Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Business is a numbers game. When you know your numbers, you’re in a better position to scale, acquire customers, and maximize customer lifetime value.

When you don’t know your numbers, it becomes a guessing game about what’s working and what isn’t.

That’s a dangerous place to be.

The first number to look at is your average order value (also known as AOV). When you know that, it becomes easier to set KPIs and make campaigns that grow your business.

This article looks at what average order value is and what it means in your business.

The average order value is the average dollar amount (or whatever currency you bill in) a customer spends when they buy goods from you.

The AOV is an aggregate number and isn’t indicative of any single transaction. It’s still important because it normalizes how much you can expect to make every time you process a transaction.

In other words, the AOV doesn’t reflect a single transaction but when you have a decent number of transactions, on average, they’ll equal your AOV.

The calculation is simple.

Take total revenue for a given period and divide it by the number of orders in that same period.

AOV = total revenue in a given period/the number of orders in the same period.

Here’s an example to better illustrate average order value.

Acme Inc. made $150,000 in revenue over a 2 month period. During the same 2 month period, they recorded 1,000 individual transactions. For them, average order value would be:

150,000/1,000 = $150.

It can expect $150 every time they get an order. AOV is also an important part of the customer lifetime value calculation which you can view in this post here.

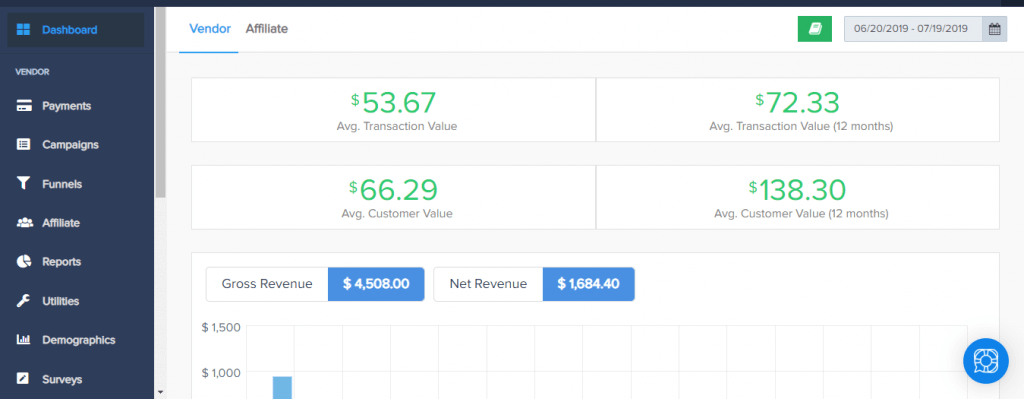

When you’re using PayKickstart, your average order value is automatically calculated and shown on your dashboard.

There are two major schools of thought when it comes to using AOV.

It’s an important distinction that will affect how fast you can grow your business.

This is the traditional school of thought and is where most entrepreneurs start out. When people spend money on your products and services, you should be turning a profit – right?

Here’s how it plays out in the real world.

An entrepreneur launches a campaign to acquire new customers on Facebook, Pinterest, Googles Ads, or wherever. The AOV for new and existing customers is $100.

In order for them to be profitable, they know their acquisition cost shouldn’t exceed $50 so they optimize for that.

They cut their bids a bit so they can get cheaper clicks and they also keep an eye on how much they’re paying designers for creatives. After optimizing their campaigns, they’re able to hit their target of $50 for customer acquisition and turn an instant profit.

They’re then able to reinvest in acquiring more customers. Customer acquisition is stable and they’re growing their business by profiting on every transaction.

The second school of thought is where successful entrepreneurs eventually end up. Instead of making a profit on every transaction, they use all the revenue from the first transaction to acquire a customer.

Here’s how that will play out in the real world.

An entrepreneur launches a campaign to acquire new customers on their platform of choice. The AOV, just like in the first example, is $100.

Instead of trying to turn a profit on that first transaction, they’re focused on acquiring as many customers as possible within the constraints of AOV.

They’re willing to deploy the entire $100 to acquire that customer. They’re able to bid higher in ad auctions, spend more money on design, and hire more people to help out.

In essence, they can deploy more capital to reach more people and acquire more customers.

Why would they do this?

Because they understand that initial transaction is the first of many a customer will make. It’s the front end. The bulk of their money is made on the backend because it’s many times cheaper to get an existing customer to buy again.

If it costs you $100 to acquire a customer then it may only cost $20 to get them to buy from you again.

When you deploy more capital – the entire AOV – to get customers, you’re accelerating growth. You’re building a list of buyers for free. You spend $100 to get the customer and instantly earn $100 back.

You’re not losing anything but you’re gaining a list of buyers and leads which you can sell to down the line. Some companies even go further and spend more than their average order value to acquire customers.

These are the businesses that grow the fastest but it’s important to have a clear handle on your customer lifetime value and cash flow. If you’re too aggressive then it’s possible to spend yourself out of business even though you’re acquiring customers.

Your goal, as an entrepreneur is twofold.

The first part is a decision. You have to decide to spend more money to acquire customers because you know the benefits of it. PayKickstart was built to help you with the second one.

With the platform, you’re able to create upsells, downsells, cross sells, order bumps, and more to increase your average order value.

The higher your average order value, the more you can spend on acquisition.

The more you can spend on customer acquisition, the faster you grow.

Business is a numbers game – simple math. When you know your numbers, starting with AOV, you’re able to grow faster than the competition.

Your average order value is an important number to track. It informs almost every other aspect of your business.

When you know it, you can decide how much you can spend on acquisition, calculate your customer lifetime value, and accelerate growth.

When you don’t know it, you’re focused on the wrong parts of your business. This post has covered what it is and, more importantly, how to use it to accelerate your growth.

Let me know what you think of AOV and its impact on your business in the comments.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu