Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

I’ve said it before and I’ll say it again, the subscription economy is booming and many people are starting successful companies.

SaaS and other subscription businesses have unique metrics that apply mainly to them. For example, churn in a subscription company is measured differently from churn in a sporting goods company.

One of those important metrics is net dollar retention (NDR) or dollar retention rate (DRR). This gives you and other stakeholders a better idea of how sticky your products are.

In this article, I’ll look at net dollar retention, why it matters, and how to calculate it in your business.

I’ve said it before and I’ll say it again, the subscription economy is booming and many people are starting successful companies.

SaaS and other subscription businesses have unique metrics that apply mainly to them. For example, churn in a subscription company is measured differently from churn in a sporting goods company.

One of those important metrics is net dollar retention (NDR) or dollar retention rate (DRR). This gives you and other stakeholders a better idea of how sticky your products are.

In this article, I’ll look at net dollar retention, why it matters, and how to calculate it in your business.

In a nutshell, NDR is expressed as a percentage and is the amount of revenue from current customers you were able to retain when compared to another period after accounting for upsells, downgrades, and churn.

NDR isn’t directly tied to MRR but can affect its growth. For example, you may have a month where your MRR contracted but your NDR grew. That could happen because many people failed to renew but the people who stayed on upgraded their accounts.

I’ll look at this in more detail later in this post.

Conversely you may have a month where MRR grew but NDR contracted. For example, existing customers downgraded their plans from $200/m to $100/m. Overall, your retention would hold steady but your NDR would be cut in half.

NDR is only useful when it’s calculated based on specific cohorts. The timeframe you use is optional but when comparing two cohorts, be sure to keep it consistent.

It’s a good idea to measure NDR based on a number of different periods such as monthly, quarterly, and yearly. You can further slice your cohorts based on ACV and get an even better idea of how certain segments are being retained.

The net dollar retention formula is straightforward. You just need to know your numbers.

The calculation is as follows.

(Starting MRR + expansion – downgrades – churn)/Starting MRR

All values in the formula are expressed in dollar amounts but the final figure is a percentage.

Here’s an example:

Acme Inc. started the period with $10,000 in recurring revenue. At the end of the period, it added $2,500 in expansion revenue and had $1,000 in downgrades and another $500 in churn.

After plugging in the proper figures, the formula would look like this.

($10,000 + $2,500 – $1,000 – $500)/$10,000 = 110% NDR.

Acme Inc. is doing well because they have an NDR above 100%. It started the period with $10,000 in revenue from a specific cohort and ended the period with $11,000 in revenue. That means its customers are becoming more valuable as time goes on.

They’re experiencing net negative churn. This is the holy grail of subscription businesses and it’s in your best interest to structure your product to take advantage of this.

The same isn’t true for XY Inc. The company started the period with $10,000 in recurring revenue. At the end of the period, it added $500 in expansion revenue, lost $1,500 to downgrades and another $1,000 to churn.

For XY Inc. the formula would be as follows:

($10,000 + $500 – $1,500 – $1,000)/10,000 = 80% NDR.

XY Inc. has a problem that needs to be addressed. It started the period with $10,000 in revenue from the cohort but ended it with $8,000 in revenue. This means its customers are becoming less valuable as time goes on.

A common problem with subscription companies is that they only look at MRR growth. While this is an important metric that can’t be ignored, it only tells part of the story.

You could be adding 20% to your MRR every month which is a good thing. What may be hidden under the surface is poor retention.

You should retain the majority of your MRR or even increase it in most cohorts over the course of a year.

For example, a cohort started at $5,000 and at the end of the year it’s a bit more than $5,000 or a bit less than $5,000. That’s a good thing. It means you’re retaining revenue.

If you’re unable to keep the majority of that MRR during the year then it may be necessary to focus on retention.

At its core, NDR serves as a way to benchmark then improve your performance over time.

NDR can also reveal where you’re not churning customers but still losing money. Logo churn looks at how many customers you lose but doesn’t account for the revenue lost to downgrades.

Technically, logo churn is zero but revenue is still down.

How would you account for that otherwise?

Without NDR, you’d be left scratching your head and have a hard time slicing and dicing the data to understand what’s going on.

With NDR, you can identify patterns and take action accordingly. For example, you may notice that the majority of your users downgrade in the third month then stay with you for the long haul.

Is there are reason for that?

It could be a problem with onboarding or your sales pitch. Users think they’ll need a larger plan then figure out the entry-level tier is just fine.

You could take steps to alter your messaging or the way plans are structured to reduce downgrades.

There’s no hard and fast rule for this one.

NDR varies across industry and product category. You’ll likely have a higher NDR if you bill customers based on seats or a value metric that scales like customer service or email marketing apps. Your NDR may not move much if you have a single pricing plan or the value metric isn’t clear.

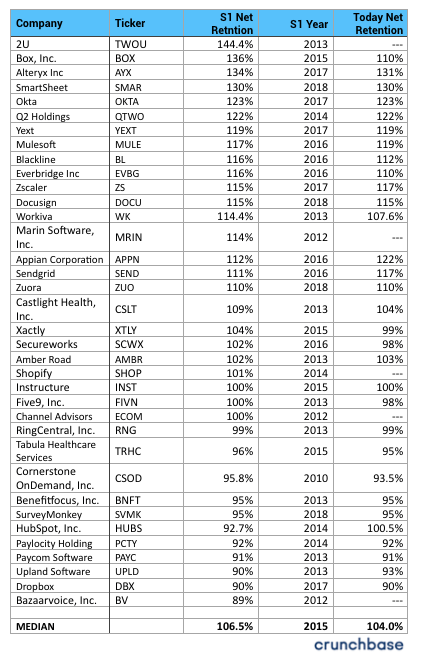

With that being said, the top performing companies have NDR of 120%+ and the median is 106%.

Anything above 100% and you’re on the right track.

Net dollar retention is an insightful metric that lets you know how long people are staying with you. It gives you the ability to dig into your growth in a way that MRR doesn’t.

At the same time, you can use it to spot trends and problem areas you can address.

Divide your users into cohorts and use the formula from this article to calculate your NDR. Compare it to different periods and see if you can spot any places for improvement.

Remember, net dollar retention is just one metric of many that’ll help you grow a successful subscription business.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu