Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

Automated Clearing House or ACH payment processing is an electronic money transfer merchant service that businesses offer to customers as an alternative to credit card payments. Although credit card payments are ubiquitous and almost all merchants offer it, there are some situations when ACH payment processing makes more sense for both the customer and the business.

As a merchant, offering ACH payment processing can be advantageous to your business and to your customers, some of whom may find ACH billing cheaper and easier to use than credit card payments.

In this article, we look at how ACH payment processing works and how your business can start accepting ACH transfers.

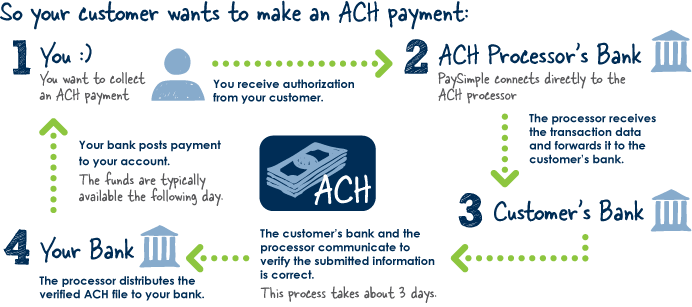

ACH payment processing involve your customer authorizing you, the merchant, to pull funds directly from their bank account as payment for a good or service. This authorization is usually in the form of a web form or document that the customer fills out with their bank details and authorization.

While this is the definition of how ACH payment processing works, these days, few merchants handle these agreements directly. Instead, a customer authorizes a third-party payment processor like Stripe to pull funds from their bank account on behalf of a merchant. In most cases, a merchant will also work with a reputable payments integrator like PayKickstart to handle the integration of Stripe to their shopping cart to enable ACH payment processing.

ACH wire transfers work in one of two ways – automatic payments and on-demand payments. In an automatic payments’ agreement, the payment processor will automatically pull funds from the customer’s account with no further consent from the customer. With on-demand payments, the customer can set up the ACH agreement between the bank and the payment processor but reserve the right to initiate ACH wire transfers.

As a merchant, you will often hear ACH payment processing and wire transfers mentioned almost interchangeably. While they are both electronic money transfer services, they differ in a few fundamental ways. Here are some ways ACH payments and wire transfers differ:

As a merchant, safety and security of payment methods is a major concern. So, how secure is ACH payment processing? To ensure security, ACH payment processing has some requirements, which include:

While these features enhance the safety and security of ACH payment processing, customers also have a role to play in ensuring their safety. As a merchant, you may need to communicate customer-focused safety measures to enhance the security of ACH payments further.

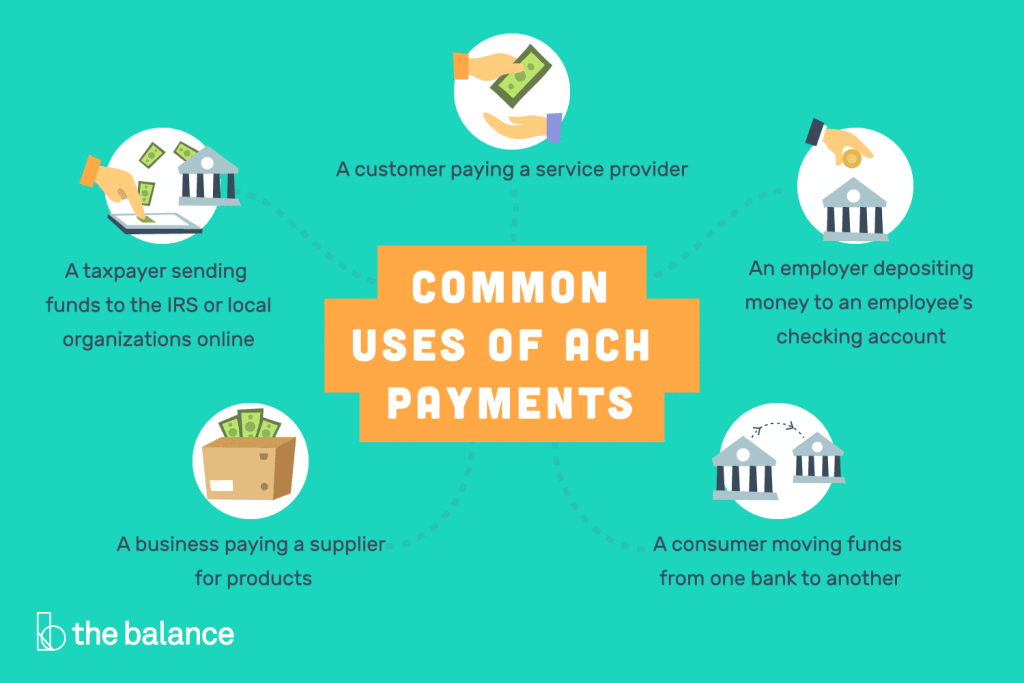

In general, the types of businesses that can benefit most from ACH payment processing are those that offer higher-ticket sales or those offering utility-like services like Internet connectivity or business services like bookkeeping.

Now that we have covered most of the basics of ACH payment processing, how can your business start accepting ACH wire transfers?

PayKickstart makes it easy through our integration with Stripe, a leading payment processor.

To get set up, follow the following steps:

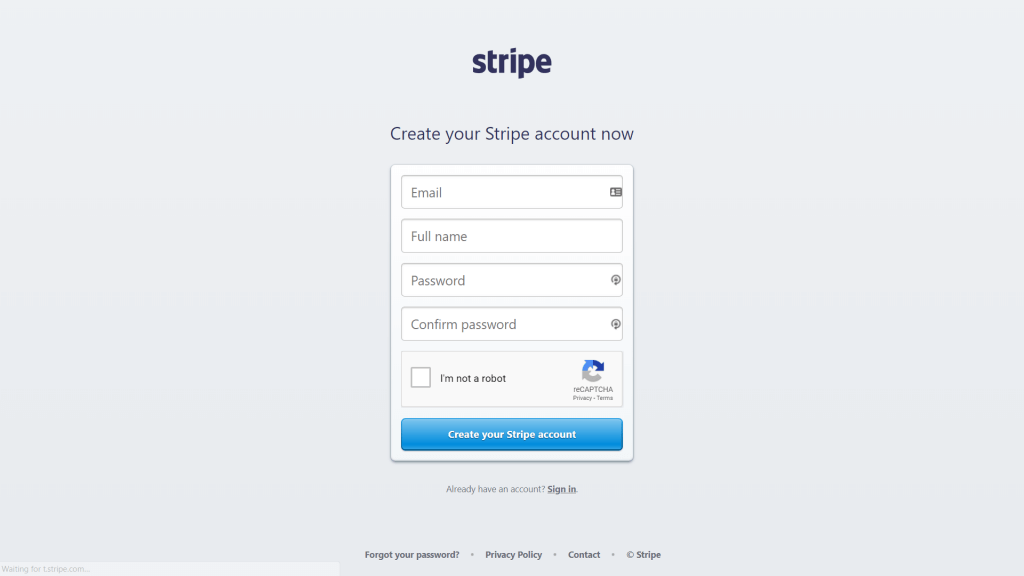

Go to stripe.com, create a free account and agree to their terms and conditions.

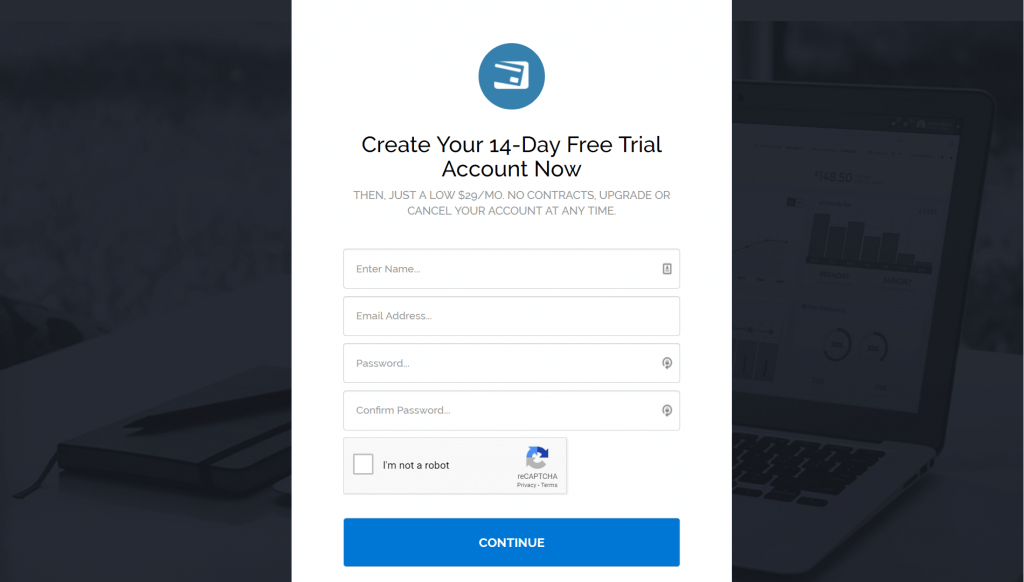

Go to PayKickstart.com, create an account and agree to the terms and conditions.

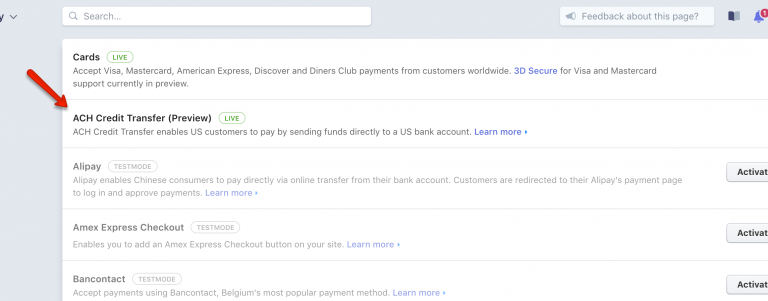

Within your Stripe account, click on “Payments,” then “Settings” and then “Enable ACH Transfers.”

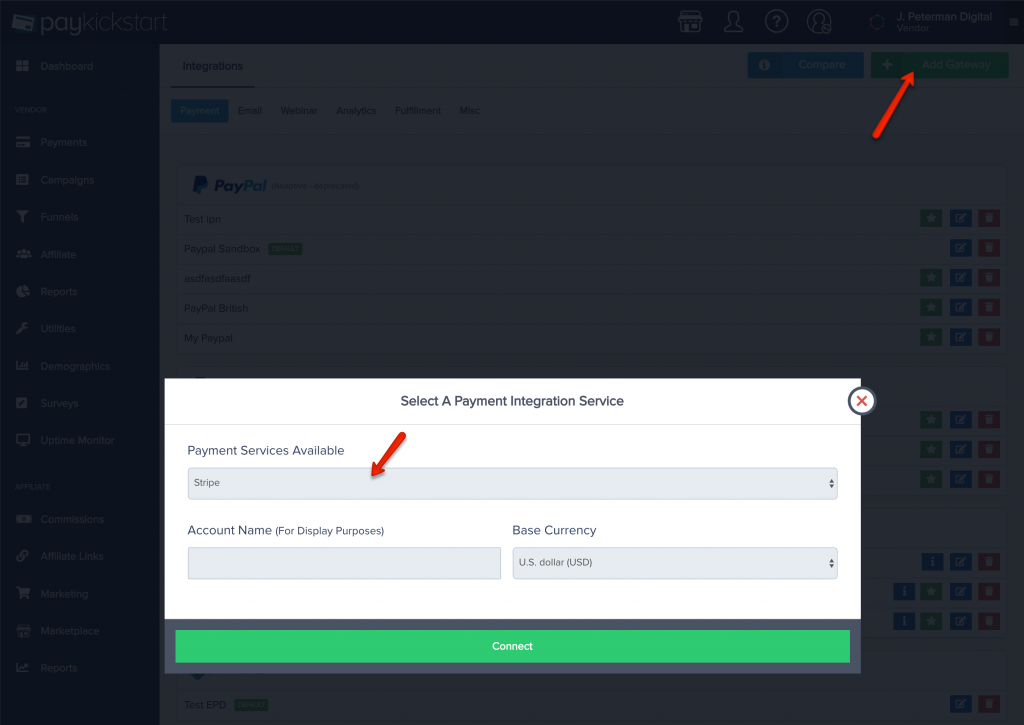

Within your PayKickstart account, add Stripe as a payment integration by clicking on “Integration,” then “Payments,” then “Add Gateway.” Once you select Stripe, follow the instructions to connect your Stripe account to PayKickstart.

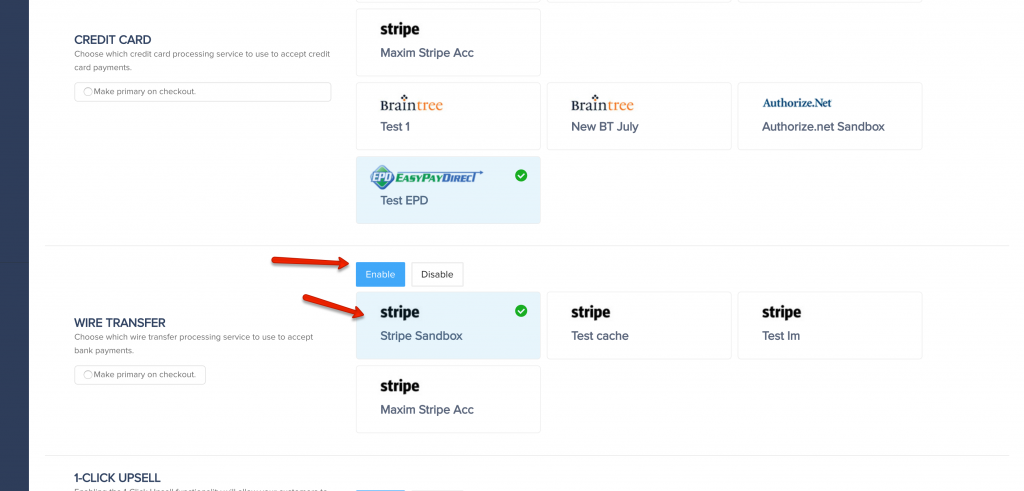

In your PayKickstart account, click on “Campaigns,” then on the “Edit” button to access the Campaign Settings. Under Campaign Settings, pick the campaign you want to enable ACH payments for, click on “Enable Wire Transfer” and pick the payment getaway account preciously added on the Integrations page.

Once complete, your checkout page will now display an ACH wire transfer payment option.

Please note that ACH payments will have a slightly different workflow compared to credit card payments. These differences include:

In summary, ACH wire transfers are a great option for merchants wishing to offer their customers further convenience in the way they pay for goods and services.

As an established payment integrator, PayKickstart helps merchants across different industries offer their customers the safest and most convenient payment methods on the market today.

With dozens of integrations with leading payment processors, you have all the options you need to take control of your business’s payments. To find out how PayKickstart can help your business accept ACH payment, Start your Free PayKickstart Trial today.

Dan Macharia is an experienced copywriter with over ten years of experience writing for both large and small companies all across the United States. When he is not writing, find him reading a book or outdoors playing lawn tennis, running or just walking and soaking in life.

Read More About Dan Macharia