Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

You’ve probably debated this with yourself multiple times considering that you are reading this article.

But do you know exactly what it would take, and how hard it could be?

You may think that building your own billing solution could have big upsides, because you would be in full control…

But does owning the turf really equate to success? Is setting your own fees, creating the layout, and other development really crucial to increasing the profitability and longevity of your business?

You have to come to terms with the reality of building a platform of this caliber: there will be unforeseen challenges ahead.

Not to mention, could all this work you’re doing take away from your core business or product? Would your time, focus and resources be pulled away?

As you read on, you will see that it probably would…

At first, you may have simple components, but eventually you will come to the realization that the maintenance of code, and evolving your software, will take more than you expected it to. Additionally, as you grow, your billing models may get more complex. How do you plan to handle that in the future.

You have to consider aspects such as upgrading, downgrading, cancellations, expired credit cards, and a slew of other problems that may arise with payments.

Are you really willing to create a software that can do all these things, while simultaneously accepting payments? Or are you better off paying for a payment processor that can handle all of it for you?

This article will go over the details, and what you should factor in when deciding to build or buy a recurring billing solution.

Let’s take a deep dive, so you can make a better decision…

Building your own billing software can seem like an attractive option, especially if you have the technical expertise to do so. Some of the benefits of building your own software include:

However, building your own billing software also comes with several challenges and potential drawbacks:

Buying an existing billing software solution can be a great option for businesses that want a more turnkey solution. Some of the benefits of buying software include:

However, there are also some potential drawbacks to buying billing software:

So which one will you choose?

Do you pay for an already existing service, or do you build one?

Really the answer to this question comes down to getting honest with yourself, and looking at how much time and money you’re willing to spend.

It’s fairly straight forward: If you want to save money upfront, time, and you generally have low patience for the development of software, you should pay for an existing service.

We all know time is money, and if you feel that you buckle under pressure in the development phases, or you have had a past where you have quit when the going gets tough, you may want to do a self-analysis.

Unless you are willing to make a big change, maybe paying for a service is your best bet.

This is where PayKickstart can help you.

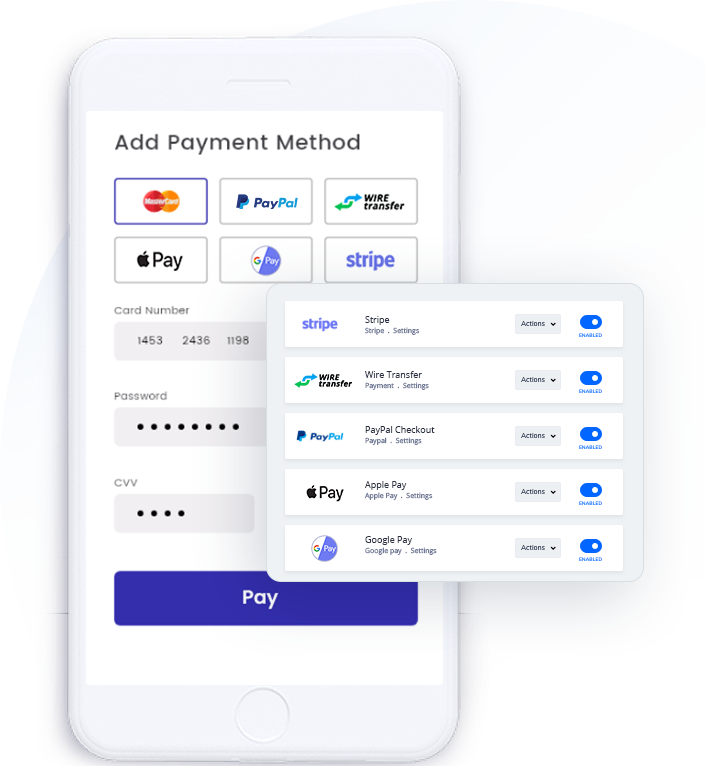

We accept major credit cards, Wire transfers (ACH & SEPA), PayPal, Stripe, Braintree, Authorize.net, Checkout.com, Apple Pay, Google Pay, Coinbase, and EasyPayDirect.

You’ll notice that when using our payment processor, your customers will smoothly checkout, and this reduces the chances of a disgruntled complaint.

And in this day and age, you want to avoid bad press as much as possible, so why take the risk?

But that’s just the tip of the iceberg, we also offer:

So as you can see, there’s a lot of upside with little downside.

But again, if you have a track record of sticking to and finishing what you start, and you have money to spend, making your own software could pay off in a big way for your company… over time.

Reduce points of friction

If you so choose to create your own billing solution, you will have to face another reality of the market currently…

With an economic downturn and changes in consumer preferences, the simple subscription plan is going out the window. It’s probably already in free fall…

What you need to reduce the friction points in your billing process, is a dynamic system that can easily change on a whim to adjust to your customers in real time, and at worst, as quickly as possible.

The key here really is to avoid a billing bottleneck as much as possible with your software when it comes time to pay…

You should make it easy to:

Imagine implementing all these important concepts into your own billing solution…

Daunting right?

This is yet another benefit of PayKickstart. It gives you and the customer flexibility when it comes to payments.

We’ve got your customer’s covered when it comes to:

Not to mention, we know that you use many different services, not just one.

We offer connection to 3rd Party Apps, including 5 payment gateways, 18 email services, 7 webinar services, 14 membership services, 2 fulfillment services and over 2000 Zapier services.

Billing issues are definitely an unsavoury experience, especially when your customer’s payment subscription fails.

But some business owners may look over the other side of the coin; what if your billing system is malfunctioning because of bugs? It’s crucial that you address these issues in your billing service beforehand.

Your customer may encounter these problems:

Anytime a customer encounters these problems, the chances of them churning increases.

Obvious right?

Yet, some companies overlook these issues, simply because they are not paying enough attention to their customer complaints.

What are they saying? How many are you receiving? These are crucial indicators, and you need to consider the waning patience of your customers in an era of abundant options, and places to complain about it.

This is definitely an indication that regardless of how great you think your service is, your customers are not understanding how to pay, and that your system may not be as effective as you think.

When it comes to payments, you want to ensure the most transparency possible, and create a system that saves both you and the customer time and money.

The key here is that you have to notice patterns, identify problems regarding payment, and fix them quickly.

So how do you reduce and recover loss of revenue?

It really starts with having a strategy and plan ahead of time.

Do you know what you would do in the event that a customer fails to pay?

At this point, if you have decided to build your own payment processor, you need to make sure there are options to deal with delinquent payments. If you are paying for a service, verify if there are effective options available to collect your payment.

Considering that creating your own payment processor is harder, you will also need to ensure that you have covered your bases with your billing solution, as previously mentioned.

Are you looking at your customer complaints? Are you fixing the bugs and making the process as smooth as possible? If you are, then you’re on the right track.

You also want to make sure that in your good or service:

But even then, you could get a failed payment. What else can you do as a payment processor?

Here are several things you could do:

Luckily, PayKickstart offers solutions that can help SaaS, Digital goods, Physical goods, Memberships and other services stuck in these types of situations.

Do you need…

Also, if at the end you decide to build your own service, remember that with dunning, it is important to ensure that the service you build has options built in that can handle different types of payment.

A sequence of automated messages sent to a delinquent customer is also crucial.

The more streamlined you can make this process, the smoother this process will go, and the higher the chances you may receive a payment.

You could learn more in this article about at-risk customers…

Measure, and you can manage

As you begin to implement all these concepts, and if you choose to build your own payment processor, measuring your results will be crucial.

Similar to customer complaints and feedback, knowing how and why your customers use your billing system will be critical.

Again, if you have the money and time, you can build your own analytics tracking systems.

But in all honesty, if you want to save resources and hate technical headaches, you are better off using paid versions that are already experts on tracking.

Often, the problem with the softwares is the cost, and at times, the overly complicated layout. This again is where PayKickstart has you covered…

In the PayKickstart Control Center dashboard you’ll get:

If you want to truly get ahead in this market, you need an advantage your competition doesn’t have. Not to mention, many overlook the idea that you can’t manage what you don’t measure.

This is something that may not immediately come to mind when deciding to build your own payment processor.

The government has regulations regarding payments, and you need to make sure you follow them, or face the consequences…

When building your payment processor, some things you need to consider are GDPR compliance, ISO compliance, compliance with the AICPA’s Trust Services Criteria in relation to your SOC audit, PCI (Payment card industry data security standard) and the EU-US Privacy shield.

Spoken in plain english, these compliance and security standards are a mouthful.

And again, if you don’t follow through with them, you may find yourself in a heap of trouble with regulatory institutions.

Well then, where’s the good news you’re probably asking?

There isn’t, it gets worse as the costs weren’t even mentioned.

You could likely expect to pay upwards of 6 figures in fees to just certify you are compliant with these organizations. Again if you have the time, money and patience, go ahead with this.

But if not, you need a better option…

PayKickstart covers many bases for you when it comes to compliance:

Ok, but what about security? We’ve got you covered there too:

So all in all, when it comes to security and compliance, we cover the bases ahead of time, so you don’t have to.

Obviously, as a business you have to offer customer support.

However is it any good? Is it limited? This could be a major problem if your payment processor starts to get traction, and especially if it processes many transactions in a given day.

We’ve all experienced some form of lackluster support from services we use, and many times it can be hard to find the support button, as they may purposely make it hard to locate.

Luckily at PayKickstart, we offer top-notch customer support for you and your customer.

We believe in personalized communication, and easy to use self-serve options:

Sometimes, you may get customers who will have complaints about charges and invoices. Maybe that happens often for you…

Wouldn’t it be great if you could prevent these issues with itemized, easy to understand invoices?

Again, we’re already there.

PayKickstart offers On-Demand invoicing:

With these features, you will definitely see a reduction in customer support inquiries, giving you more time to focus on individual customers and other business tasks.

Should you buy or build your own payment processor?

This may be a big debate for some, but the answer is obvious.

Buy one, don’t build one. It’s faster, cheaper, and less risky.

Especially in this day and age, we have increasing regulations, liability, and changes in technology are happening faster than ever before.

We also have a pandemic and the economic downturn that comes with it. This can bring some business opportunities in the software industry, but we have to acknowledge the business risks, and act accordingly.

If you are a risk taker, then by all means create your own payment processor. But do so in a calculated way, that covers potential problem scenarios and reduces the chance of a huge loss.

If you are less of a risk taker, or at least someone who takes calculated risks when it counts, you are really better off buying a service that is already done for you.

It’s as simple as that.

You read this far, so maybe we’re striking a chord with you.

Hi, my name is Ryan from Higherdesirecopywriter.com! I write effective content and copy for B2B SaaS companies. I do blog posts/articles, website copy, and make engaging content for readers that truly draws them into your software and company. SaaS, eCommerce, CRO, and inbound marketing are my passions!

Read More About Ryan Desantis