Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit GroupEver landed on a website, basket full, only to bounce back because they didn’t offer your preferred payment method? Frustrating, right?

Nowe imagine how many customers you may be losing over not meeting their payment preferences.

The truth is, it’s not just what you sell that counts, but how you sell it. And a big part of that ‘how’ boils down to one crucial moment: the payment.

Are you truly seizing the power of diverse payment options? And what might you gain if you did?

By expanding and securing payment options, businesses are essentially saying, “We value your convenience and trust.”

Here are a few tangible benefits of integrating multiple payment methods:

A study from Barilliance showed that the global average for online cart abandonment rates hovered around 70%. One of the leading reasons cited? The absence of a preferred payment method. By diversifying payment options, businesses can address this issue and boost conversions.

Recognizable icons like those of PayPal, Apple Pay, or Google Pay can instill a sense of security among customers. This assurance that their financial data remains protected can be the push needed for them to finalize a purchase.

Payment preferences vary dramatically across borders. While credit cards may be the go-to in the US, other countries might lean towards digital wallets or direct bank transfers.

Catering to these regional preferences ensures businesses don’t miss out on international sales. You can also integrate your payment methods into your link in bio pages to convert your global social media users.

Different generations may prefer different payment methods, and by offering many payment options you expand your target audience to all the age groups.

Age, cultural background, economic status, and even geographic location play a significant role in shaping these preferences.

For instance:

By diversifying payment methods, businesses can more effectively tap into these demographic segments, ensuring that they are not alienating potential customers simply because their preferred payment method isn’t available.

For e-commerce and SaaS platforms, it’s not just about having a product that resonates with the audience, but also about creating a seamless user experience, from selecting products to finalizing the purchase.

The payment stage is the most crucial part of any sales funnel: You have taken a user that far, you cannot let this step fail.

Let’s explore the influence of several popular payment methods on conversion rates:

Established in December 1998, PayPal has since evolved into a global giant in the online payment sphere. Its vast user base and trust-driven platform give consumers confidence, which directly translates into higher conversion rates.

A 2018 comScore study highlighted that merchants offering PayPal witnessed a staggering 70% higher checkout conversion rate than those that didn’t. The reasons? Security, speed, and convenience.

PayKickstart offers a seamless PayPal intergration with your shopping cart. You can integrate multiple Paypal accounts for your single PayKickstart account.

With the rapid rise of mobile commerce, the integration of digital wallets like Apple Pay and Google Pay has become a must. While Apple Pay is a popular choice among iOS users, offering Apple Pay alternatives ensures accessibility for customers using other platforms or devices.

A report from Business Insider projected that by 2023, digital wallets might contribute to 52% of global online transactions. These platforms’ allure is their one-click payment feature, effectively reducing the checkout process’s friction.

Another research from the Baymard Institute reveals that overly complicated and prolonged checkouts contribute to approximately 26% of cart abandonment. By offering swifter payment options, businesses can recapture a significant portion of these potential sales.

PayKickstart offers an easy Apple Pay integration. Apple Pay will only display on Apple-supported devices and browsers, i.e. IOS devices using Safari.

Likewise, PayKickstart offers a quick Google Pay integration.

SaaS and ecommerce are quickly adapting to even more payment methods. Cryptocurrencies like Bitcoin, Ethereum, and many others are already making their presence felt in select online marketplaces. As digital currencies become more mainstream, businesses that adapt early might gain a significant competitive edge.

The decentralized and secure nature of cryptocurrencies means lower transaction fees and enhanced security, further simplifying the online transaction process.

A KPMG report suggests that by 2030, a majority of online transactions might involve at least one form of digital currency. This implies that the payment methods landscape isn’t static; it’s evolving, and businesses must evolve with it to remain relevant.

PayKickstart users are now be able to add a new payment method at checkout enabling customers to use digital currencies to complete the purchases.

Once enabled, crypto payments become available to your customers as an option to pay.

If your customer chooses crypto to finalize their purchases with you, Coinbase will create a charge (i.e. a request to pay) representing the expected payment.

Every decision a SaaS or e-commerce business makes can be the difference between a sale and a lost opportunity.

While most business owners obviously prioritize product quality, marketing, and user interface, payment methods cannot be overlooked as they influence conversion rates.

By adopting a diverse range of payment options, businesses can address various customer pain points, build trust, and boost conversions.

Embracing this multi-faceted approach isn’t just a strategic decision; it’s a step towards global inclusivity in the SaaS and ecommerce domain.

While diversifying payment methods is essential, ensuring a seamless integration of these options into the overall user experience is equally critical. This includes everything from intuitive UI/UX design, quick loading times, to transparent fee structures.

A holistic approach ensures that the user not only finds their preferred payment method but also enjoys the process of making the payment. After all, a satisfied customer is more likely to return.

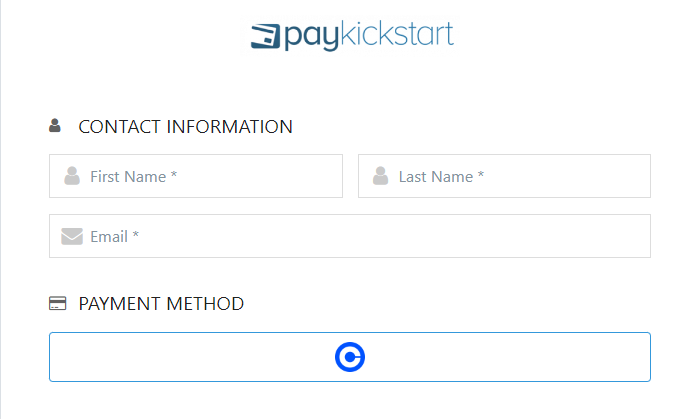

Luckily PayKickstart makes multiple payment method integration process easy, so it doesn’t require any development investments or resources.

Check out PayKickstart through a FREE TRIAL or SCHEDULE A DEMO

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty