Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Customer acquisition cost (CAC) is one of the must know metrics in your business. It doesn’t matter if you’re selling jeans or cars.

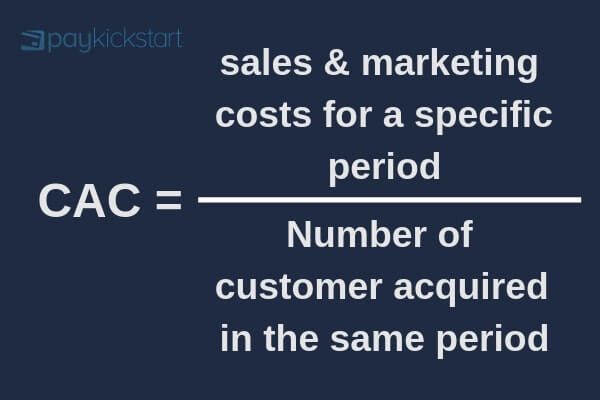

The formula for CAC is straightforward. It adds sales and marketing expenses over a period of time and divides it by the number of new customers.

This is also known as blended CAC but it doesn’t give you the full picture.

When you want to dig into the weeds, you’ll see that it falls short of the mark.

In this article, I’ll go through multiple ways to look at CAC as well as some effective strategies to reduce it over time.

The most popular method, by far, is to take all your marketing and sales expenses, add them together, and divide it by the number of new customers you gained.

This works but doesn’t give you the full picture when you want to do more granular analysis. There are a few other ways to measure CAC to help you improve your metrics across the board.

This includes all the costs you can directly add to a customer account. It includes salaries for the ads team, the costs associated with distributing the ads, marketing collateral etc. Direct CAC doesn’t take into consideration indirect costs associated with acquiring customers.

An example would be a podcast you did in 2017 that introduced prospects to your brand. After listening to the podcast, they clicked through to your website, and later started seeing retargeting ads on Facebook.

Full CAC is a step above direct CAC and adds your fixed costs or overhead expenses to direct CAC. This includes expenses like software needed to do the job, office space, and equipment. CLTV is often compared to full CAC or blended CAC to understand how close you are to the golden ratio of 3:1 CLTV to CAC respectively.

These are things that cost money but wouldn’t be added in your direct CAC costs. An example would be a free trial period. It costs you money to support free trial users but you don’t directly allocate that cost to customer acquisition.

If you want to get granular with your CAC calculations, you’d break down how much it costs to acquire customers based on the channel used.

For example, you’d calculate how much you spend when using Google ads to acquire customers. You’d also calculate how much you spend when using channels like Facebook Ads or content marketing.

When you understand the costs associated with each channel, you can make informed decisions about whether or not it’s profitable for you to continue.

There are a lot of ways you can use to reduce your CAC. Some will give you immediate results while some will take time to ramp up.

Let’s look at a few methods.

It may seem irrelevant at first glance, but segmenting your market will have a marked impact on your acquisition costs.

How?

Your products and services may appeal to a large group of people. For example, a book about online business or photography will appeal to a huge audience.

Each group has different wants and needs. Segmentation allows you to market your product differently based on the wants, needs, and goals of the customer. The end result is dialed in marketing campaigns that generate customers at a fraction of the cost.

You may already know this but less than 10% of your visitors convert to paid customers on the first visit. A lot of them will never return to your website without reason. In that scenario, the money you spent to get them to land on your website in the first place is gone.

That’s not a nice position to be in.

Retargeting campaigns via ad networks like Facebook and Google allow you to show your message to people who’ve visited your website in the past.

You’re able to turn more people into customers and drive down your customer acquisition costs.

At PayKickstart, we have a special relationship with affiliate marketing. Our platform lets you recruit and manage affiliates without the hassle.

Affiliate marketing has its own merits. You’re able to develop a commission only salesforce that works hard to push your products. Your CAC is minimal but there is a tradeoff. Instead of paying to acquire customers, you’ll pay a commission to your affiliate partner.

That could be one-off, recurring, or based on leads generated. The choice is yours. When structured properly, it’ll drive your CAC down to the bare minimum.

Organic traffic can take much longer to develop but once you get the ball rolling, you become an unstoppable force. A single piece can produce customers for weeks, months, or years.

The key is to focus on top of the funnel (TOFU), middle of the funnel (MOFU), and bottom of the funnel (BOFU) content. Each type of content performs a different function.

TOFU brings new visitors into your sales funnel and shows why you’re qualified to deliver your product or service. MOFU introduces prospects to your products and services. BOFU helps turn leads and prospects into customers.

Organic traffic is an investment you’ll make alongside your advertising efforts. Over time, it’ll deliver more customers than your paid advertising efforts.

Start investing in it early so you can reap the rewards when your company matures.

In a way, every strategy for reducing your CAC deals with optimizing the sales funnel. The better your sales funnel is, the more people turn into customers.

A few more ways to optimize the sales funnel include:

There are many more ways to go about optimizing your sales funnel but these are enough to get you started.

Customer acquisition cost is an important metric to keep track of. There’s the basic measurement which gives you limited insight and there’s the granular measurement which I talked about in this post.

Be sure to keep an eye on all the different CAC measurements so you have a complete picture of your business health.

The best CAC doesn’t exist but the lower it is the more profit you’re able to extract from every transaction. Use a few of the ideas mentioned in this article to continually drive your CAC down to a level you’re happy with.

Let me know what you think about customer acquisition costs in the comments and don’t forget to share.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu