Subscription growth hack (by PayKickstart)

Facebook Group - 3,932 members

Visit Group

In your personal life, accounting is easy. You get a check and record it as income.

SaaS revenue recognition is a lot more complicated. When money hits your account, it seems natural to recognize it as revenue and pat yourself on the back for a job well done.

In reality, that cash isn’t revenue until you’ve earned every last penny of it. Instead, it’s a liability and until you’ve delivered your service in full, the customer can ask for a refund.

What would happen if they asked for their money back and you’ve already spent it? A situation like that would put you in a difficult spot.

This article looks at SaaS revenue recognition and the unique challenges faced by subscription companies.

SaaS revenue recognition is the process of converting cash from bookings into revenue within your business. It’s an accounting principle for reporting revenue by recognizing the value of a transaction or contract over a period of time as it’s earned.

Put another way, it’s the process where cash generated is officially recognized as revenue which you can use to pay salaries, expenses, and record profit. To be able to recognize cash as revenue, you first have to deliver the goods or services.

This presents special complications for SaaS companies. Customers commonly book a month or year in advance. The cash is in your account but it hasn’t been earned by you.

Before software moved to the cloud, it was much easier to book revenue and recognize it. The transaction would occur and your customers would have full control of the software immediately.

According to the Financial Accounting Standards Board (FASB) there were two stipulations before revenue could be recognized:

This is how the transaction would go:

In this circumstance, both obligations laid out by the FASB were met so the revenue was booked that month and was recognized as soon as the refund period was over.

Those standards worked well before software moved to the cloud.

In SaaS revenue recognition, the process is different.

The entire point of SaaS software is to make it available all day every day in the cloud while giving your customers constant access to the latest version.

It would defeat the purpose of your business model to allow them to run it on their own systems or contract a third party to do it.

Customers prepay for the promise of using the service for a specific amount of time. That’s usually monthly or annually. There is no cut and dry period for when the service delivery has been completed.

A customer may stay with you for five years. Does that mean you won’t recognize the revenue until canceled or should you recognize the revenue as soon as the money hits your account?

In essence, the FASB standards didn’t apply to SaaS businesses. This allowed SaaS companies to account for revenue in any way they pleased. That changed with the implementation of ASC 606 accounting standards.

I won’t go too deep into the ASC 606 accounting standards here, but in essence, they spelled out a method to recognize revenue under any circumstance.

There are five steps to follow in every contract before revenue can be recognized. Note: someone signing up for your service is a contract.

What these five steps are saying is you need to have a contract with a customer, a product or service you deliver, clear pricing, and delivery terms. When the delivery terms are met, you can recognize the revenue.

Let’s use a simple example to illustrate how this would work in SaaS.

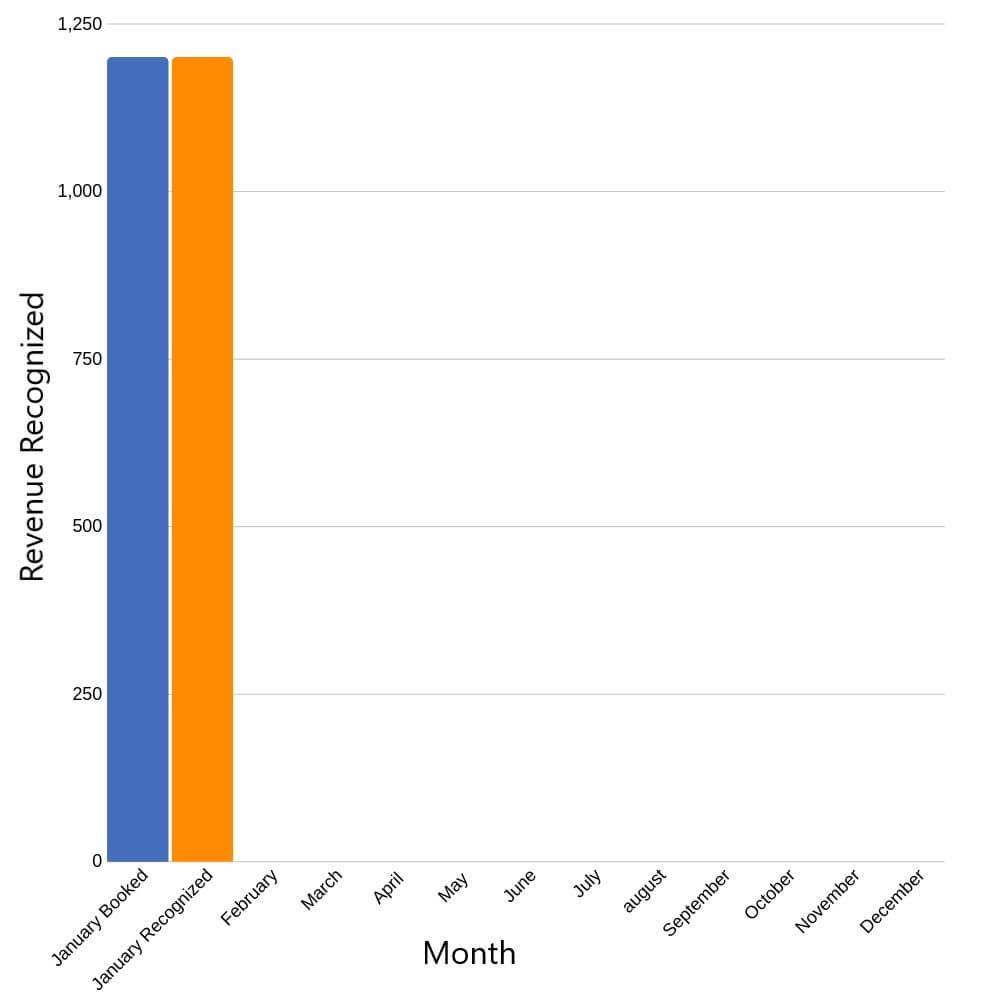

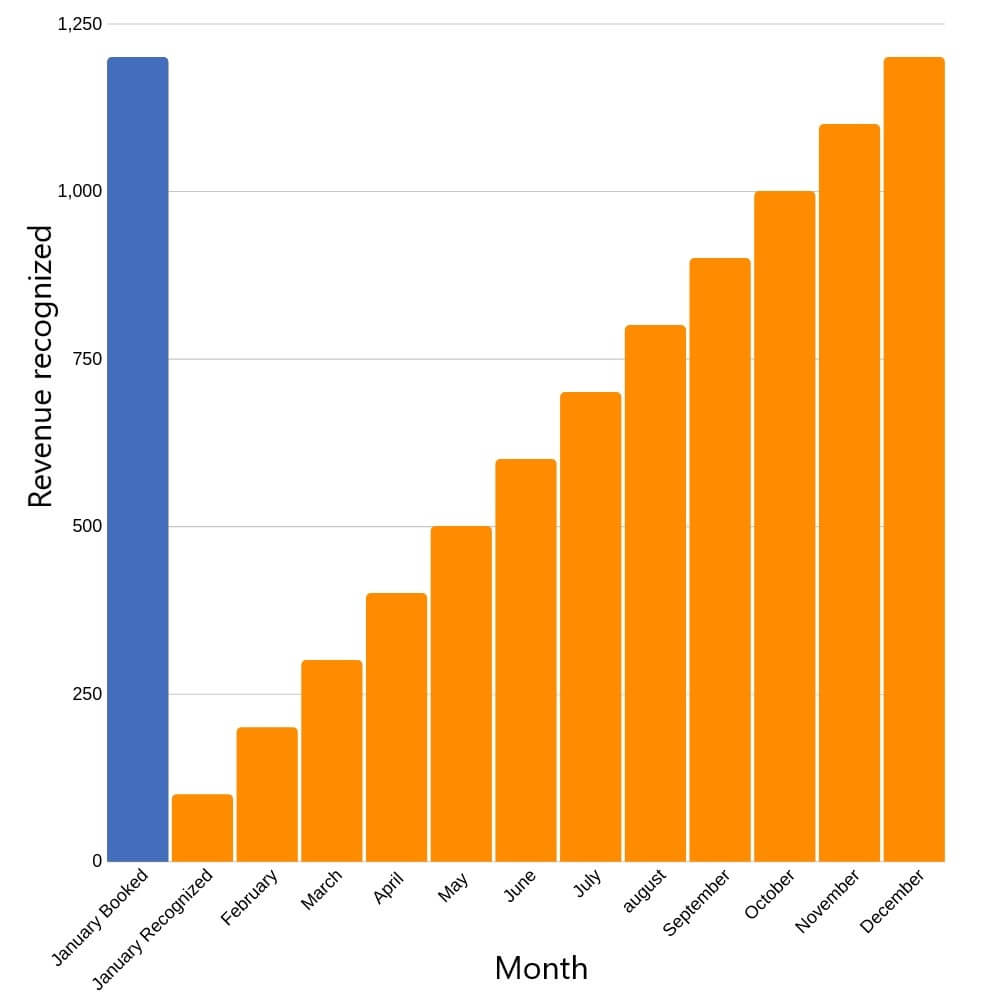

Acme Inc. just booked a client for a one-year subscription to their dog analytics software. The customer signed up and prepaid for one year of service which was billed at $1,200.

As soon as the money lands in Acme Inc.’s account, it’s treated as a liability and marked as deferred revenue until it has been recognized as earned revenue.

There are a number of things we can extract from this simple statement.

The contract is between Acme Inc. and a customer for dog analytics software. The first step is in order. Acme Inc. has a performance obligation to deliver the service for an entire year with little to no downtime. The timeframe can be broken down into smaller timeframes for recognition purposes. The second step is in order.

The transaction price is $1,200 total. Step three is clear. Step four is the tricky part. Acme Inc. has to allocate the money paid to performance obligations. Should they recognize revenue after one year or every six months, or another timeframe?

Since they’re fulfilling a performance obligation every moment they give their customer access to the software, it’s up to them to choose a recognition period. It’s possible for the company to go with days, weeks, months, or any other timeframe. This part is flexible.

It’s standard to go with 30 day periods for SaaS revenue recognition because that tends to be the shortest billing cycle associated with SaaS subscriptions.

Each month, Acme Inc. recognizes $100 as revenue from their customer. If they fail to deliver their service, they’re liable for any amount not recognized as revenue.

In January, $100 total was recognized. By May, $500 total will have been recognized. This process continues until the entire 12 months has elapsed.

In most cases, straight line SaaS revenue recognition like this will serve you well.

SaaS revenue recognition can seem complicated at first glance but in reality, it reflects how your business works. You deliver value to your customers over time and you’re rewarded with revenue in the same way.

Keep in mind that in order to recognize revenue properly contracts should be taken through the five step process mentioned above.

When you’ve accomplished that, it’s just a matter of moving revenue from deferred to recognized at the appropriate time.

Let me know what you think about SaaS revenue recognition in the comments or if you have any questions.

Daniel Ndukwu is a regular contributor to the PayKickstart blog. He has extensive experience with online businesses, conversion optimization, and subscription revenue models. When he's not writing insightful content, he works with other entrepreneurs to help them grow their bottom line.

Read More About Daniel Ndukwu