Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

A subscription business model is a great way to produce a predictable income but comes with its own set of unique challenges. It takes a lot of energy and well thought out strategies to acquire customers.

Once they’ve signed up, you work hard to keep them satisfied by delivering first class customer service and products.

There’s no reason to lose all of that because of a failed payment. Just like you fought to acquire the customer, you should fight to recover that revenue.

Contrary to popular belief, a failed payment doesn’t mean someone wants to cancel. It just means the payment failed.

Depending on the reason for the payment failure, you can put in place a revenue recovery process that wins back over 45% of failed payments.

In this article, we look at how you can implement a revenue recovery process that’s thoughtful and effective.

There are many sources that treat revenue recovery like a science. I wish it were that simple.

Before you can talk about recovering payments, it’s important to understand why they failed and how that affects the revenue recovery process.

Payment failures are divided into two groups:

Soft declines are usually temporary and the card can be retried at a later date. Hard declines are not temporary and the card shouldn’t be retried.

Cards can be declined for a number of reasons but an acceptable card decline rate is around 10%. It may seem high but a lot of that can be recovered. We’ll look at how to do that later. For now, I’ll list out a few common reasons:

You can get a comprehensive list of why cards are declined here.

Some of these reasons may be out of control of your customer and require a different approach and a bit of understanding.

More than 45% of revenue is recovered when it’s a soft decline. If you give up too soon then you may be leaving a lot of money on the table.

At the same time, you have to keep your business running and healthy. If there’s an invalid card number on file, it may make sense to give them a shorter amount of time to sort it out.

It’s a balancing act – an art form – that depends on your business, customers, and the relationship you have with them.

In a given year, 30% – 50% of card users will change their card number. Credit card companies are aware of the hassle involved with updating dozens of subscriptions when an old card expires.

A few have implemented what’s called an “account updater” service. Merchants are able to get updated credit card numbers so they can continue to bill their customers without interruption.

The participating card issuers are:

Usually, you interface with them through your merchant account but if you’re using a platform like Stripe, Braintree, or Authorize.net they’ll take care of it for you. Be sure to reach out to them to learn more about how they handle it on your behalf.

Setting up an automatic updater is one of the simplest things you can do to start the revenue recovery process. That alone will dramatically reduce your invalid card declines.

After that, it gets trickier.

How do you recover revenue when the reason is card declined, temporary hold, or insufficient funds? You send your customer a message.

These messages are called dunning messages and stands for delinquent user notification. A dunning sequence is the process of systematically communicating with customers to ensure you recover revenue that would be otherwise lost.

Without dunning messages, most customers would never know they’re delinquent. These types of messages have been in use since before the internet and can be divided into two types:

A few years ago, pre dunning messages were considered best practice. Now, they’re frowned upon by most people because they’re annoying at best and can make you seem greedy and inconsiderate.

That being said, there’s still a time and place to use them.

The purpose of a pre-dunning message is to inform your customer about an upcoming payment or expiring card.

Note: up to 70% of expiring cards may be updated automatically so you may not need pre-dunning emails at all.

Your customer may be well aware that it’s almost time to pay and don’t need to be told half a dozen times.

Use these pre-dunning messages sparingly and only for specific segments and use cases. They’re fine for yearly billing or longer but may not be a good idea for monthly billing.

This is the gold standard in revenue recovery. A customer’s payment fails, you send an email, and all is right in the world.

Many payment processors have a built in dunning email workflows that send out messages over the course of two weeks or so.

In this scenario you have little control of the message and frequency. You’re leaving one of most important aspects of your business – revenue recovery – in the hands of a third party.

Now, I’ll say this. The dunning emails they send aren’t bad. It’s just not their core competency.

Sending out dunning emails isn’t your core competency either but your brand and your customers are.

Here are a few things to do when setting up your dunning emails:

A lot of revenue recovery happens in the first few days – up to 21% – without you having to do anything. All that’s required are a few retries.

Instead of sending a message, simply retry the card a few times. If it still doesn’t go through then you can start sending revenue recovery messages.

Even though no one likes sending or receiving dunning emails, they’re an important part of keeping your business running. Make sure you also include important information. It makes it easier for your customer to pay and cuts down on confusion.

Dunning emails you send should have:

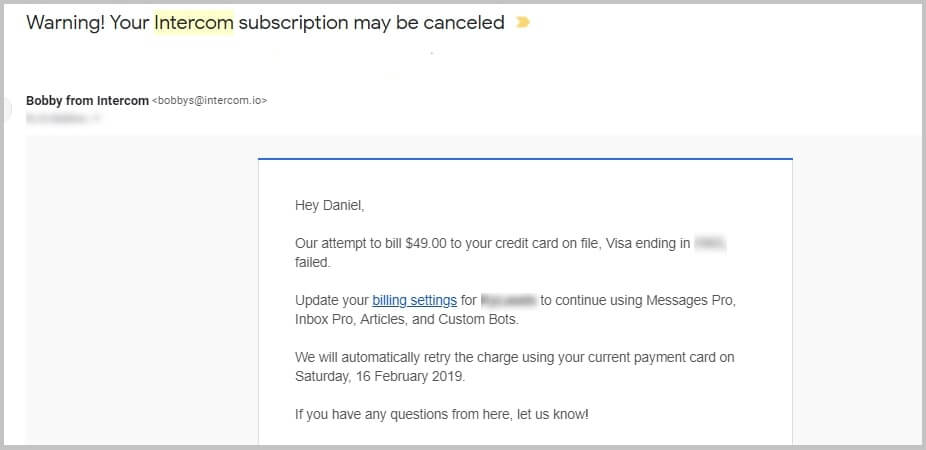

Here’s a short email from Intercom that checks all of these boxes.

This is one of those things where there’s no straight answer. Of course, it depends on the tone you’ve adopted with your brand. Apart from that, recovering revenue is serious business and you want to convey its importance in your message.

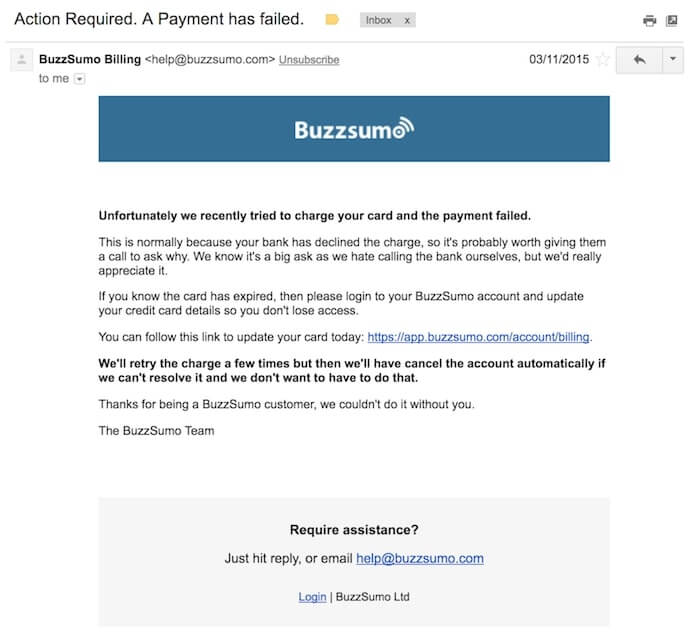

Look at this example from Buzzsumo.

They do a good job of getting their message across without appearing combative. In fact, they’re friendly about it. There’s clear information about what the customer can do to keep their account current.

The last thing to take into consideration with dunning emails is frequency. Many payment processors have automatic retries built into their system.

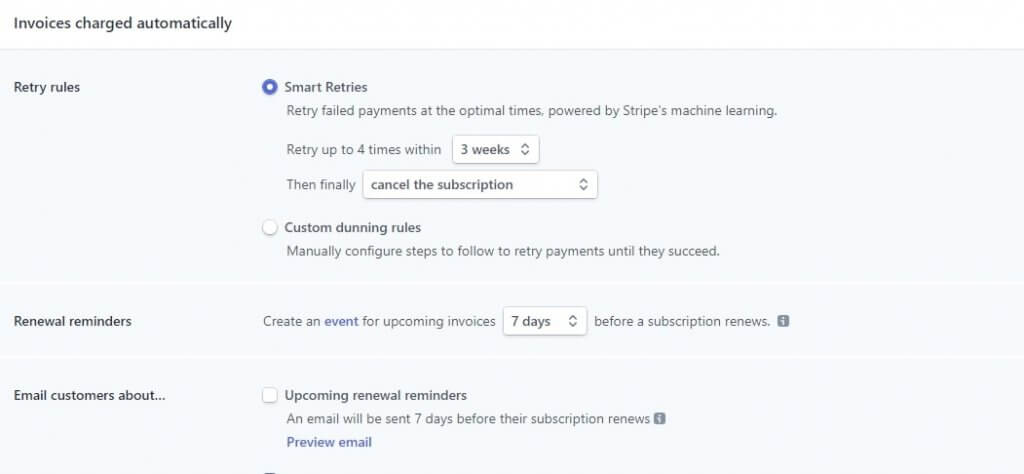

The screenshot below is from Stripe.

You can choose to let Stripe handle payment recovery through their Smart Retry machine learning algorithm or set it up yourself.

With the first option, you’ll have less control because you don’t know exactly when the retry will happen. It’ll be difficult to time your dunning emails to take advantage of the retry schedule.

If, on the other hand, you set it up manually, you’ll know when dunning emails are going out and can time your emails correctly.

Remember your dunning emails should be decoupled from your payment retries. For example, a card attempt fails at 3AM it wouldn’t be a good idea to send an email at that point.

Instead, you can wait and send the email during business hours or based on the time your customers usually open messages from you.

Revenue recovery can be an awkward experience for everyone involved but it doesn’t have to turn out that way. Instead of sweeping it under the rug and leaving it to automated systems, take a proactive part in it.

It can turn into a positive experience for you and your customers.

We’ve looked at the main causes of failed card payments and a few effective strategies to tackle them.

It’s your turn to implement the insights you’ve gained and tweak them until they work or your business. Here’s a quick recap:

Let me know what you think about revenue recovery or ask any questions you have in the comments and don’t forget to share.

Mark Thompson is CEO of PayKickstart and a serial entrepreneur. He is passionate about helping thousands of entrepreneurs and businesses grow through advice, automating payments and providing affiliate tools.

Read More About Mark Thompson