Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Major companies like Microsoft and Adobe are shifting from a fixed payments model to a recurring payments model. Even smaller, traditionally fixed-payment businesses like flower sellers, lawn maintenance and plumbers are moving to recurring payments models.

While the main driver behind this trend is the availability of recurring payments platforms like PayKickstart that allow businesses from any industry to implement such payments, businesses now realize the impact recurring payments can have on boosting customer lifetime transaction value or LTV.

For example, while Microsoft had to convince customers to upgrade to a new version of Office every few years, often at a significant upfront cost, with its new Office365 subscription model, users can upgrade to new versions of Office for less than $10 a month, significantly reducing churn rate, and customer acquisition costs.

In this article, we look at five major ways focusing on recurring payments can boost your customer LTV.

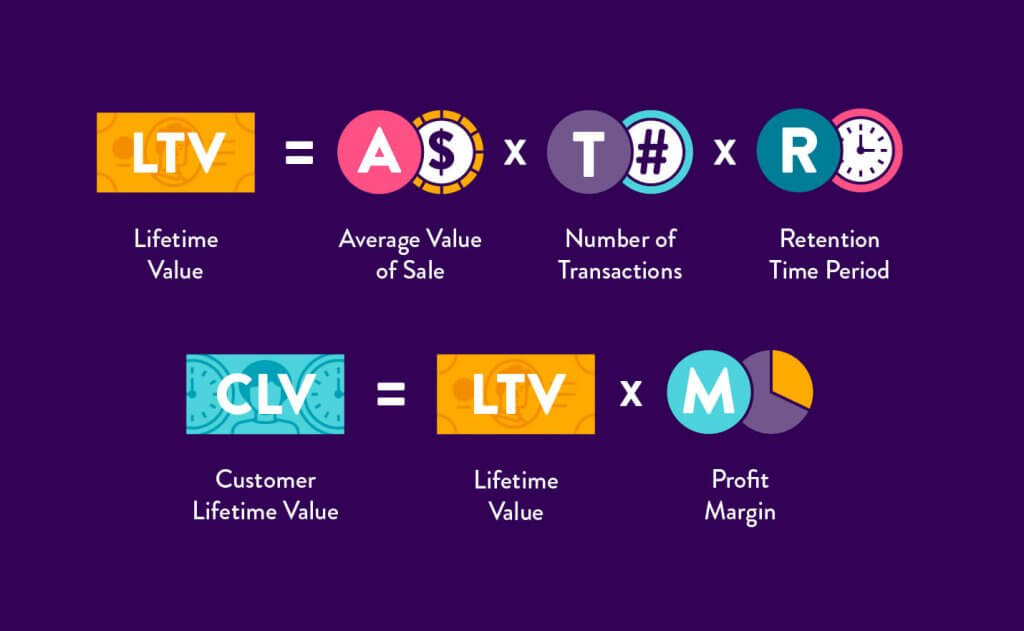

Customer LTV is the financial value a business realizes over the life of a relationship with a customer. For example, a customer paying $29 per month and who remains a customer for three years will have an LTV of $1,044 ($29 x 36 months).

This calculation assumes no further efforts or gaps are experienced over the three years. Naturally, fixed payments make it difficult to calculate LTV. For example, if a business must sell an upgrade or an add-on each month or each year to maintain or grow LTV, this introduces uncertainty into reliably calculating customer LTV.

Recurring payments solve this challenge elegantly. If you run a subscription model, for example, you know how much each customer pays you per billing cycle. You also know that whatever value you are offering them will either remain constant or increase throughout the billing period.

Additionally, customers are limited to available subscription levels, further giving control and predictability in LTV calculations. As you can see, recurring billing simplifies LTV calculations, making it easier to predict other metrics like ARR, which we look at next.

Fixed payments introduce uncertainty in calculating ARR. So much so that companies with recurring payments models (subscriptions in this case) are perceived as more valuable than companies with fixed payments models.

One great example of this disparity is Adobe. After implementing a subscription model, the company’s revenues went up by 35% while the company’s valuation jumped over 120%.

Why was there such a jump in valuation? Because investors perceive ARR for recurring-payments-based businesses as less risky and more predictable, making the company more valuable in their eyes.

While not all businesses are listed on the stock exchange or currently pursuing valuations, predictable ARR can also be a handy tool for planning purposes. Consider a business that is trying to figure out whether to bring on more staff and move to a bigger office.

By offering predictable ARR, recurring payments make the planning process easier and less grounded on hypothetical projections. By analyzing real customers and real ARR, the business can make a decision that will not threaten it later if its projections are not realized.

Churn rate is calculated as the percentage of customers who leave your business over a given period. For example, if you start from zero and gain 1000 customer over a year but in the same period lose 100 customers, your churn rate is 10% (100 / 1000 x 100). Recurrent payments make this easy to calculate as you assume customers will stay with you over a period as they use your product or service.

Fixed payments, on the other hand, make it challenging to calculate churn rate. If a customer buys from you today, there’s no way of knowing whether they will do so tomorrow, or next month or even next year, making it difficult to calculate churn rate.

But, why is churn rate so important? At its most basic level, it is an indication of perceived value. If customers are leaving, it shows they have a declining perception of the value you offer.

By implementing a recurring payments model, you can easily measure churn rate and by extension, the perceived value of your products or services. In so doing, you can either adjust your value, communicate your value better or institute other changes that convince customers to stay longer, thus increasing their LTV to your business.

Net-new Revenue or NNT is a measure of how much revenue originated from new customers. For instance, a music streaming company would need to know how much new revenue came from new subscriptions.

New revenue from current customers, on the other hand, is any new revenue from upsells and upgrades. For a fixed payments business, calculating each may be easy but predicting how each will affect future revenue will be hard.

Going back to the music example, a store that sells music CDs can use its CRM to identify NNT and even new revenue from current customers. However, the challenge comes in tying these figures to future revenues.

Conversely, a recurring payments company can easily monitor both NNT and new revenue from current customers and then extrapolate this, based on its recurring payments model, to see how these numbers will impact its future revenue.

It will also be able to ask questions like, “How do we capture more value from new customers once they have been with us for X months?” As you can see, such insights would play a crucial role in increasing customer LTV.

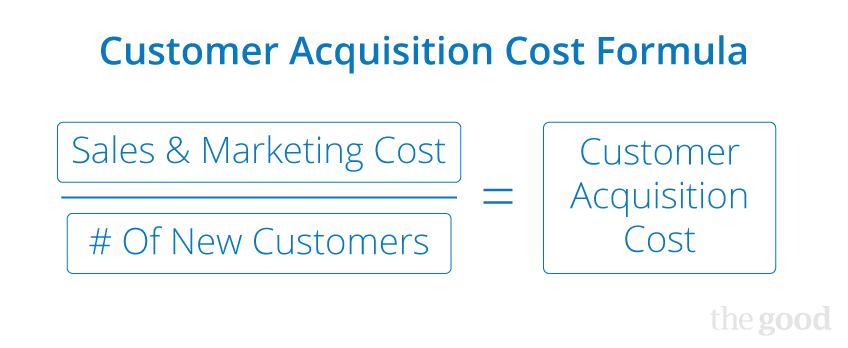

It costs seven times the amount of money it takes to keep a customer to acquire a new one. Businesses that manage to keep their customers, therefore, not only have higher customer LTV values but also significantly lower customer acquisition costs. How do recurring payments help with this? Consider a flower shop that rents an expensive store, markets and advertises heavily, and relies entirely on multiple (sometimes recurrent) one-time purchases.

Also, consider a flower shop that employs a recurring payment model where customers subscribe to get flower deliveries. Over time, customer acquisition costs for the first example will climb (store rent goes up, advertising rates go up, competition increases, etc.). For the second example, customer acquisition costs will go down over time as the business will manage to hang on to more of its customers through a recurring payments agreement.

In conclusion, recurring payments can have a massive impact on your business in similar ways it has on businesses like Microsoft and Adobe. However, there are also many challenges associated with recurring payments such as chargebacks, declined cards, and others.

Working with a reliable and reputable shopping cart and affiliate management software company like PayKickstart can help you avoid these challenges and implement a solution that works for your business and helps you grow.

To find out more about how PayKickstart can help you implement recurring payments in your business, find out more about our services or start a free 14-day trial today.

Dan Macharia is an experienced copywriter with over ten years of experience writing for both large and small companies all across the United States. When he is not writing, find him reading a book or outdoors playing lawn tennis, running or just walking and soaking in life.

Read More About Dan Macharia