Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

In the flood of new and emerging payment methods, it’s hard to find what’s best for your business. Working with merchants, gateways, security, it can all get to be a series of hurdles you have to face… as if starting a new business is not overwhelming enough!

Accepting online payments can become surprisingly difficult, at best, and downright dangerous at worst. When it comes to handling users’ sensitive data, you want to make sure that you work with a trustworthy and reliable partner that can handle payment processing properly.

There are a few solutions allowing you to make the process a bit easier (but still obviously requiring integration). One of them is Stripe:

Stripe is a payment processing platform aiming to enable you to accept all major debit and credit cards from customers worldwide while bypassing gateways and merchant accounts. It’s also quite affordable and doesn’t require any upfront investment which makes it a solid solution for startups or new businesses.

With Stripe there are no monthly charges. They do ask for 2.9% and .30 cents per processed payment.

To sum up the reasons why you may want to consider using Stripe as your payment processing solution:

Another powerful argument in favor for Stripe processing is the company’s strong support for new entrepreneurs. With Stripe Atlas solution you can get your business incorporated easily. The platform also connects to the whole community of new entrepreneurs like yourself for further help and support.

As it has been mentioned above, Stripe is considered one of the most transparent and easiest payment processing networks out there. The full list of charges you’ll incur include:

There are also paid addons you may want to consider (which will add up to the monthly charges). Those are listed here.

While being a solid payment processing solution, Stripe does have some limitations you should be aware of:

While being one of the leading payment processing solutions featuring an easier-than-most shopping cart solution, Stripe may require some development budget to integrate which may be a challenge, especially if you are just starting your store.

Stripe can be integrated through a “simple” API call. However if you are a non-tech-savvy entrepreneur and/or a small business owner, you may find yourself overwhelmed and intimidated by just scrolling through the Stripe API documentation.

Luckily, PayKickstart eliminates the need for any development budgets by giving you an easy way to integrate Stripe payment processing with your shopping cart.

With PayKickstart, Stripe integration takes just a few minutes.

Moreover, if you are running several products or campaigns inside PayKickstart, you can add several Stripe accounts within your single PayKickstart account.

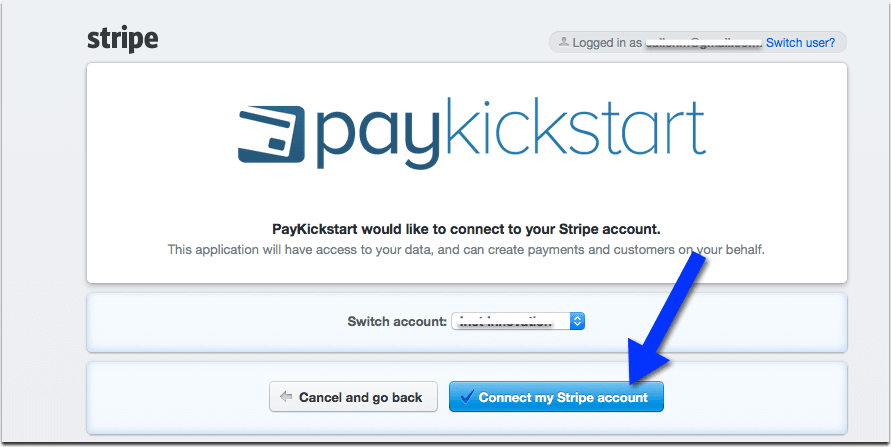

To integrate Stripe, follow these simple steps:

Proceed to “Integrations” section inside PayKickstart and there click “Payment” and then “Add a payment gateway“

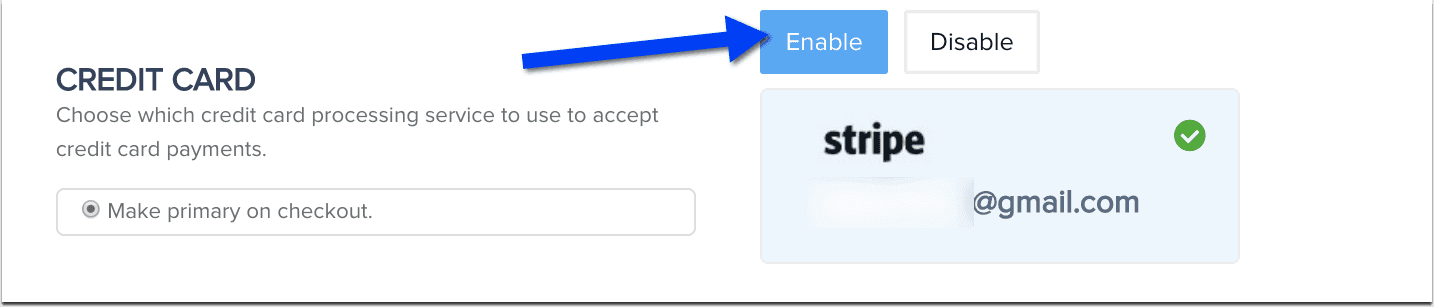

Once you are done, proceed to your campaigns list and click “Edit” icon next to the campaign you want to enable Stripe for. There enable Stripe and save.

You are all set! You have created your own Stripe shopping cart (and it took you just a few clicks).

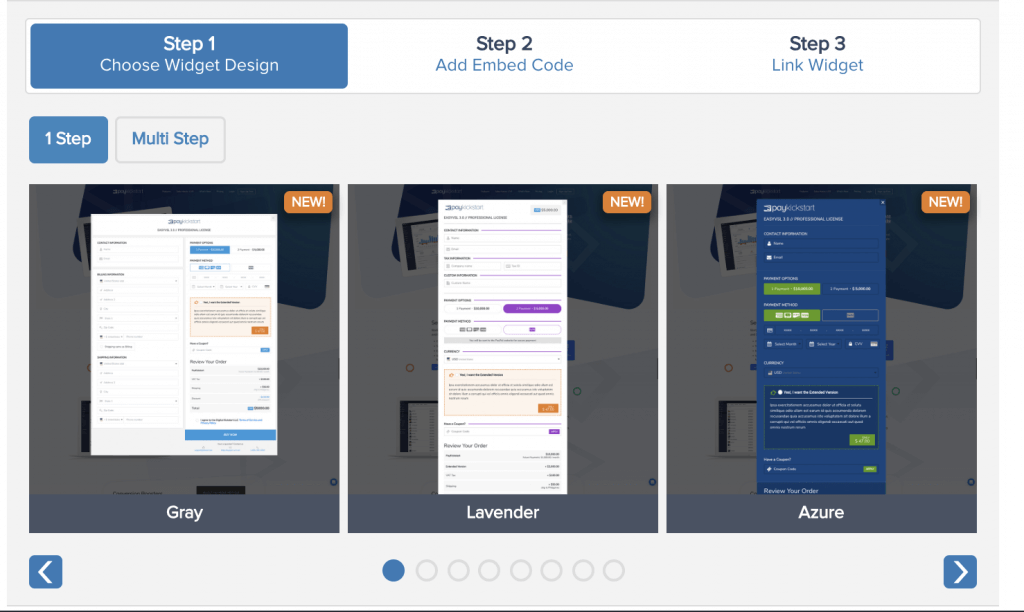

You can now use PayKickstart beautiful checkout design templates and popup widgets to accept online payments via Stripe:

If you are running a subscription-based business, making sure that your customers are being billed is crucial for your revenue. As mentioned, Stripe can handle recurring payments but it has no good system in place for managing failed payments.

Why recurring payments may fail?

In most cases, you can recover the failed transaction if you properly notify the customer of the fail and help him/her update their card information (which is were Stripe fails).

PayKickstart Dunning / Subscription Saver feature will help you recover your customers’ failed payments by sending three emails to the customer before canceling the payment:

If you’re new to Stripe, here’s a quick guide to help you out:

The Stripe shopping cart was created to help small business owners sell simple products easily. Stripe payment processing features include:

All the payments go to your Stripe account. From there, you can have your funds sent to a bank account that you have linked to your Stripe account.

If you need to process a refund for a customer for any reason, you can access the function directly on your Stripe dashboard or if you are using PayKickstart, you never have to go back to Stripe, as you can process a refund right from PayKickstart.

From there, you can process either a whole or a partial refund back to the customer. Just note that a refund may take up to 2-3 days to get back to the customer.

PayKickstart automatically adds Stripe dispute and chargeback statuses inside your account, so you can handle them promptly. How you actually handle chargebacks depends on the unique circumstances around each order and the nature of the dispute.

In most cases, replying promptly to solve the issue will help you get things sorted out peacefully.

If a dispute is unsuccessfully challenged, you are responsible for both the dispute fee ($15.00) and the Stripe processing fee on the original payment.

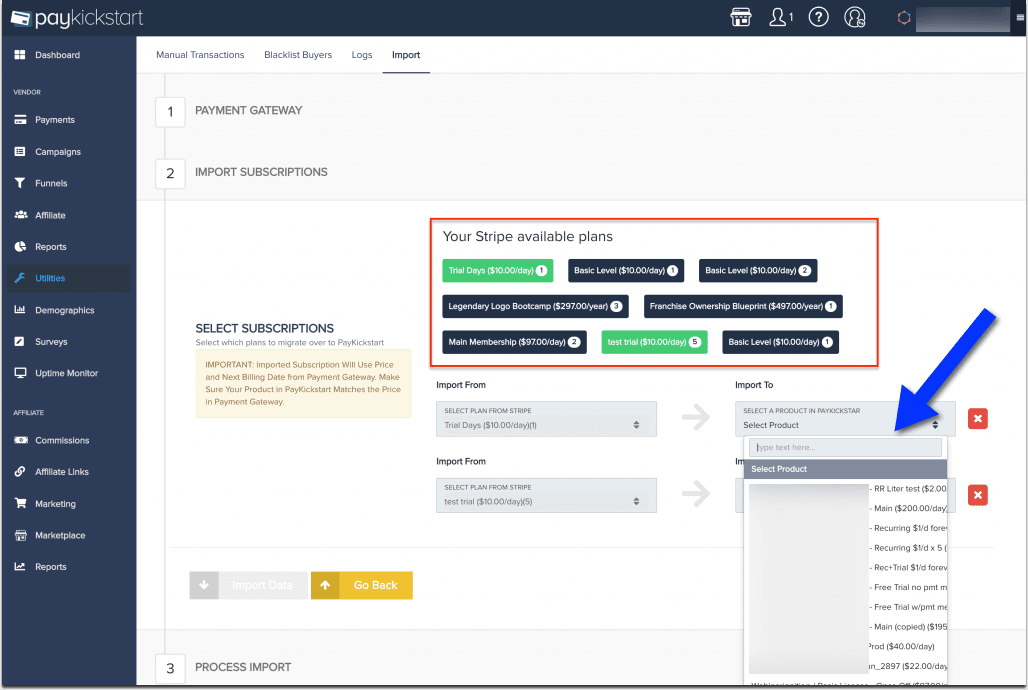

If you were using Stripe previously, you can easily import all your current subscriptions to PayKickstart by going to “Utilities” and from there to “Import Subscriptions”. There select Stripe as your Payment Gateway and the account where those subscriptions are located.

[Follow these steps to import Stripe subscriptions into PayKickstart]

Have you considered using Stripe to process online payments? Use PayKickstart to create your Stripe shopping card, with no development help required.

Ann Smarty is the Brand Manager at Internet Marketing Ninjas, as well as co-founder of Viral Content Bee. Ann has been into Internet Marketing for over a decade, she is the former Editor-in-Chief of Search Engine Journal and contributor to prominent search and social blogs including Small Biz Trends and Mashable. Ann is also the frequent speaker at Pubcon and the host of a weekly Twitter chat #vcbuzz

Read More About Ann Smarty