Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

With players like Google Pay, PayPal, Stripe, and Apple Pay leading the charge, the payments industry is getting more and more fragmented.

As an online merchant, it can be difficult to understand and choose the best payment methods and facilitators for your business. If you add Apple Pay or Google Pay will people even use it?

It’s better to err on the side of caution and have more payment options than is absolutely necessary. The alternative would be losing sales because you don’t cater to the preferences of your prospects.

In this article, you’ll get a rundown of Google Pay, the benefits, and how to start accepting Google Pay on your website.

Google Pay is the successor to Android Pay and Google Wallet. It’s a virtual wallet that allows you to store your debit cards, loyalty cards, credit cards, and add money to your account balance. It can be used in physical stores that accept contactless payments, for in-app purchases, online stores, and even as a peer-to-peer payments facilitator.

Think of it as a direct competitor to Apple Pay for the portion of the world outside of Apple’s ecosystem. As of September 2019, it had 67 million monthly active users which is up from 22 million in September 2018. Needless to say, it’s growing rapidly and cannot be ignored by merchants that want to give their customers true flexibility.

For the end-user, it can be downloaded from the app store and installed on a mobile device. Once installed, new users will need to add their payment methods and verify their identity via email or phone.

After set up is complete, the cards on file can be used to make purchases in applications, physical stores, online stores and more. All the user needs to do is tap their phone against a contactless terminal.

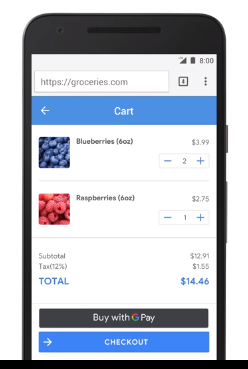

If the transaction occurs online, once a user clicks the Google Pay option, they’ll be asked which card they’d like to use. Once selected, they just need to enter their three-digit security code from the back of the card.

Google Pay works on mobile and desktop but the majority of users are mobile-only.

For merchants there’s a different process to get up and running which we’ll discuss a bit later in this article.

I mentioned it before but it’s worth mentioning again, the payments industry is fractured. It’s beneficial to accept as many forms of payment as possible – especially if it’ll make your customers feel safer.

Not only that, but you’ll also be able to tap into the growing user base of Google Pay as an early adopter. It was 67 million in September 2019 and that number may double again in September 2020 meaning well over 100 million people may be using the service. It simply can’t be ignored.

Let’s look at some of the tangible benefits of Google Pay for merchants.

No transaction fees – Since Google Pay isn’t a payment processor but rather a digital wallet and payment facilitator, it doesn’t cost the merchant anything. There’s no transaction or setup fee to use the service.

Increased security –One of the biggest concerns with online transactions is the increased risk of fraud. They’re declined much more than any other type of transaction. Real-time eCommerce payments are declined about 15% of the time while recurring/saas payments are declined over 20% of the time.

Those are tough numbers to swallow but with an added layer of security, that may be less of an issue.

Better user experience – A long and confusing checkout process is one of the top reasons for abandoning the cart. This is especially true on mobile devices. Using Google Pay helps shorten the checkout process which should have a positive impact on your conversion rates.

Brand affinity – Another intangible benefit of Google Pay is the ability to associate your brand with the search giant. Users will make the assumption that you’ve been assessed by the company and found to be legit so will more readily trust you.

First, you’ll need to be a developer, hire a developer, or have a developer on your team if you want to implement it on your own.

There are five key steps.

The major bottlenecks here are development resources and approval from Google.

With PayKickstart, that’s already taken care of for you. We’ve recently built a Google Pay Integration. Now, all you need to do to take advantage of it is connect your details within your PayKickstart account and you’re off to the races.

Google Pay will show up as a payment option for your customers and you’ll be able to reap the benefits that come with it.

It’s essential that you’re able to meet your customers where they are instead of forcing them to jump through hoops to pay you. They won’t. Google Pay is one of many players in the ever-evolving payments landscape.

With 67 million users and growing, it’s a solution that cannot be ignored. It comes with many tangible benefits that can help you increase conversions and it’s free to use.

What more can you ask for?

After our recent integration with Google Pay, getting started is as simple as clicking a few buttons. Now, there’s no excuse because all of the heavy lifting has been done for you.

Let me know what you think about accepting Google Pay and your experience with it in the comments and don’t forget to share.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu