Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

You put in a lot of time, energy, and money to get your business to the point where it brings in a steady stream of customers.

The last thing you want is to get a slew of chargebacks that damage your reputation with your payment processor and incur extra charges.

If you’re not careful or fail to put chargeback protection processes in place then problems are bound to pop up.

This article will answer the question “what is a chargeback” and chargeback protection best practices you can adopt today.

A chargeback is a reversal of a credit card transaction that is initiated by a customer and carried out by the bank (or credit card processor). The bank or processor sends a demand to the merchant to make good on a fraudulent or disputed transaction.

There are many ways a transaction can trigger a chargeback.

The main difference between a chargeback and a refund is that with a refund the customer contacts the business.

With a chargeback, the customer goes directly to the bank to remove the money from the company’s account. When the process is initiated, an investigation is carried out. If the customer’s claim is found to be valid then the money is returned to the customer.

Note that the customer is under no obligation to return the goods they received.

When credit and debit cards were first introduced, people had many fears about protecting their cash.

How would they be protected if they lost the card and someone made an unauthorized transaction? What about merchants who added extra charges to a transaction to turn an extra buck?

To increase adoption and ensure the safety of the customers, The Fair Credit Billing Act 1974 was introduced. This allowed chargebacks to take place.

In its original form, it was a safety measure that encouraged consumers to adopt credit cards.

It worked.

Credit cards are now part of our daily lives.

It’s important to note that chargebacks are only legal in cases of stolen credit cards, identity theft, or otherwise fraudulent transactions.

A customer is not legally entitled to initiate a chargeback if they bought a product and don’t want to use it anymore. In that scenario, they should contact the business and ask for a refund. If the business refuses because it’s against their policy then that’s perfectly legal.

If the consumer then goes to the bank and initiates a chargeback and it’s approved, they’re stealing. They get their money back but are not obligated to return the product to the business.

They’ve essentially gotten something for free while the business has paid twice in addition to a fee associated with a chargeback.

Unscrupulous individuals have been known to abuse their power which is why it’s important to put measures in place to protect yourself.

Legitimate chargebacks from fraudulent transactions may not be entirely avoidable. Sometimes things happen. Malicious or accidental chargebacks are entirely avoidable.

Here are a few things you can do to help yourself.

Avoid chargebacks by providing clear contact information at multiple touchpoints. That means your contact page shouldn’t be the only place where customers can get in touch with you.

A few places you can display it are:

Consider adding multiple ways to contact you such as live chat, email, and phone calls.

It can be tempting to bury your policies in legalese but this doesn’t help anyone. When customers are dissatisfied with purchases and don’t know how to initiate a refund then they’ll simply file a chargeback.

They’re not interested in knowing whether or not it costs you extra money.

Unlike legitimate refunds, they’re not obligated to return the products either.

Look over your refund policy. Is there any area that can be misinterpreted or cause confusion? If so rework it until it’s clear for anyone reading.

Add language that encourages them to reach out to you with any questions or concerns.

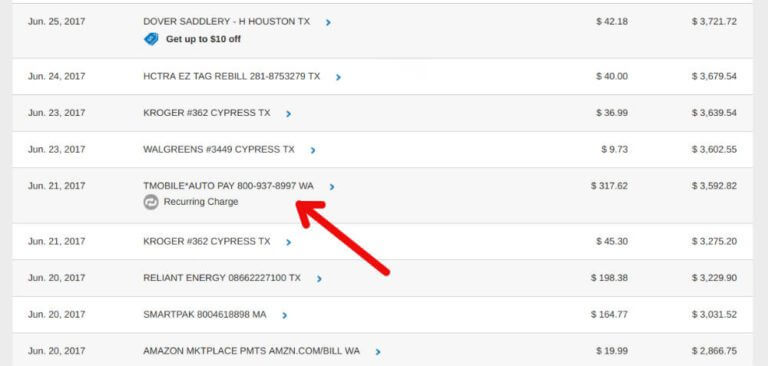

This is an often overlooked area where you can save yourself some grief. Oftentimes, payment descriptors are like code. Many of them use the parent company name or product SKU.

While this is good for you, it doesn’t help customers track down where the charge came from.

Use descriptors which reflect your store name and have built in contact information like a URL, email, or phone number.

Here’s an example from T-Mobile.

You can go a long way towards preventing credit card fraud, which will initiate a legitimate chargeback, by following best practices.

We’ve covered it already in this article on credit card fraud so I won’t go into it too deeply here.

Some things to keep in mind are:

Some products are more prone to fraud and chargebacks. That’s the way the world works. Keep a close eye on them and understand how they’re performing in your business.

If the chargeback rate is too high then it may be time to discontinue the product altogether. It may not be worth the risk of being dropped by your payment processor.

As an online business, everything you do is at high risk of fraud because your business model is built on card not present transactions.

With that being said, some products or situations are higher risk:

Set up rules to flag these transactions and review them manually.

Once your business grows large enough, chargebacks will happen.

Your job isn’t to prevent them entirely. Rather you should focus on reducing the ones you have control over. That includes accidental or malicious chargebacks that may occur.

Let me know what you think about chargebacks and chargeback protection strategies in the comments.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu