Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

When someone mentions SEPA wire transfers they can be referring to multiple things. There’s something known as SEPA credit transfer (SCT) and SEPA direct debit (SDD).

Both of them entail moving money out of your account and into another person’s account but they’re used in different situations.

If you’re not careful, it could spell trouble for your business.

In this article, I’ll explain the difference between the two, the best times to use it, and how to accept SEPA wire transfers.

Let me mention up front that both of these payment methods are wire transfers that your customer has to authorize.

SEPA stands for Single European Payments Area and works to make transfers across the European Union as easy as a transfer within a single country.

A SEPA transfer encompasses SDD and SCT which are payments or transfers which are denominated in Euros. As a merchant, you initiate the SEPA transaction using your customer’s IBAN or BIC and the customer has to authorize it.

Transactions have a 0.5% – 1.5% fee and take 1 – 2 business days to settle. These transactions can be reversed for up to 8 weeks after they’re processed and for up to 13 months if it’s found out that it was unauthorized.

It encompasses all the European Union member states as well as nonmember states. Currently, 34 countries support SEPA transfers.

SEPA Credit Transfers are simple one time bank transfers made within the Eurozone. They’re equivalent to ACH transfers in the United States. It debits one account and credits another account. The entire process takes 2 business days or less.

SCT was introduced by the European Payment Council in 2008. During that time, the EPC created a set of standardized protocols which enabled payment service providers to offer SCT as a service to merchants in the 34 participating countries.

This solution is ideal for larger one off payments from a customer.

SEPA Direct Debit allows individuals and businesses to make direct debit payments to any of the 34 participating SEPA countries. The originating account can be in any SEPA currency but the transfers are always in Euros.

When using SDD to make a purchase, the customer has to submit their account name, IBAN, and BIC while agreeing to be charged by the merchant. This agreement is referred to as a mandate.

The SDD Mandate is what shows your customer has agreed to be charged by your business for a specific amount. As a merchant, you’re obligated to store them indefinitely.

The mandates you collect from customers can authorize multiple types of transactions. It can be used to enable recurring payments for an indefinite period, a predetermined number of transactions, or for one-off payments.

There are two ways to issue a mandate:

This solution is ideal for processing fixed amount recurring payments.

SDD is divided into two types:

SDD Core

This is for intended for B2C transactions and is mandatory for all SEPA banks which offer Euro denominated direct debit transactions.

SDD B2B

This is intended for B2B transactions so the debtor must be a professional or organization. It’s not mandatory for all SEPA banks which offer Euro denominated SEPA wire transfers.

Differences between SSD Core and SDD B2B

Everything else between the two schemes are common.

PayKickstart enables you to accept SEPA wire transfers through a Stripe integration.

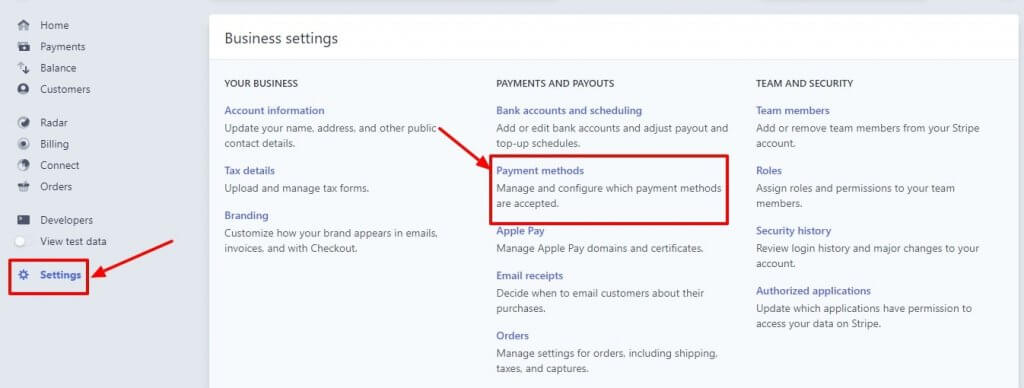

Log into your Stripe account and navigate to the settings menu option. Click settings then click on payment methods.

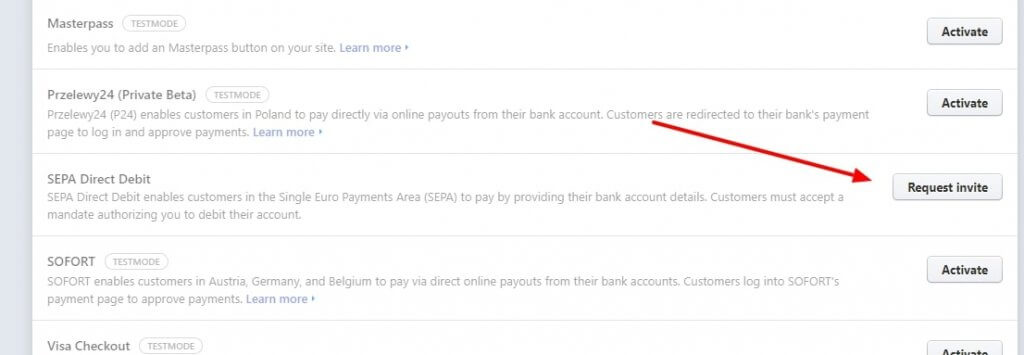

It’ll take you to another screen. Scroll down until you see the option for SEPA direct debit transactions. Look to the right and click on the “request invite button.”

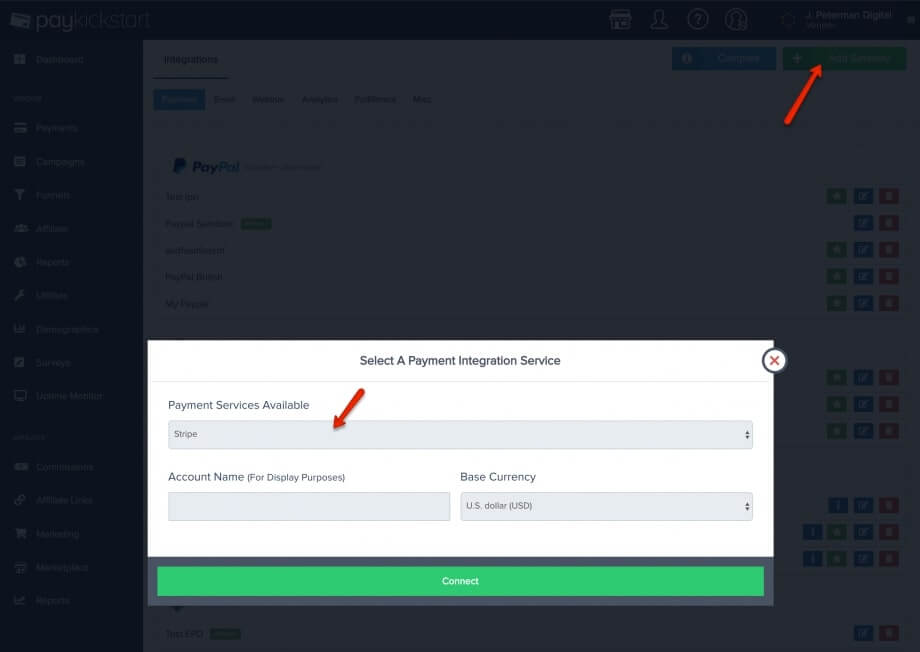

Next log into your PayKickstart account and add Stripe as a payment gateway. This step is only necessary if you’ve not done it previously.

Click on integration -> payment -> add gateway. Select stripe from the available options and follow the instructions.

After integrating Stripe, click on campaigns -> edit. This will take you to the campaign settings page.

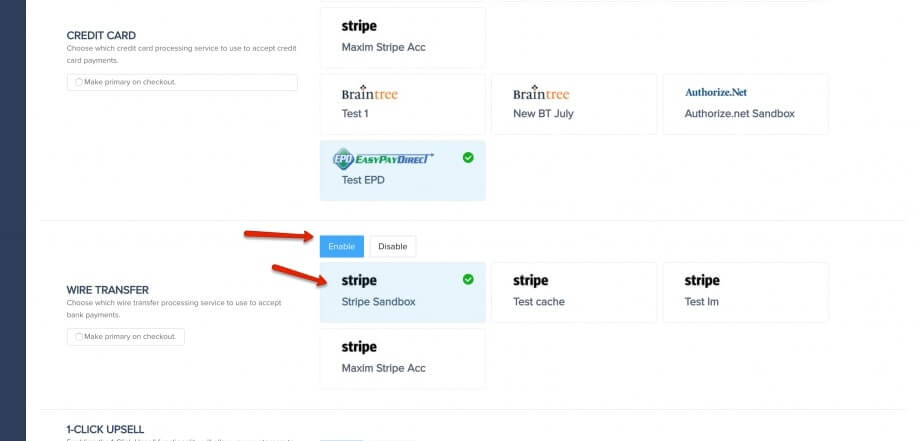

On the settings screen, select the button next to wire transfers labeled “enable.” You’ll see Stripe as an option there.

That’s it, when your customers get to the checkout page, they’ll see an option to pay using a wire transfer. That’s all the heavy lifting required.

Note: SDD can take up to 14 business days to confirm the success or failure of payments. It may not be ideal in every situation. For example, if you’re sending a physical or digital good, you may want to go with a different payment method.

If you’re offering high ticket consulting services then this is a more viable option to collect payment from your customers.

SEPA wire transfers are an effective way to get paid by your customers but it’s important to understand what you’re getting into.

The fees are low but there’s a lot of buyer protection built into the system. They have the ability to request a no questions asked reversal for up to eight weeks.

It’s not ideal for every type of transaction.

If you’re selling low cost one off goods then a normal credit card or debit card transaction may be best for you.

Accept SEPA wire transfers for higher ticket consulting and recurring revenue transactions where there’s more trust between you and your client.

Let me know what you think about accepting SEPA wire transfers in the comments and don’t forget to share.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu