisis and income loss by identifying potentially fraudulent use of a credit card in their payment systems.

Prior to discussing how you can minimize the credit card fraud risk, let’s take a look at techniques used by fraudsters. For online fraud, there are two major types of credit card fraud:

Hackers will also sell credit card numbers to other criminals who use these to open accounts on online sites and pay for their purchases using the stolen numbers.

It is difficult to detect this type of fraud as many individuals and businesses don’t monitor their credit card statements properly. This means that credit cart fraud victims often don’t even know someone has opened an online account using their details.

This is the most important step in ensuring your business is protected: You need a reliable payment processing partner.

Reputable payment processing solutions have powerful fraud prevention tools built-in keeping business secure.

The two credit card processing companies that can be easily integrated with PayKickstart are:

Radar, our fraud prevention toolset, is built directly into the payment flow and contains powerful machine learning algorithms. This process detects patterns across payments processed with Stripe, assessing the risk level of each.

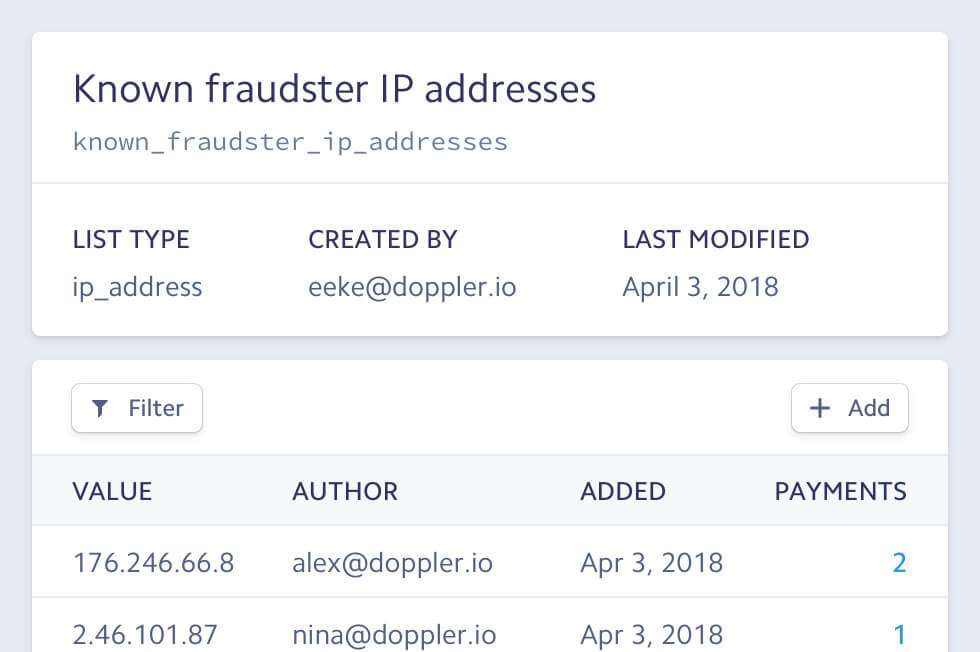

You know your business like nobody else does. You know the buying patterns of your biggest spenders. Monitor all transactions and your accounts and look for red flags, such as inconsistent shipping and billing information, as well as your customers’ physical location. Tools are available to track customers’ IP addresses and warn you if they originate in countries known as fraudster paradise.

It’s worthwhile to check if your new customers use anonymous or free email addresses, such as Yahoo or Gmail. The amount of fraud done through free emails is much higher than those done from paid emails.

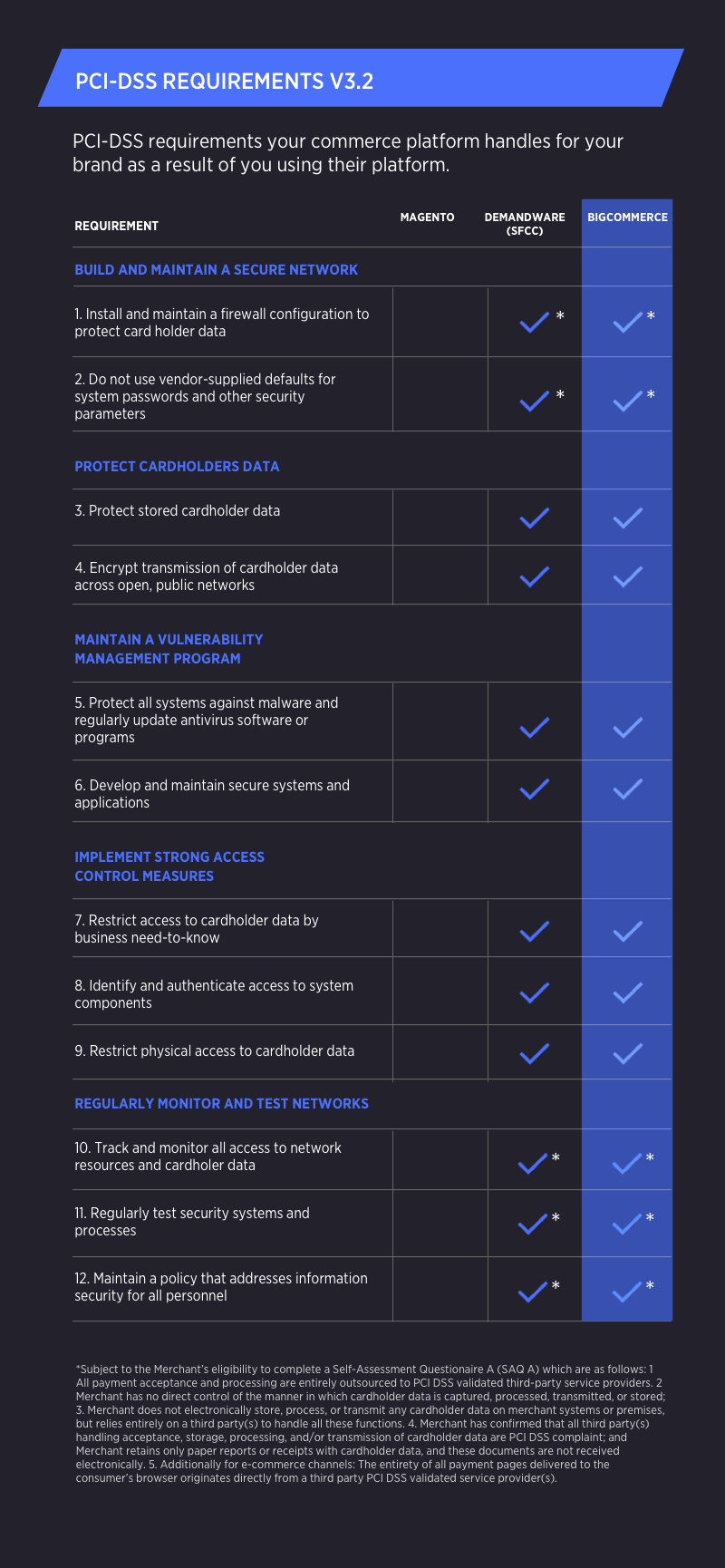

The PCI (Payment Card Industry Security Standard Council) helps businesses protect their customers and themselves from online fraud. This forum of global brands has been developing best business practices to protect consumer data.

PCI Compliance is mandatory and is strictly enforced. You can get the full requirements from the PCI Security Standards website.

It is also a good idea to make sure everyone in your company who has access to backends have powerful antivirus and VPN security systems installed to avoid any attacks executed through their devices.

The address verification system compares the numerical portions of a billing address on file at the credit card company to the address stored within a credit card.

This tool is included with many payment processing solutions, but make sure your payment processor supports it.

Use the unique characteristics of your business to set limits for the total dollar value and the number of transactions you’ll accept from a single account in one day.

This will minimize your exposure to fraud.

Hackers use powerful software that runs through the permutations of a password very fast. Four digit, alpha-numeric passwords are very easy to crack.

Nowadays, best practices typically enforce an 8-digit alpha-numeric password that has to have at least one special character and one capital letter.

This 3 or 4 digit security code is printed on the back of credit cards. PCI rules prohibit the storage of the CVV with the card owner’s name and the credit card number.

This makes it very effective, as fraudsters can only get it if they steal the physical card. Again, most processors need the CVV as part of their checkout process.

Always run the latest version of the operating system and data management systems. Software providers are always updating their prod, implementing security patches to protect against vulnerabilities and the latest malware and viruses.

Only use business-grade anti-spyware and anti-malware software that is regularly updated. Free, consumer-strength anti-virus software is simply not good enough.

It is crucial to only use payment gateways that use a mix of the latest and most effective techniques to prevent card payment fraud, minimizing losses, and safeguarding your business from the threats mentioned.

PayKickstart works only with the most reliable payment processing solutions helping you avoid credit card fraud and associated risks.

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty